Market strategists and journalists are regularly in search of catch phrases or acronyms to succinctly describe financial conditions, market performance, and investor sentiment. These have included such noteworthy monikers as The Nifty Fifty, BRICs, Dot-com’s, FANG, FOMO, TINA, The Greenspan/Powell Put, and MAMAA. Some of these go back several decades. If they sound unfamiliar and you are curious, please call. We always welcome discussion of the shifting sands of the investment landscape.

For 2023, the “Magnificent 7” stock reference by Bank of America strategist, Michael Hartnett, has dominated the headlines. Borrowing from a 1960s Western movie title, one must wonder if Mr. Hartnett appreciated the destiny of his May research characterization of seven stocks that were pushing higher despite the day’s economic uncertainties.

“I have a rendezvous with destiny.” The character Billy the Kid in Young Guns, 1988.

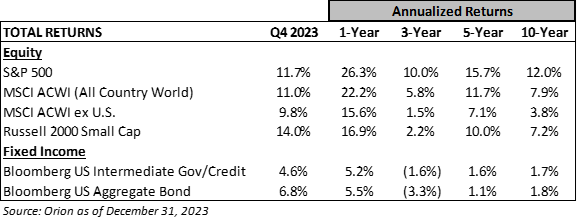

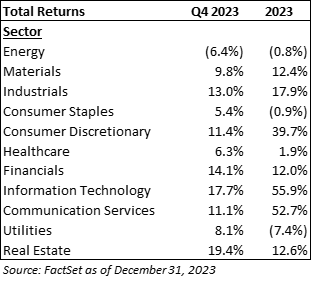

And move higher they did. Specifically, the “Magnificent 7” (Apple (AAPL), Alphabet (GOOG), Amazon (AMZN), Facebook (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA)) increased by an average of 110% on the year. These stock gains accounted for nearly two-thirds of the S&P 500’s 26% return for 2023 and at year end, represented an astounding 28% of the index’s market capitalization. Given the concentrated nature of these returns, and the diversification inherent (and often regulatorily required) for most equity portfolios, many active portfolio managers have been more inclined to malign than applaud the 2023 results.

As you might suspect, we were not concentrating portfolios in just a few large-capitalization technology stocks this time last year. Most Woodmont equity portfolios are diversified by company style (e.g., growth and value), market capitalization, and geography.

We did, however, share three important conclusions in last year’s January Market Commentary, which helped guide our 2023 investment decisions. These were 1) the stock return outlook had improved given reduced valuations, 2) the correction of 2022 meant markets had already priced in lots of bad news, and 3) capital was still available supporting continued economic expansion, albeit certainly more expensive.

Sticking with this format, we have drawn three new conclusions heading into 2024:

- Despite the significant gains of the equity indices in 2023, many industrial, financial, energy, healthcare, small-cap, and non-U.S. stocks remain at or below historical valuations and should benefit from either an economic “soft-landing” or an extension of the current economic cycle.

- Fixed-Income yields are well off their 2023 highs, yet continue to offer reasonable rates of return without the risks that come from extending duration through the purchase of long bonds.

- There is nothing like a market rally to improve investor sentiment. And while it is much easier to advocate for owning stocks (and by extension write this commentary) when the equity indices are closer to recent lows than highs, investors are far from “all-in” and some underappreciated fundamental tailwinds remain.

Given decades of investing experience, we appreciate the fluidity of markets and how investors must be prepared for the unexpected. One need only consider the 2023 atrocities at home and abroad to be reminded of life’s fragility and the existence of evil in the world, let alone, the unforeseen challenges of investing in the financial markets.

“Knowing what you don’t know is more useful than being brilliant.” Charlie Munger, 1924-2023, Longtime Berkshire Hathaway Vice-Chairman

Yet decades of compounding returns amidst the most uncertain of times highlight the financial opportunity costs of attempts to time the market. Costs that stand in sharp contrast to the benefits of identifying an appropriate investment allocation and sticking with it during turbulent times. And while a Presidential election year, wars, and the elongated economic cycle all present risks, this steady approach has and should continue rewarding long-term investors, regardless of the market moniker of the day.

Equity Opportunities Remain, Although We Now Have to Look a Little Harder

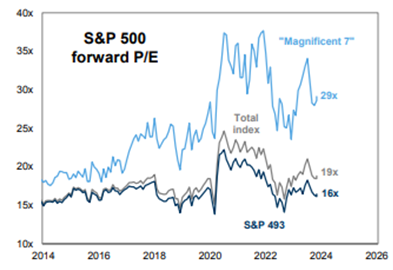

A year ago, the forward twelve-month Price to Earnings (P/E) multiple for the S&P 500 was 17X, which was close to the twenty-five-year historical average. Today it sits at 19X. However, peeling this back proves insightful. Specifically, the “Magnificent 7” trade at nearly 30X. The other 493 are trading at 16X.

Source: Goldman Sachs & FactSet Data Systems

Of course, we’ve discussed before how growing companies with more resilient earnings deserve premium valuations. Certainly a case can be made that many of these seven deserve premium valuations. For investors concerned about paying top (or at least above average) prices for U.S. large-capitalization stocks, the valuation metrics of the other 493 are an important consideration.

In addition to a review of valuations, it is worth noting stocks within the S&P 500 remain on average a surprising 24% below their five-year highs. The median gap is 19%. (Source: Woodmont and FactSet Data Systems). While the Dow Jones and S&P 500 have essentially returned to their historic highs, the healthcare, financial, consumer staples, utility, and energy sectors are all 10%-20% from their 2021 and 2022 highs. We’re sensitive to the secular challenges facing some of these sectors and companies. For many companies, however, the demand for their goods and services and their ability to innovate is as intact as ever, leaving them attractively positioned to generate long-term returns.

“If all the economists were laid end to end, they would not reach a conclusion.”- Unknown

The near-term prospects for many energy, financial, and industrial stocks closely correlate to the economic outlook. This is also true for many small-cap stocks. While lagging for the year, these more economically sensitive sectors have outperformed in recent weeks as the optimism for either a “soft landing” or elongated economic cycle has increased. And while the economy will inevitably cycle, there is considerable incentive for those in Washington, arguably including the Federal Reserve, to pull what levers they can to delay an economic downturn until after the November elections.

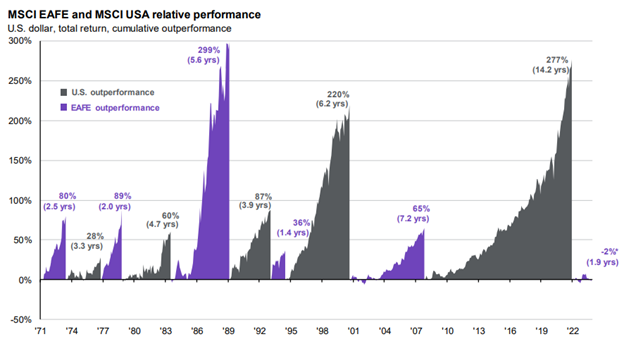

Non-U.S. stocks lagged in 2023 continuing a tough run of performance relative to the U.S. indices. Exposure to non-U.S. stocks is typically 10% to 20% of a client’s equity allocation compared to 40% of the global benchmark. This exposure is much less for our income-oriented investors where the dividend stock concentration is high.

Source: JP Morgan

While we’ve benefited from this underweight position relative to the global benchmark in recent years, the increased portfolio diversification certainly represented a drag in 2023 versus the U.S.-focused S&P 500. Looking ahead, we remain intent on keeping the current non-U.S. investment exposure to maintain portfolio diversification and given the attractive relative valuations and yield premium (e.g., 2.8% for the all-world benchmark versus 1.4% for the S&P 500). Moreover, if the dollar weakens due to lower U.S. Treasury yields attracting fewer foreign investors, non-U.S. stocks should benefit.

Fixed-Income Yields: Back Where We Started

Second only to the “Magnificent 7,” the financial market press devoted considerable ink to interest rate volatility and discussing the Federal Reserve’s next move in 2023. The focus on the topic is understandable. After all, beginning in March of 2022, the Federal Reserve executed its fastest ever series of rate hikes, resulting in the Federal Funds rate increasing from 0.25% to the current 5.25%. This increase was a seismic shift with implications for most all asset prices, bank CD and fixed-income yields, and borrowing costs across the credit spectrum.

The magnitude of this shift for borrowers was evident in the 30-year mortgage rate, which approached 8% in late October after a few years where 3% or below had become standard. These higher interest rates were not all bad news. For savers, at the peak in 2023, those banks desperate to retain deposits offered two-year CDs with yields approaching 6%.

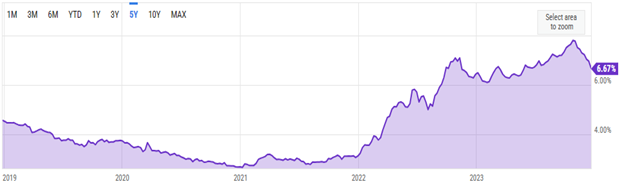

30-Year Conventional Mortgage Rates – So Much for those COVID Lows

Source: YCharts, December 28, 2023

As volatile as the year was for savers and borrowers alike, the Two-Year and Ten-Year Treasury Yields ended the year back where they started. Specifically, yields on the Two-Year U.S. Treasury stand at 4.3% versus 4.4% a year ago. The Ten-Year U.S. Treasury yields 3.9% - same as this time last year - albeit down from 5% in late October, a level which had not been seen since 2007.

Any seasoned fixed-income investor will tell you that the pace and magnitude of the spike in rates late summer and through the fall was disconcerting. In fact, many began to wonder if the yield curve was finally starting to price in the well-documented fiscal challenges of the U.S. and other sovereign nations, which would result in a permanent shift in borrowing costs.

"The bottom line is that investors across all asset classes need to spend some time not only on who is buying Treasuries…but also on Treasury auction metrics and what the rating agencies are saying and doing." Ray Dalio, Bridgewater Associates, November 2023

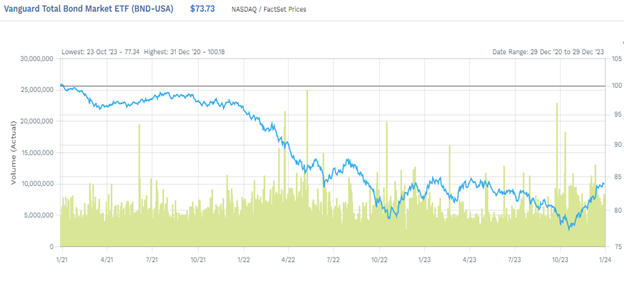

While we are hesitant to dismiss these concerns (and thus our persistent disdain for long bonds), mid to high-single digit yields for three to five-year bonds were certainly appealing, particularly for risk-averse investors. The appeal of these 5%-7% yields, coupled with signs of slowing inflation and dovish Federal Reserve comments, contributed to the significant November and December bond and stock market rallies. The Vanguard Total Bond Market Fund (BND) price chart below captures this nearly 10% bond market rally to end the year.

Source: FactSet Data Systems. BND – Total Bond Market ETF, FactSet Data Systems, December 28, 2023

As a result of the rally, bond prices have anticipated 1.5% of Federal Reserve cuts in 2024 compared to 0.75% indicated by the most recent Federal Reserve Dot Plot, which charts each official’s rate expectations. Only time will tell whether bond yields for this cycle peaked in October. And while some strategists see deflation as the next great Federal Reserve worry, a whole generation of investors now better understands duration and the inverse relationship between bond prices and yields.

Strong Investor Flows and Improved Sentiment. Fortunately, some Fundamental Tailwinds Remain.

We never advocate jumping in and out of markets. This is a loser’s game and often carries a big tax bill. Yet, the math is clear. The best expected returns come from buying when markets are depressed, the economic outlook uncertain, and investor sentiment is poor.

According to Jefferies & Co., equities experienced nine consecutive weeks of inflows in the fourth quarter, and investor optimism is back to April 2021 highs, which equates to the 92nd percentile of the AAII Bull-Bear spread. This data certainly indicates the low-hanging investment return fruit has been plucked.

Even still, based on conversations with current and prospective clients, we would be hard pressed to conclude retail or institutional investors skew overly bullish, let alone, euphoric. We also think the improvements in household net worth and income remain underappreciated. These factors lend support to the potential for additional investment gains in this latest market cycle.

And while the geopolitical picture is as tenuous as it has been in decades, there remain meaningful fundamental tailwinds supporting the prospects for corporate revenue growth and margin expansion. These tailwinds include 1) continued signs of the “reshoring” of manufacturing, 2) state and local coffers flush with “use it or lose it” cash thanks to stimulus and other infrastructure programs, and 3) a persistent consumer aspiration (both among the retired and the gainfully employed) to go and do.

“The trouble with retirement is that you never get a day off.” – Abe Lemons, former University of Texas Basketball Coach, 1922-2002

We’ve discussed these and other multi-year tailwinds such as innovation trends in life sciences and A.I. before. Yet, in many respects it still feels like the early innings. So, while some stocks may have priced in considerable potential already, these tailwinds seem very different than the fleeting experience of the Dot-com stock bubble of the late 1990s and early 2000s.

An Eventful 2023 and Festive Start to 2024

It was an eventful year for Woodmont including partnership promotions, an office relocation, upgrades to our technology stack and support team, and the addition of talented new colleagues. Most recently, Jack Dupuy, CFA and A.J. Peapos, CFP officially joined our team. Jack comes to Woodmont with a background in corporate lending and adds another University of Georgia alum to our ranks. We are proud to say Jack has hit the ground running as a member of our investment team. A Pennsylvania native and life-long Nittany Lions fan, A.J. is the newest member of our financial planning team. His tax-planning experience has already proven valuable, particularly in anticipation of fourth quarter estimated payments due January 15th. Most importantly, however, both Jack and A.J. bring terrific can-do spirit, attention to detail, and a passion for doing what is best for our clients. We are thrilled to have them on the Woodmont team, which currently totals sixteen.

On January 11th we will host an open house to celebrate the new year in our new office in Green Hills. If you plan to join us and haven’t already, please give us a call or RSVP to RSVP@woodmontcounsel.com. The event is from 4 PM to 7 PM. It is our goal that the event provides clients and friends of the firm an opportunity to visit with old friends and make new ones in our recently renovated office setting.

As always, let us know if you have questions regarding your portfolio or financial plan. Thank you for your continued trust and confidence and best wishes for a healthy and rewarding 2024.

The Woodmont Team

January 2, 2024

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.