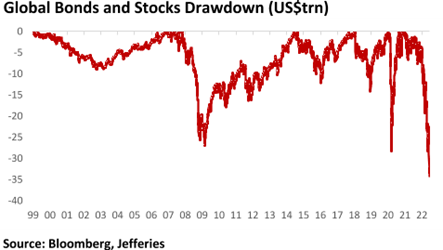

The upcoming 4th of July holiday is a welcome mid-year respite. For investors, the “Rapidly Shifting Investment Landscape” we discussed in our May intra-quarter commentary is now a much-changed investment landscape. Not only did stocks decline for nine consecutive weeks, bonds had the worst year ever in just half a year’s time. The rare occurrence of stocks and bonds declining in tandem was a one-two punch, particularly for investors who had capitulated to the idea that rates would remain low forever and thus owned intermediate and long duration bonds.

While the historic volatility in stocks and bonds created plenty of angst for investors, the combination of the ongoing war in Ukraine, mass shootings, crime, inflation, and political posturing heading into the November elections has been enough to discourage even the most optimistic among us. In fact, it is not unusual to hear even someone disconnected from the political fringes ponder whether our two-hundred and forty-six-year democratic experiment may be entering its later stages.

“There is nothing wrong with America that cannot be cured by what is right with America." – President William J. Clinton

We recognize the challenges to democracy, capitalism, and the human species only seem to mount with each passing year. Certainly, the first half of 2022 has added several new issues to the list. Yet in the context of World War II, turmoil of the 1960s, Cold War, and global pandemics, it is important to remember the first half of 2022 is far from our first rodeo.

Lessons Learned and Some Context

As the resilient see hope, so too does the disciplined investor uncover opportunities. For instance, who among us still believes everything they read on the Internet (particularly when the ads are popping up alongside the text), has not been inspired by Ukrainians or the millions of healthcare workers who showed up every day during the pandemic, or believes the typical state or federal government agency moves faster than the free market? While it is easy to be disheartened by the many tragedies and emerging obstacles that have characterized the start to the 2020s, the lessons we can learn from them are as timely as ever.

As for the one-two investment punch that characterized the first half of 2022, it has presented opportunities for both risk tolerant and more conservative income-focused investors. We’ll discuss some of the opportunities in this market commentary.

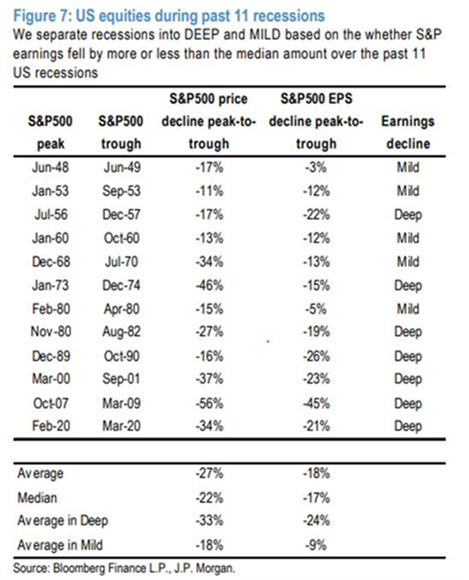

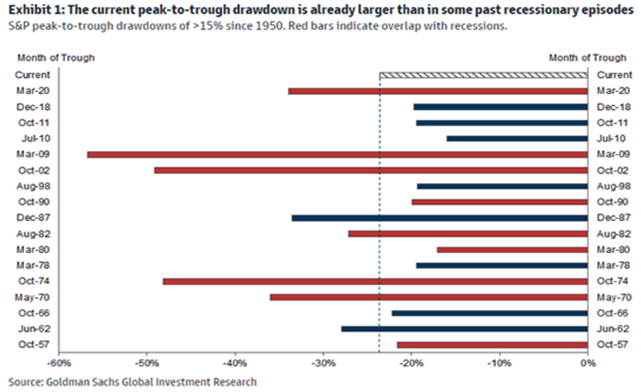

It is also helpful to understand how markets have fared during other challenging periods. While no one knows for certain if this next economic recession will be mild or deep, the 24% intra-year decline has already eclipsed the average decline for a mild recession. And while there will be new and significant challenges, time and again those businesses well-positioned heading into the downturn will inevitably emerge stronger, as will investors who remain disciplined and temper the inevitable emotional tug and short-term agony that comes with the proverbial gut punch.

Some Stocks Had Further to Fall

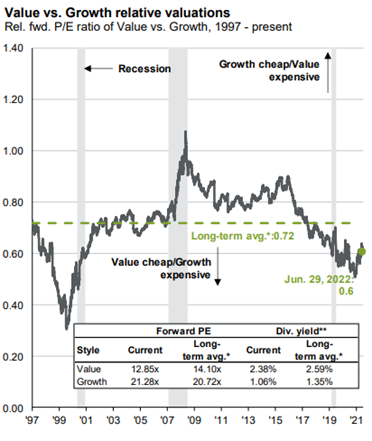

We have always believed equities provide the best long-term risk adjusted returns for investors. However, valuation matters in providing a margin of safety in a downturn as well as opportunity for future appreciation. During the last few years, many investors have benefited from buying the most exciting businesses regardless of price. This strategy worked well for a while as the P/E gap grew between speculative growth stocks and cheaper businesses.

Since the start of 2022, there has been a significant regime change from growth to value, as evidenced by the 10% decline in U.S. large-cap value index versus 31% for a comparable growth index. High-flying performers from the start of the pandemic, such as Meta (Facebook), Netflix, and PayPal have all seen their valuations cut by more than half since the start of the year. In fact, these companies have fallen so far from their highs that FTSE Russell has added all three to their Russell 1000 Value index. The growth company valuation reset has not been limited to high-profile public companies. Last month, highly touted hedge fund Tiger Global, disclosed losses in its flagship fund that includes 50-70% mark downs on its private investments.

Source:J.P. Morgan

Warren Buffett compares interest rates to gravity for their impact on asset valuations. When interest rates are low, valuations can go the moon. Conversely, as rates begin to rise, so does the gravitational pull on valuations. We have seen these forces at work during the first half of the year. So far, earnings revisions have been mild, but prices have fallen significantly. The forward P/E for the S&P 500 has gone from 23x to 16x from the start of the year through the end of June. As we mentioned in our May intra-quarter commentary, as most asset prices decline, so too does the riskiness of the investment.

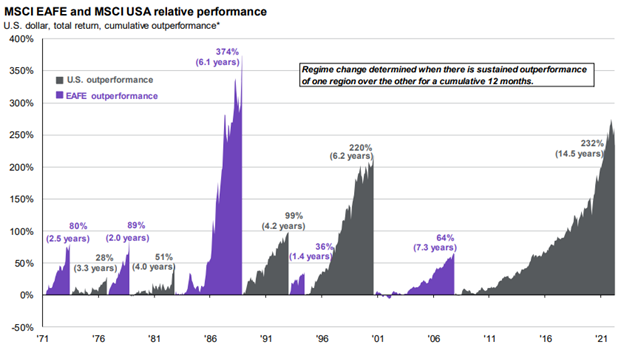

Buying great companies at good prices is one important way to help protect against significant losses. Diversification also plays an important role in our portfolio construction process. While we have always been U.S.-biased in our allocations, we believe an international allocation deserves consideration. Currently, the U.S. markets are on a 14+ year streak of outperformance relative to international stocks. The P/E spread between international and U.S. markets is roughly two standard deviations from the historical norm and the dividend yield is twice as great. No one knows when or the extent to which this valuation gap could close, but the risk-reward tradeoff is attractive enough that we want our clients to maintain exposure.

Source: J.P. Morgan

The Valuation Divide: Less Extreme Than It Was

In previous commentaries, we have pointed out the top-heavy concentration in the S&P 500. The top 10 holdings in the S&P 500 have fallen from 32% to 28% of the index. Yet, the 24x forward P/E is still 25% more expensive than its historical average. Compare this to the remaining 490 stocks, which are selling at 15x, cheaper than their historical average. Perhaps not surprising, the top 10 stocks in the S&P declined by 27% compared to a decline of 16% for the remaining 490.

Small-cap stocks are even cheaper, selling at 80% of their historical valuation average, a valuation level last seen in the Great Financial Crisis. While historically more volatile, in recent quarters we have begun to modestly increase our investment exposure to small-cap companies due to their attractive valuations and to provide diversification to the top-heavy S&P 500 index. Unlike in the large-cap space, lower valuations have not helped small-cap stocks, which are ahead of the Nasdaq’s 30% decline but still down a painful 23% year-to-date.

Bonds Are Priced Lower Too (Much Lower)

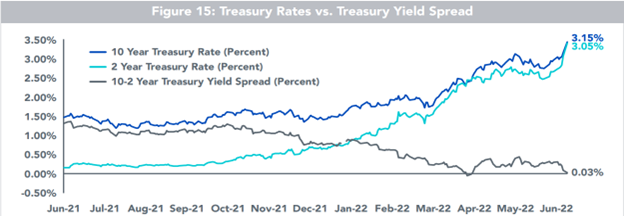

In our April commentary, we discussed the thesis behind our fixed income investments and why we were positioning portfolios into shorter duration bonds and bond funds. To recap, we did not believe investors were receiving proper compensation for the extra risk of extending down the yield curve. This prudence has served our clients well, considering the total bond index is down 10%. The risk that rising interest rates pose to longer maturity bonds is significant. For instance, the thirty-year treasury bond index is down 23% year to date compared to a 3% decline for the two-year treasury bond index.

Yields have increased significantly on the short end of the yield curve. For example, the two-year treasury is yielding 12 times the rate it was just one year ago. However, the yield curve remains flat outside of four years, and in our view fails to offer investors adequate compensation for the additional risk. We are also finding better return opportunities in investment grade corporate bonds. Over the past few months, we have invested cash otherwise earning close to 0% in relatively short duration investment grade fixed income. Many short-term (5 years or less) investment grade corporate bonds currently yield greater than 4%. By keeping our fixed income exposure limited to short-term bonds, we can earn meaningful returns over cash without taking on much credit or interest rate risk.

Source: Wisdom Tree

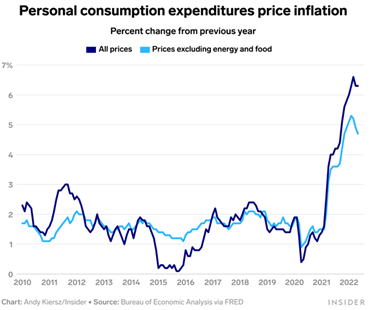

Seemingly Everything Is More Expensive, But Some Commodities Are Off Their Highs

According to the American Automobile Association, the average price per gallon is $4.87. That’s up $1.80 from this time a year ago. For the first time ever, the median apartment rent in the United States is over $2,000 per month, up over 15% from a year ago. Despite rising expenses, Americans are quitting their jobs at a record rate. Over 4 million Americans have voluntarily resigned from their job each month for the past 12 months. This mass exodus is nearly a 50% increase from historical average and adds costs to businesses’ bottom lines as they refocus their efforts on hiring, training, and retaining employees. The labor force disruption is particularly apparent in service industries, with “now hiring” signs more common than not.

One recent bright spot in the inflation debate is falling commodity prices. Commodity price movement is often seen as a leading indicator for future inflation. Most major commodities (timber, copper, oil, etc.) are down double digits from their record highs. Some experts believe this is a sign of softening inflation and a potential slowdown or pause in Federal Reserve rate hikes.

The impact of higher interest rates is particularly acute for first-time and new home buyers. The average 30-year fixed rate mortgage in the United States is approximately 5.8%. Less than one year ago, that figure was below 3%. It’s possible we will never again see such low borrowing rates. However, as noted in our bond discussion above, what is bad for borrowers can be a silver lining for investors. Retirees or more conservative income-focused investors can now earn reasonable returns on their cash without taking equity market risks.

Pessimism Abounds. What’s Priced In?

According to The Conference Board Consumer Confidence Index, consumer sentiment is at a 9-year low. As investors, we ask ourselves how much of this negativity is now reflected in reduced market prices? Looking back at S&P 500 peak to trough drops of 15% or more since 1950, the current drawdown has already surpassed more than half of all drawdowns. If we use historical data as a guide, a significant amount of concern for the economic outlook has been priced into the equity markets.

A Mid-Year Check In

The year’s half-way mark is a good time to review your investment portfolios, reflect upon long-term objectives and identify any new goals or near-term needs. With the stock and bond market declines, you’ve likely observed investment activity in your portfolio. Please contact us should you have any questions or concerns about any long-held or new investments. We appreciate the uncertainty of this era and welcome a discussion regarding the investment and financial planning challenges and opportunities this new landscape presents.

Thank you for your continued trust and confidence. We look forward to answering any questions and wish you and your families a safe and relaxing 4th of July weekend.

The Woodmont Team

July 1, 2022

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.