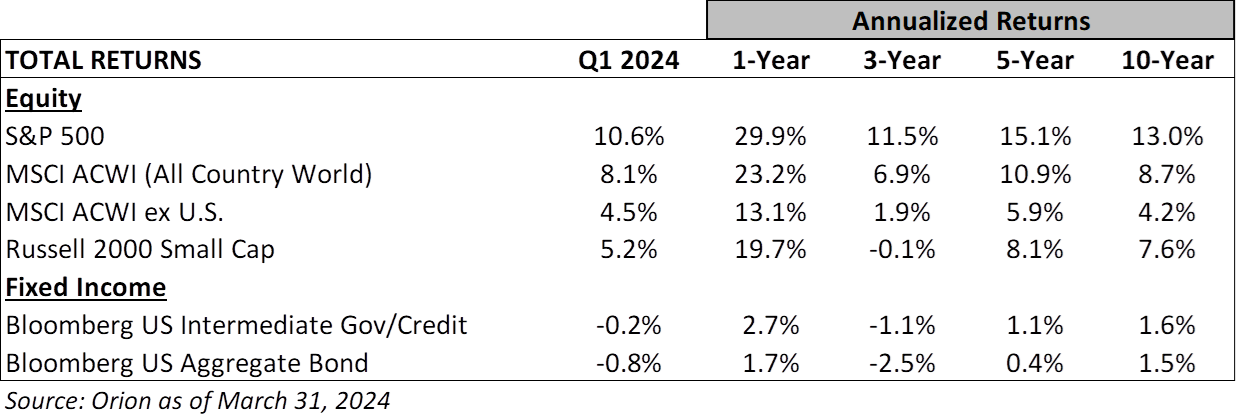

Momentum is a powerful thing – in life, sports (just ask March Madness opponents of N.C. State’s men’s and women’s teams), and the financial markets. Fortunately for investors, the stock market momentum from last year’s “magnificent” rebound and fourth quarter rally carried into the first quarter. Quite frankly, with the S&P 500 posting its best quarter since 2019, and one of the best in 20 years, the extent of the rally shocked even the most bullish market prognosticators.

Unlike the historically narrow market in 2023, a wide range of large-capitalization cyclical and non-cyclical stocks have rallied, including those where any potential A.I. boost is far from imminent. In fact, ten of eleven S&P 500 industry sectors were positive in the first quarter, with real estate as the only one missing the party. In addition to this broadening participation among U.S. large-capitalization stocks, non-U.S. stocks, mid-capitalization, and small-capitalization stocks rallied as well, albeit posting gains in the mid-single digits compared to the S&P 500’s 10.6% surge.

One might presume the strong start reflected a diminishment of the headwinds confronting investors. Yet, in many respects, the obstacles have only grown: 1) Interest rates moved higher during the quarter, resulting in losses for the bond indices, 2) the expectation for 2024 earnings is lower (still expecting growth but less growth), and 3) geopolitical tensions continue to rise. Not to mention, a January Reuters/Ipsos poll revealed that almost 70% of Americans are concerned that neither of the two presumptive major party Presidential nominees are fit for the job.

Seasoned investors understand the stock market’s unforeseen and often crazy swings - both the positive and the negative - are the nature of the beast. Investors must also appreciate that current headlines may very well be old news for equities, which are valued on the outlook for future earnings.

And the Next Shock Is…

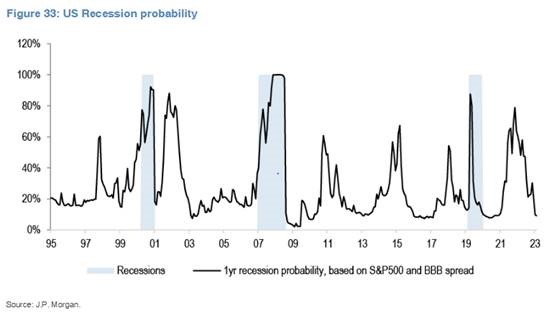

Despite the challenges, the probability of a recession in the next twelve months is down from over 80% in 2022 to under 20% today, based on the relationship between the S&P 500 and bond credit spreads (Source: J.P. Morgan). The reduced likelihood of a near-term recession has been a catalyst for the broadening of the market gains to include many 2023 stock laggards (e.g., cyclical sectors such as financials, industrials, and consumer discretionary).

In this commentary, we’ll discuss current equity valuations, some concerns (the widely deliberated and the arguably neglected), and how we are adjusting portfolios on the heels of such strong equity gains and interest rates that are higher today than at the start of the year. It will come as no shock to our clients that any portfolio adjustments are relatively modest, independent of a client-specific financial planning consideration. We have long recognized making significant quarterly adjustments in hopes of positioning for the next near-term market move can be a destructive strategy. Put simply, history tells us market shocks are inevitable, but the long-term reward for those who can endure the craziness is compelling.

The Price Is Much Higher. Will the Earnings Respond?

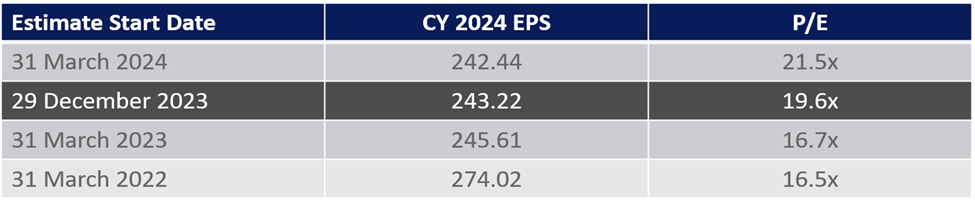

It is often said “earnings are the mother’s milk of bull markets.” Yet while the Wall Street consensus for 2024 S&P 500 earnings has declined 12% from two years ago, the index has gained 18% during this period. An expansion of the price to earnings (P/E) multiple, which is at 21X versus 17X two years ago, has fueled this rise.

Companies will report first quarter earnings and, in many cases, update annual forecasts in the coming weeks. This will increase investor visibility for 2024 earnings and provide insight into whether the recent S&P 500 price gains and P/E expansion were correctly anticipating a better earnings outlook.

While an unexpected development can quickly derail the earnings outlook, we continue to see potential underappreciated tailwinds for U.S. corporate earnings. These include:

- The consumer’s desire to spend has yet to falter. Many homeowners have low fixed-rate mortgages and savers now earn a real return on their cash savings. Never mind, the potential “wealth effect” of a Bull market.

- Companies have generally been able to sustain the price increases they took to offset inflation. At the same time, these companies are improving productivity and experiencing declining or at least stabilizing input costs.

- As noted in our January commentary, we could still be in the early innings of some compelling multi-year trends such as A.I. (including its seemingly insatiable need for electrical power), innovation in the life sciences, and aggressive “reshoring” of certain manufacturing activities.

Even if the Earnings Come Through, Sustaining Investor Confidence Is No Small Feat

Market pessimists have plenty of ammunition to make their case. Concerns include commercial real estate fallout from higher interest rates and increasing vacancies, declining consumer and industrial shipments, and a potential big tech U.S. and China trade war. While no less formidable, we take some solace that it would be difficult to argue any one of these represents an unforeseen shock factor.

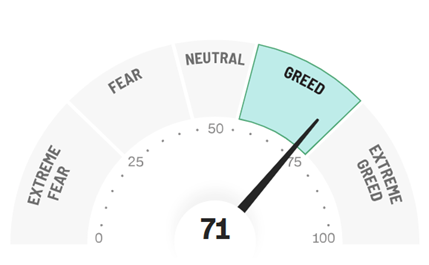

We would struggle, however, to argue investor sentiment is still supportive. Specifically, the market’s gains over the past year have translated to improved investor sentiment and an increased appetite for risk. Whether the American Association of Individual Investors’ weekly survey or CNN Business’ Fear & Greed index, most recent data point to considerable individual investor optimism.

Source: CNN Business Fear & Greed Index, 4/1/24

As regular readers of this commentary understand, we always find it easier to advocate for equities when sentiment is poorest. Put another way, it makes us nervous when most everyone seems to be “sitting on the same side of the boat,” which in today’s case would be the “greed” side. The practical application of recognizing this shift in sentiment is often investing a risk-averse client’s cash over the course of several months versus all at once. And while we’ll always be sensitive to the pitfalls of market timing, this dollar cost averaging plan is generally welcome news for the more cautious investor.

The Strong Continue to Get Stronger

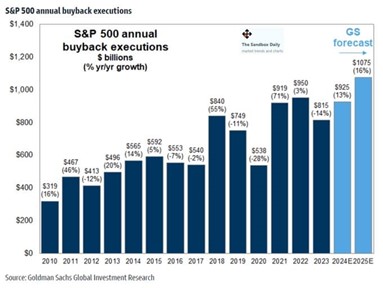

Impressive levels of cash flow and historically low debt leverage ratios provide public companies with considerable flexibility to drive future earnings growth. Per the chart below, many companies in the S&P 500 plan to repurchase their own stock. If these estimates are correct, almost 2% of the S&P 500’s market capitalization could be retired in 2024. While new issuances from stock awards and capital raises will offset the repurchase activity, the net benefit is not insignificant.

Companies may also use this strengthened financial position to purchase other companies. There have been several high-profile public merger announcements in recent weeks. What may be underappreciated, however, is the opportunity for public companies to purchase some of the thousands of private equity-owned companies anxious for an exit.

According to a recent Bain & Company report, private equity portfolios include 28,000 unsold companies seeking more than $3 trillion in value. Higher interest rates and an M&A valuation reset have stalled deal activity, as evidenced by sales being down 44% in 2023.

Most of these companies will eventually sell to other private equity firms or existing private companies. Still, we would not be surprised if well-positioned public companies took advantage of the private equity need for liquidity and a resulting reset in valuations.

Interest Rates: Higher for Longer, But for How Long Is Still Up for Debate.

Late last fall, bond investors had anticipated 1.75% of Federal Reserve rate cuts in 2024. Those expectations have now reset to 0.75%. Consistent with this shift, the yield on the Ten-Year Treasury bond is 4.2% at quarter end compared to 3.9% to start the year.

The bottom line is that inflation has not retreated as quickly as the market (or Federal Reserve) anticipated. Record levels of financial liquidity, government largesse on the heels of COVID still working through the system, and the less frequently discussed yields on cash savings are all factors. Eventually, the economy will slow as prices in restaurants, hotels, shopping malls (online and virtual), and other goods and services hit levels that squash demand. Alternatively, some unforeseen shock will cause consumers to panic and/or investors to flee riskier asset classes in exchange for Treasuries. This shift would drive Treasury prices higher, conversely pushing down yields.

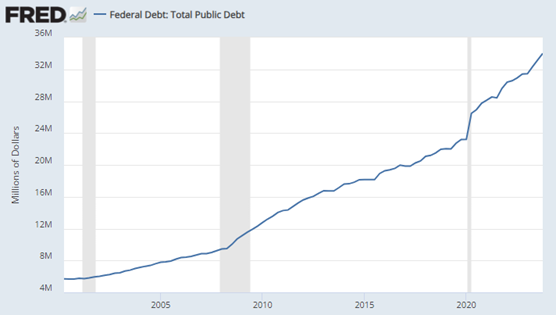

In the interim, one challenge for a significant decline in interest rates may be supply. Outstanding United States’ public debt now exceeds $33 trillion. Given the short duration of most U.S. government bonds, the government issued $23 trillion of debt in 2023 alone to fund deficits and refinance maturing bonds (source: Wall Street Journal). For context, the entire market capitalization of the S&P 500 is less than $50 trillion.

Source: Federal Reserve Economic Data

The United States is still a good credit. There is no better place in the world to do business and the dream for innovators and hard workers to live and work in the U.S. has hardly diminished. Yet, it is tough to argue that today’s fiscal challenges, particularly with regard to our unfunded entitlement programs, haven’t made the U.S. a less-good credit.

Whether our deficits and mounting debt mean we won’t return to the unusually low rates of the past decade or result in a yield spike a’ la the 1970s and 1980s is unclear. In the meantime, we continue steadily increasing bond portfolio duration to add investment grade government and corporate bonds yielding 4% to 6%. We are sensitive, however, to preserving investment flexibility with what is the conservative portion of client portfolios. That means fixed-income portfolio duration is likely to stay between three and four years for most balanced portfolios.

A Community Can Come Together

The one-year anniversary of Nashville’s Covenant School shooting was this past week. One passing through the West Nashville neighborhoods near the school would notice the signs of encouragement, commemorative ribbons, and on this past Thursday, many students trading their respective school colors for those of The Covenant School. Nothing can undo this tragedy. Yet, we are encouraged that so many have and continue to step forward to support all those affected in big and small ways.

Thank you for your continued trust and confidence. We look forward to answering your questions and wish you a wonderful spring season.

The Woodmont Team

April 2, 2024

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.