The shifting landscape for commerce (e.g., bricks to clicks), record unemployment, and the number of businesses that have permanently closed due to COVID-19 creates a degree of economic uncertainty we have not seen since The Great Recession of 2007-09. In this commentary, we will discuss some of these economic challenges, assess how the markets responded in the second quarter, and highlight a few of the most pressing threats and opportunities for investors.

Included in this issue:

- Fighting COVID-19

- Another Great Challenge

- The Storm Beneath the Broader Markets’ Calm

- The Federal Reserve Just Did What?

- With Rates So Low What Do Investors Do With Their Cash?

- Can I Count on These Dividends

- As Many Have Concluded, “the Stock Market Is Not the Economy”

- All Eyes Are on 2021 Earnings (and the elections in November)

- Some Welcome ConstantS

Fighting COVID-19

Since issuing our April Market Commentary, “The Will to Win Cannot Be Beat,” there has been significant progress in the fight against COVID-19. Of course, the surge in cases in recent days reminds us this fight will go on through the fall and into 2021. Yet thanks in large part to our scientists and healthcare workers’ “will to win,” improved treatment methods have dramatically reduced the hospitalization mortality rate, and a vaccine could be available by early 2021. While no less devastating to those impacted, most experts agree that given what we’ve learned thus far we are likely to avoid the more catastrophic predictions for the virus issued earlier in the year.

Nevertheless, emerging from the sheltering in place that characterized March and much of the second quarter has and will continue to present tremendous challenges.

Another Great Challenge

As significant as the COVID-19 threat has been and will be, our nation faces another great challenge, which will also affect the economy and financial markets. The most recent and tragic deaths of Black men and women have again brought to the forefront longstanding issues of inequity, which are rooted both in prejudices/racism and terrible public policy. For a growing number of Americans, the trust in our institutions and the elected officials who serve us has been fractured.

The protests, national discourse, and our conversations around the dinner table highlight the magnitude of what is transpiring in communities large and small. How our nation responds will impact everyone’s cultural and economic experience for decades to come. Specifically, can we seize the opportunity to do better, including finding common ground around the ideals we must promote and the wrongs we must right?

“The greatness of America lies not in being more enlightened than any other nation, but rather in her ability to repair her faults.” -Alexis de Tocqueville

The path to progress and a restoration of trust won’t be a smooth one. It rarely has been. Yet we are encouraged during this July 4th season when we reflect upon the challenges our nation has overcome in our 244-year history. Yes, the ability “to repair her faults” Tocqueville observed will be tested. The track record, however, is not one we would advise betting against.

The Storm Beneath the Broader Markets’ Calm

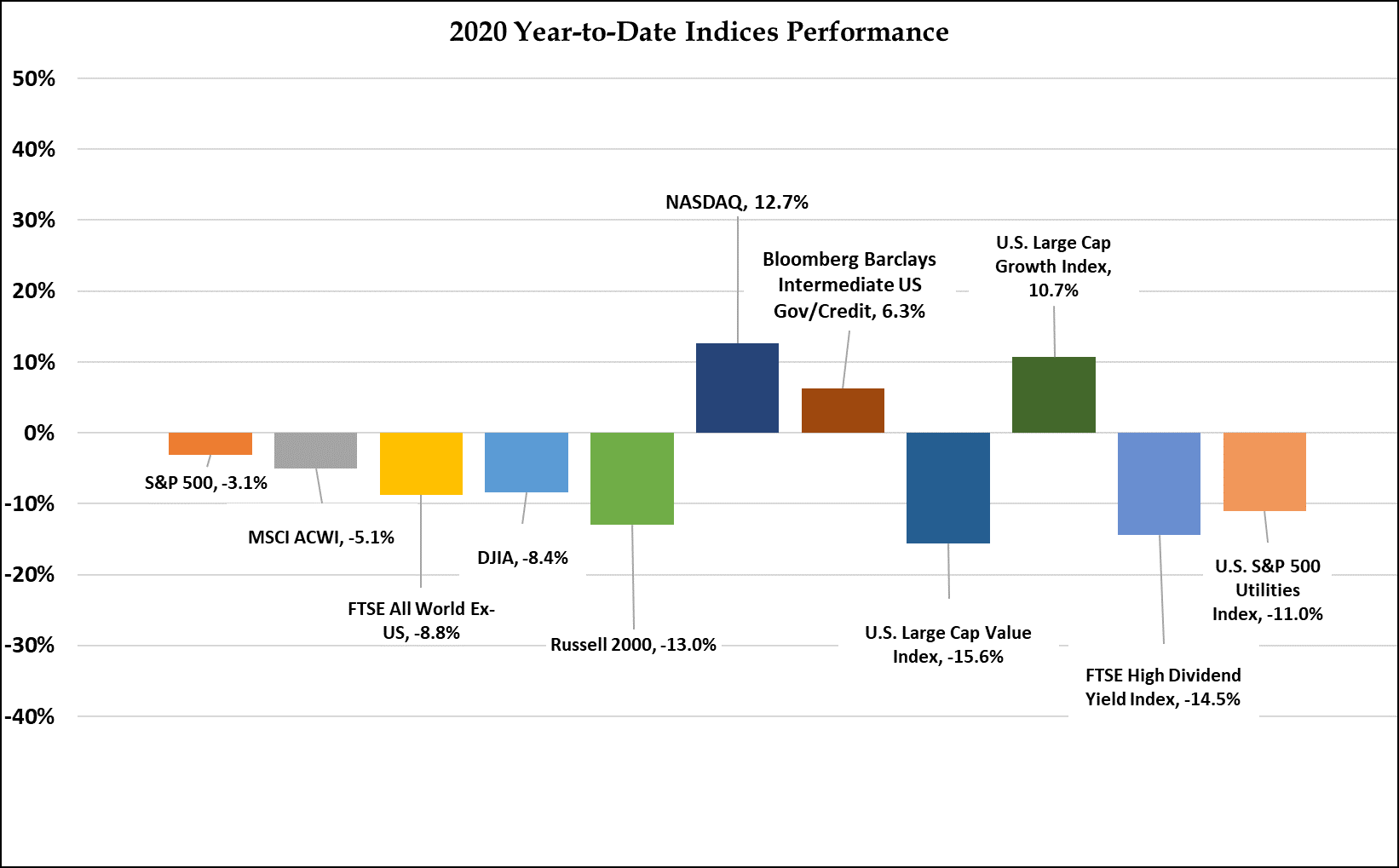

Year to date, the S&P and All World Equity indices are down 3% and 5%. The Barclays aggregate bond index is up 6%. While the record stock and bond declines from February to March tested even the most seasoned investors, the markets bounced back in April and May in record fashion thanks in large part to progress fighting COVID-19 and unprecedented Federal stimulus.

Source: WIC & FactSet

Looking beneath the surface of the major market indices reveals a picture more representative of today’s economic challenges and the shifting landscape. For instance, year-to-date value and dividend focused stocks are down 16% and 15%, respectively. These groups include hard hit financial, transportation, and energy stocks. The small-cap and non-US indices are down 13% and 9%. Even the usually defensive utility sector has lost 11% in the first half, including 4% the past two weeks. As a result, many quality companies in the utilities sector offer investors yields 6-7X the current U.S. Ten-Year Treasury yield of 0.7%.

Supporting the prices of the major market indices as much as ever has been several large-cap tech companies. The tech-heavy NASDAQ, for example, is up 13% for the year. The NASDAQ’s outperformance of the S&P and Dow represents the largest first half gap since 1983. More specifically, the share prices of FAANGM (Facebook Amazon Apple Netflix Google and Microsoft) have gained on average 26% year-to-date. Given our dependence on the services of these behemoths, which has only increased during the COVID-19 crisis, it is not surprising investors have flocked to these stocks.

Source: Bespoke Investment Group

Fortunately, most of our clients have some exposure to many of these high performing stocks either directly or via broad-based exchange-traded funds (ETFs). Whether this basket of companies can continue to outperform is difficult to discern. While the secular growth tailwinds are significant, the increased valuations reflect considerable optimism. Also, shareholder ownership concentration is at record levels. For instance, the S&P technology sector plus Amazon (a consumer discretionary company) now represent 27% of the S&P 500’s market capitalization versus 20% a couple years ago. Clearly, finding the incremental buyer will be increasingly difficult.

The Federal Reserve Just Did What?

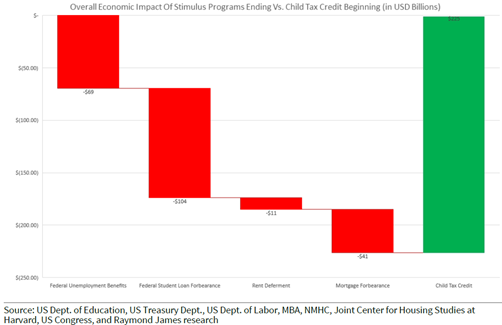

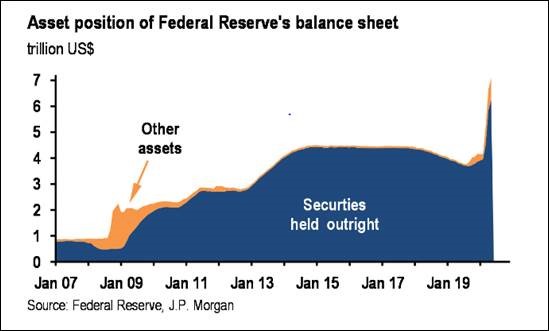

Federal stimulus legislation, including the March 27, 2020 CARES Act, has injected $3 trillion of support for individuals and businesses. We discussed some of these opportunities in our update here. While it remains unclear what happens later this summer as parts of the stimulus dissipate, the legislation provided a crucial buffer during the most severe phases of the shutdown. Perhaps even more meaningful for the performance of the financial markets has been the unprecedented actions of the Federal Reserve. Not only has Chairman Powell indicated the Fed Funds rate will be maintained near zero for the next couple of years, but the Federal Reserve has purchased trillions of dollars of fixed-income securities. These purchases quickly reversed the widening of interest rate spreads between risk free and risk assets. This was crucial since for a brief period in March and April the fixed-income sell-off meant many companies either had no access to credit or faced dramatically increased borrowing costs. While Chairman Powell and the Federal Reserve’s commitment to supporting financial markets appears unwavering, one must worry about the limitations. After all, there is $16 trillion of mortgage debt outstanding, $10 trillion of corporate debt, and another $4 trillion of state and municipal debt outstanding. We are reasonably confident the Federal Reserve does not intend to buy it all.

In the meantime, borrowers may want to evaluate the prospects of refinancing existing debt. Specifically, thirty-year conventional mortgage rates have reached historical lows. Our brief update on the topic from last week is available here.

With Rates So Low What Do Investors Do With Their Cash?

The Ten-Year Treasury began the year yielding 1.9% versus a forty-year average well above 4%. Today the Ten-Year yields 0.7%. We’ve seen a collapse in yields at the short end of the yield curve as well. For instance, money markets and short-term CDs, which were paying over 2% one year ago now yield less than 0.2%. Investors would have to purchase securities with greater than five-year maturities to find quality municipal debt above 1.0%. Even though there are limitations to the Federal Reserve’s power to keep rates low, especially considering the unprecedented fiscal stimulus, it is possible that it could be years before yields are sufficient to warrant committing one’s capital.

We continue to believe stocks represent a relatively attractive option for cash not otherwise set aside for specific needs or as a safety net. This includes some exposure to recently underperforming small-caps and non-U.S. stocks, which have suffered in part given investors’ perceptions of risk. During the second quarter we added a modest amount of small-cap exposure to most portfolios. The asset class’s multi-year performance divide and ensuing valuation discount relative to large-capitalization stocks now exceeds that of the early 2000s, which proved an excellent time to increase exposure.

A portfolio which invests exclusively in stocks is only appropriate for a small segment of risk tolerant investors. For most other clients, we will continue to opportunistically add exposure to less correlated but liquid alternative strategies where long-term expected returns are in the low to mid-single digits. The alternatives asset class has proven much less volatile than stocks and is attractive considering today’s paltry bond yields.

Can I Count on These Dividends?

The economic recession brought on by the COVID-19 shutdown has created tremendous uncertainty for corporate earnings, let alone, the dividends many companies pay. According to the S&P 500 dividend futures’performance, as of June 27th the drawdown in dividend expectations was about 10%. In The Great Recession the decline in dividend payments from peak to low was 24%. Perhaps not surprising given the disparate impacts to sales and margins for certain sectors of the economy, the anticipated cuts have disproportionately affected sectors like energy and select consumer discretionary companies.

According to Barron’s, approximately 31% of S&P dividends now come from the relatively well-positioned technology and healthcare sectors. In the aggregate, expected dividends represent under 50% of estimated 2020 EPS and just 37% of estimated 2021 earnings. We believe these payout ratios are reasonable. It is important to note, however, that financial stocks still make up about 30% of S&P dividends. Thus, the Federal Reserve’s bank stress test results issued last week are worth noting.

While the Federal Reserve concluded banks remain healthy with capital ratios well in excess of previous periods of economic stress, for the time being it capped bank dividends at the level of the second quarter or an amount not to exceed the average of the previous four quarters’ net income. This will likely result in reduced dividends from a few banks where low interest rates or increased loan reserves had already pressured earnings. With the bank sector down 32% year-to-date and most analysts already forecasting dividend cuts for many banks, this news has been anticipated to some degree.

As Many Have Concluded, “the Stock Market Is Not the Economy”

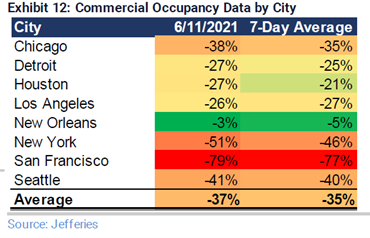

In recent weeks, we’ve seen some stabilization in the economic indicators. The unemployment rate seems to have found a current bottom at 14%, consumer confidence is no longer falling, and new building permits have recovered to last year’s levels after an initial drop early this spring. Yet the economic outlook is far from upbeat. We are still in the middle of a recession and some of the stimulus that buffered the downturn sunsets soon. And if Congress passes additional stimulus, there is no way to know if it has the desired effects.

“No one knows for sure what the second half will bring, much less 2021 and beyond. But we think that, like in the past, those who have faith in the future will be rewarded.” -Brian Westbury, First Trust Chief Economist

So, why are the S&P and All World indices just 8% and 9% below the February highs and up 40% and 35% from the March lows? Simply put, “the stock market is not the economy.” Lower interest rates, which leave investors with fewer investment alternatives, secular themes fueling earnings growth for large segments of the market, and an expectation that growth can resume post COVID have proven powerful factors in the market’s recovery. While investor sentiment can shift overnight, the markets’ first half resilience is a reminder to investors of the perils of jumping in and out of the market based on one’s view of near-term economic activity.

All Eyes Are on 2021 Earnings (and the elections in November)

The S&P 500 earnings estimates for 2020 and 2021 have come down significantly. The consensus for 2020 is now $125 versus $182 a year ago. For 2021, the consensus estimate is $162 versus $203. As we’ve discussed in previous commentaries this year, investors are mostly ignoring 2020 earnings and economic forecasts and have focused instead on 2021’s recovery prospects. After all, a company is worth the sum of its future earnings and thus the impact to long-term value of two or three quarters of deterioration is relatively modest.

At 18.6X estimated 2021 EPS, the market is trading above historical valuations but is not necessarily expensive, especially in the context of today’s low interest rates. A debate, however, is emerging on what the market has discounted in terms of the November elections, which are now just four months away. Historically, grid lock or perceived grid lock has reduced market volatility as the prospects for sweeping policy changes are muted. Thus, if it appears one party could sweep in November we could see increased volatility as potential policy details crystalize. Not surprising, one focus for investors is the corporate tax rate. It proved a clear catalyst back in 2017 so the threat of higher tax rates, if not already anticipated, could cause a reset. Whether a change in the political regime would affect Federal Reserve policy is difficult to conclude. For the time being it seems for better or for worse both parties are beholden to keeping interest rates low.

Some Welcome Constants

“Government of the people, by the people, for the people, shall not perish from the earth.” -President Abraham Lincoln

We enter the 4th of July weekend facing incredible economic and political uncertainty. In the face of such uncertainty any constants are welcome. We offer President Lincoln’s conviction on our democratic form of government as one. Another often cited constant is change. Life is full of them, both personal and professional. At Woodmont, we are enjoying the changes that accompanied adding three new team members over the past year. Their energy and insights, which we touched on in this recent firm update, are helping us identify ways to better serve our clients. In this spirit, if we can be of assistance or you have questions, please let us know.

As always, thank you for your continued confidence, and best wishes for a safe and fulfilling summer.