The Ukrainians’ incredible fortitude in the face of Russia’s invasion and merciless tactics has inspired the world. NATO has a renewed purpose, economic sanctions have been swift and arguably more severe than imagined just a few months ago, and the corporate exit from Russia has helped lift the information veil. After all, it’s one thing for an uninformed Russian citizen to make note of the volatility of the Russian Ruble, but quite another when the doors of prominent global retail outlets are literally closed overnight.

“I want to do something to change the mistrust towards politicians.” President Volodymyr Zelenskyy

The repudiation of the Russian invasion has not been universal. China, India, and a few others seem to be trying to preserve all diplomatic and economic options, including buying Russian oil below market. Moreover, some worry this war further deepens the divide between East and West and could portend an end to the post World War II global economic expansion.

There is no doubt the Russian aggression and resulting humanitarian and economic fallout have caused many to question the near and long-term diplomatic and economic paths forward. On the other hand, we’ve been reminded as one observer put it, “the world recognizes a bully when it sees one,” military and civilian heroes are not just in the movies and halls of our hospitals, and that “freedom is not free.” The response has been inspiring and we are grateful for the important lessons the Ukrainians have taught us, our children, and grandchildren. The future won’t be without its challenges, but it is brighter given their sacrifices.

A Wild Ride for Equity Investors

The first quarter started with three consecutive weekly declines for the U.S. and non-U.S. equity markets, including the worst week since the COVID-19 crisis. It was quite the wake-up call, especially considering 2021’s limited volatility had potentially lulled some investors to sleep. Following the February 24th Russian invasion, the major indices reached their intra-quarter lows on March 8th with the S&P 500 and All-World indices down 12.4% and 12.9%. Market gains in March helped the major indices end the first quarter well outside of the 10% correction territory per the table below.

A bright spot for many portfolios was that most value and dividend stocks outperformed the broader indices. In fact, the CRSP large capitalization value and FTSE dividend equity indices both had modest gains in the first quarter. In sharp contrast, the large-cap growth equity index declined 10.3%.

Still down 2.7% to start the year, the equal-weight S&P 500 outperformed the S&P 500, which has grown increasingly dependent on the performance of a few mega-capitalization stocks in recent years. While one can never predict the timing, and value and dividend stocks had trailed for some time, we discussed the increased dependency and historic valuation differences between the ten largest U.S. companies and the rest of the index in our January commentary, “Lots of Catching Up to Do.”

Source: J.P. Morgan Asset Management, Guide to the Markets, as of March 30, 2022.

Investor sentiment has improved in recent weeks. Some diplomatic boundaries for the Ukraine war seem to have been set and we have not seen a material contraction in economic activity. Nevertheless, equity investors remain on edge as measured by the various Bull/Bear and investor fear gauges. Long-time readers of this commentary and students of the market know the more on edge investors are, generally the better the near-term opportunity for investment gains. Yes, it’s a perilous time, but we would be more concerned for the markets’ outlook if investor positioning and sentiment had not already reflected some of the current challenges.

As for valuations, the broader indices are not cheap on a historic basis at 20X and 14X the 2022 estimated earnings for the S&P 500 and ex- U.S. indices. The range in company valuations within the indices, particularly the S&P 500, remains historically wide, even with the year-to-date outperformance of dividend and value stocks. As a result, many good companies with solid earnings growth potential continue to trade at or below historic market multiples of 14X-16X. While the “E” for earnings in the price-to-earnings equation can change in a hurry if the economy begins to slow, the current estimate of $225.56 for 2022 earnings stands 10% higher than this time last year and modestly higher from just a month ago.

Earnings Estimates for the S&P 500 Have Continued to Move Higher in Recent Months

Source: FactSet Data Systems

Many boardrooms have taken note of the reasonable valuations. Per the chart below, 2022 share buyback authorizations are at record levels, despite being just three months into the year. Of course, what is authorized is not necessarily what will be purchased since most companies establish stock price parameters for buyback activity.

An Even Wilder Ride for Bond Investors

The inflation data has been very “hot,” including the recently released personal consumption expenditures (PCE) index, which excludes food and energy costs. Its 5.4% increase in February was the highest level in 40 years. The steady stream of inflation data coupled with the expectations for the Federal Reserve to hike rates in coming quarters took its toll on bond prices during the quarter. Specifically, the Barclays U.S. Aggregate Bond index declined 5.9% and the Barclays U.S. Long Government/Credit index (i.e., bonds of ten-years or greater maturity) was down 10.5%. Not coincidentally given the recent inflation data records, this was the worst quarter for bonds in 40 years.

If nothing else, we have been consistent in recent periods regarding our desire to limit our fixed-income investments to shorter duration bonds and bond funds. Yes, we had some concerns about the prospects for inflation given years of accommodative monetary and fiscal policies. The crux of our thesis, however, was much simpler; we feared the impact on portfolios if stocks and bonds declined meaningfully at the same time. After all, investors take considerable risks owning stocks because of the long-term capital appreciation potential. Yet with bonds, the upside is getting your money back and collecting interest income in the interim. This distinction makes it tough to justify stretching for a little extra yield by extending maturities and/or reducing credit quality.

A Clear Response to All the Data

Currently, the Ten-Year U.S. Treasury yields 2.4%. This compares to 1.5% at the beginning of the year and 0.5% in the depths of the pandemic. The Two-Year U.S. Treasury yields 2.3% versus less than 1% in January. It is clear to all investors from recent statements by Chairman Powell and Federal Reserve minutes that their stance has shifted. Inflation is no longer “transitory,” but a real threat.

While there are a range of opinions, most believe investors have priced in at least 2.5% of rate hikes to the current Federal Funds rate of 0.5%. We’ve seen this expectation reflected not just in Treasury yields, but in mortgages that are approaching 5% for 30-year fixed rate and other loan products. Whether fixed income investors underappreciate the Federal Reserve policy shift or have overestimated it remains to be seen. What is clear, however, is that the market has moved.

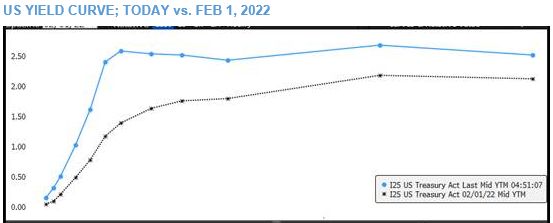

A Very Flat Yield Curve

Not only have yields moved higher, but the yield curve has also flattened. This means investors can earn yields for shorter term bonds (e.g., two to five years) that are almost as high as the yields on longer maturity bonds, which subjects investors to more interest rate risks. For most balanced portfolios, we have recently added investments in both U.S. government and corporate investment grade bonds with maturities of four years or less. While still arguably modest, the 1.5% to 3.5% yields are attractive relative to the near zero yields for current cash and cash equivalent investments. Staying with short duration bonds also limits the threat of interest rates exceeding current expectations.

Source: Bloomberg

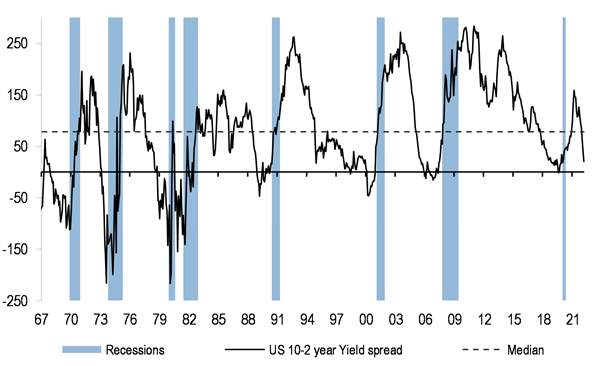

What if the Yield Curve Inverts?

While the higher rates and flattening of the curve creates an opportunity to purchase some fixed income, it also raises questions regarding the health of the economy. As you can see from the chart below, instances when the two-year Treasury yields more than the Ten-Year (i.e., inversion) have historically preceded recessions. Some investors argue the difference between the Two-Year and Ten-Year is less relevant than the gap between the Three-Month and Ten-Year Treasury. Fortunately, the spread for the latter has widened recently, helping offset some of the angst regarding an inversion of the former.

Source: JP Morgan

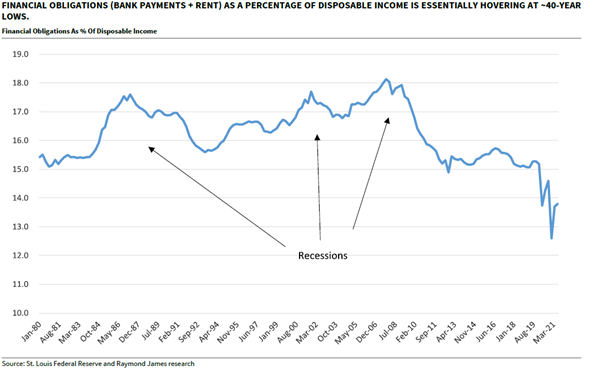

While the shifting bond market has our attention, we do not plan to dramatically adjust equity risk exposure for long-term investors for several reasons. First, an inversion has not always signaled a recession, let alone indicate when it begins and how long it lasts. According to J.P Morgan, inversions have preceded recessions by as much as two years and historically stocks have gained an average of 15% post inversion. Second, many leading economic indicators remain strong and half of the most recent infusion of $6 trillion in COVID-19 related stimulus has yet to be spent. While higher gas and consumer goods prices are obvious headwinds, household and many government balances sheets have not been this strong in years, discretionary income remains healthy, and consumer spending has so far proven inelastic. Third, the labor market and wage growth, particularly for historically lower wage positions, is incredibly strong. The U.S. Bureau of Labor Statistics and Raymond James estimate there are currently over eleven million job openings in the U.S. We certainly believe economies cycle and recessions are inevitable, but it is impossible to predict with certainty when, for how long, and the market response. The current conflicting signals of the bond market and economy should help make that clear.

It is Tax Season and Certain Deadlines Are Looming

In recent years, Woodmont has added experienced professionals focused on helping clients with important financial, estate, and tax planning considerations. As you know, we are not preparing estate documents or tax returns but instead assist our clients and their respective legal and tax professionals to identify issues and valuable financial and tax planning opportunities. Consistent with these efforts, we wanted to remind our clients that you have until Monday, April 18th to make 2021 contributions to your IRA and Health Savings Account. For Employer contributions to a sole proprietor’s 401k and SEP-IRA, the contribution deadline is April 18th, or October 17th if an extension is filed.

We are also watching proposed legislation that could result in additional planning opportunities or limitations for our clients. These include the SECURE Act 2.0, which among other things could increase the Required Minimum Distribution (RMD) age, and proposed regulations to the SECURE Act 1.0 passed at the end of 2019. We will communicate any relevant updates as we have more information, and you are always welcome to reach out to your Woodmont team to discuss in more detail.

Some “Firsts” for Woodmont in 2022

It has been a busy start to the year for the team at Woodmont. This includes adding additional investment research, planning expertise, and client service support.

Among the four new team members who have joined since January are Ralph Illges and Vicki Swann of Silver Spring Capital. Ralph, who founded Silver Spring in 2004, has joined as a senior advisor upon the merger of our two firms. Ralph and long-time Silver Spring team member, Vicki Swann, are located in our Springfield, TN office. Thanks in part to some of the things we learned during the COVID-19 crisis, they are very much connected to the rest of the team via technology and a shared commitment to serving clients. In fact, while Ralph was no stranger to our firm, we continue to be impressed with the investment and client service experience Silver Spring offered its clients over many years.

Woodmont has also hired our first full-time remote employee, Jason Bonn, CFP®. Jason is working out of Austin, Texas and primarily assists our financial planning team. In addition to Jason, Benjamin Seabourn has joined us in our Nashville office as an investment and wealth management analyst. You can read more about these new team members on our website at www.woodmontcounsel.com.

As always, we appreciate your continued confidence and trust. If you have questions or we can be of assistance, please let us know.

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.