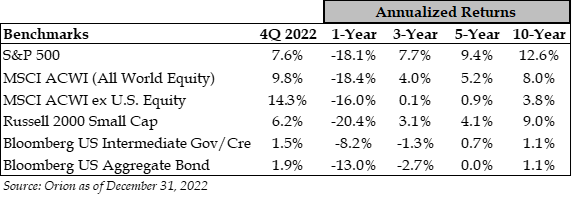

As we reflect on 2022 and plan for the new year, there is no shortage of bad news. The traditional stock and bond balanced portfolio had its second worst year on record thanks to the combination of the largest ever annual declines in bond prices and the most significant losses for stocks since 2008.

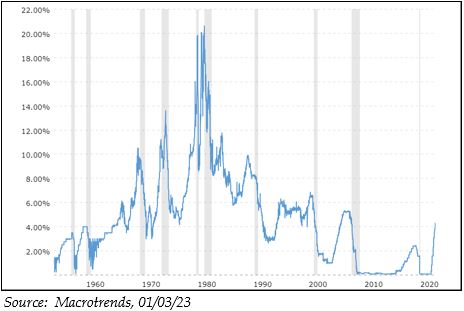

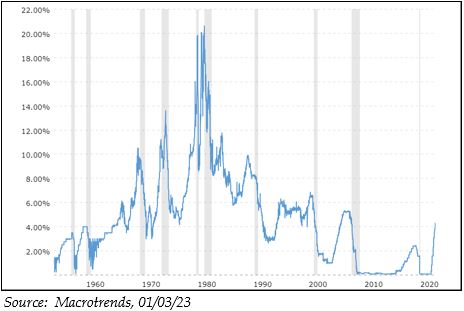

Years of fiscal excess, easy monetary policy, labor shortages, and supply chain disruptions have contributed to inflation not seen since 1981, resulting in higher prices for just about everything short of cryptocurrencies. Adding to the angst, was the 2022 mid-term election season, which once again highlighted our desperation for political leaders focused less on the next political score and more on the mounting challenges we face.

As for the good news, investors can for the first time in more than a decade earn a substantive yield on low-risk and risk-free investments. We have pulled forward exciting innovations in the life sciences and learned tremendous lessons from a global pandemic. Then, of course, the Ukrainian people continue to teach us about resilience and how precious freedom is. Lessons that arguably are only learned in tenuous times.

In the cultural realm, the recent World Cup final was a reminder that our sports heroes can still amaze us, even in the face of high expectations and tremendous pressure. And, surprisingly, Hollywood proved it can get it right on occasion with the nearly universally applauded Top Gun sequel.

With regards to the markets, we have weighed the economic and investing bad and good news heading into 2023 and have drawn some conclusions. These include:

- Stocks and Bonds Are Much Less Expensive than this Time Last Year, Improving the Return Outlook

- Lots of Bad News Is Priced in as Investors Have Rarely Been So Fearful

- Capital is Suddenly No Longer Cheap, But It Remains Available

We’ll provide analysis on each of these points in the following pages. In summary, the record pace and extent of interest rate hikes in addition to geopolitical turmoil are serious headwinds for 2023. While asset prices are not necessarily dirt cheap, we believe the significant 2022 price reset in stocks, bonds, and other financial assets improves the multi-year investment return outlook. Put simply, today’s lower prices offer more long-term upside, which is good news for seasoned and new investors alike.

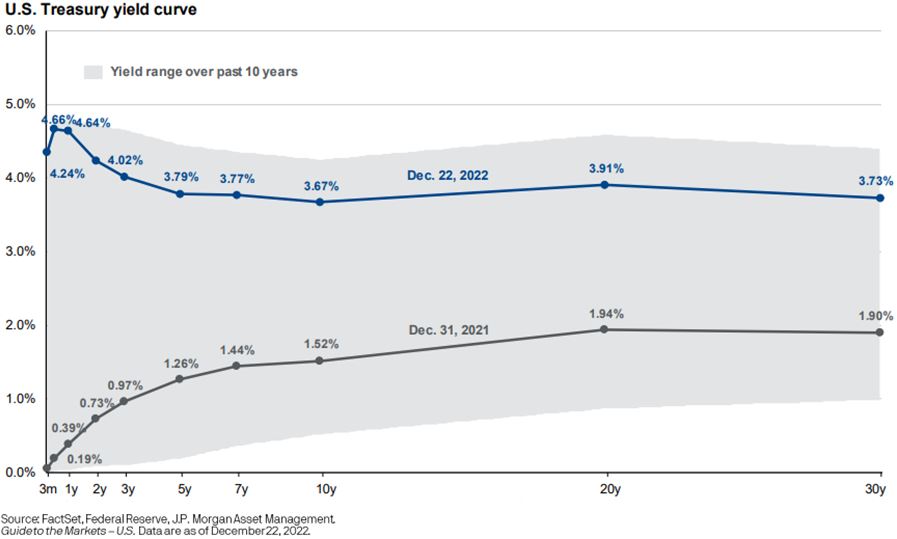

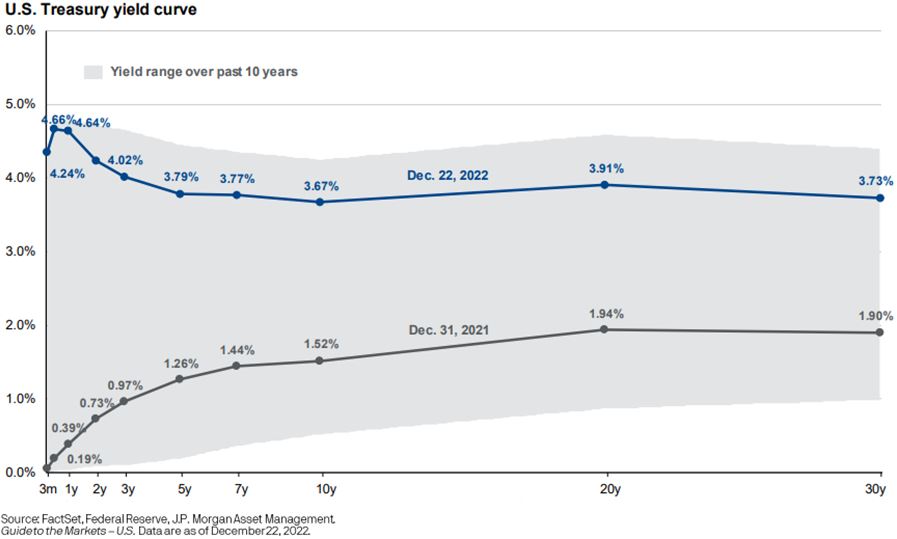

Stocks and Bonds Are Much Less Expensive than this Time Last Year, Improving the Return OutlookCentral to 2022’s asset price reset was the dramatic increase in interest rates. A year ago, investors were anticipating today’s federal funds interest rate at 0.5%. Following an unprecedented series of hikes by the Federal Reserve, today’s federal funds rate is 4.25%.

In our Market Commentary of January 2022, we shared our concerns for inflation and highlighted how dividend and value stocks have fared relatively well during past inflationary periods. While dividend and value stocks significantly outperformed growth stocks in 2022, and we were right to have set aside cash or kept fixed-income duration short for fear of much higher interest rates, the degree to which interest rates increased was no less surprising.

The good news of these dramatically higher interest rates is either income-focused and risk-averse investors now have an alternative to riskier assets. Government and investment grade corporate bonds currently yield 4% to 6% with maturities of five years or less. By comparison, historical annual equity returns are 9-10%. This investment return differential represents a significant gap, especially when compounded over a long period of time. However, in the face of the current economic and geopolitical uncertainty, many investors have decided the gap is worth enduring and have been hesitant to increase equity or other risk asset exposure despite lower prices.

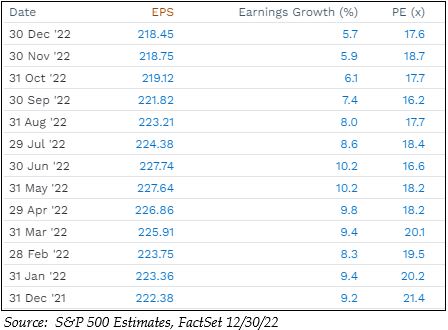

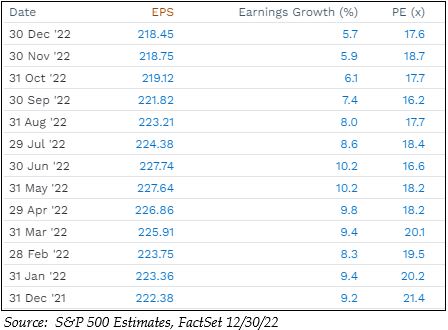

This reduced appetite for risk has resulted in the S&P 500’s Price to Earnings (P/E) ratio contracting from 21.4X to 17.6X 2022 estimated earnings. Interestingly, 2022 earnings have so far proven reasonably resilient, down just 2% since the start of the year. This means most all the index’s 18.6% loss was due to a reduction in the price investors are willing to pay versus a fall in earnings. For 2023, the Wall Street consensus is for modest 5% earnings growth, placing the index at 16.7X estimated earnings. This P/E ratio is in-line with the twenty-five year average and a notable 22% discount to the P/E this time last year.

To put these 2022 adjustments in context, the average recession-related U.S. market drawdown is 24%. At the lows of 2022 in September, the S&P 500 was down nearly 25% from its highs. The average peak to trough S&P 500 earnings estimate decline in the past twelve recessions was 14%. (Source: J.P. Morgan). Right now, 2023 estimates are 8% below the recent peak. Clearly, markets have begun to adjust to the prospects of a recession. While time will tell if the risks of a potential recession are fully discounted, we continue to believe the risks of investing decrease, not increase, when asset prices are lower.

Thanks to a fourth quarter recovery, non-U.S. stocks outperformed the S&P 500 for the first time in several years down 16% and 19%, respectively. Declines in the relative strength of the U.S. dollar in recent months and China’s willingness to peel back its restrictive COVID-19 policies have aided the recovery. Even with the small relative price catch-up, international stocks priced at 12X 2023 estimated earnings look inexpensive and are below their twenty-year historical average of 13X. While our portfolios will remain U.S. stock centric, we think it is important to have exposure to non-U.S. stocks to increase portfolio diversification. We also recognize the relative valuation discount at which non-U.S. equites currently trade.

Lots of Bad News is Priced in as Investors Have Rarely Been So Fearful

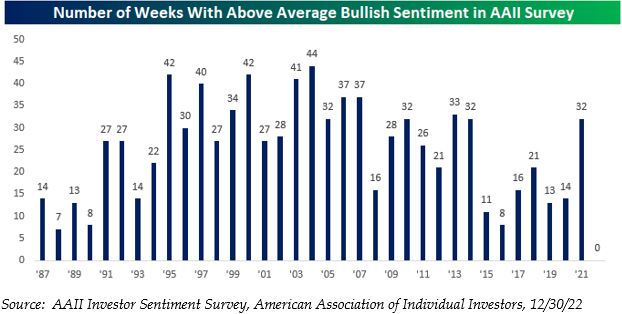

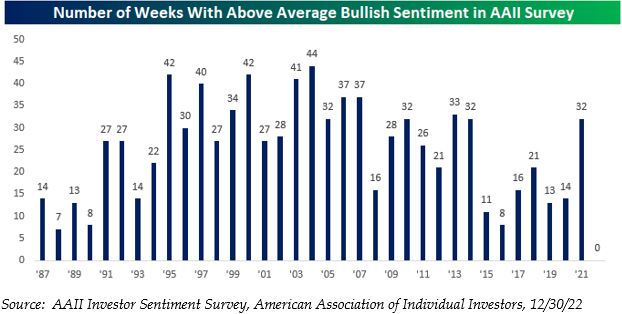

Readers of our market commentary know we regularly seek to understand investor sentiment. We’re not the only ones since the data - not to mention years of investing experience - have shown that the greater investors’ concerns are, the better the investment opportunity. This contrarian investment notion is captured in Warren Buffett’s often cited counsel to “be fearful when others are greedy and greedy when others are fearful.”

The sentiment data as an investment indicator is far from perfect. Things can always go from bad to worse. Nevertheless, the latest American Association of Independent Investors (AAII) weekly survey data struck us as even more downbeat than anticipated. Specifically, as noted by Bespoke Investments and the AAII survey charts below, 2022 was the first year on record when there was not even one week when sentiment failed to eclipse the historical average reading.

No doubt weighing on investor sentiment has been investor losses in “conservative” bond investments and underperformance of the widely held large-cap tech stock aristocrats such as Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), Meta (META formerly known as Facebook), Microsoft (MSFT), and Tesla (TSLA). Collectively, these six companies accounted for more than half of the year’s S&P 500 losses.

Moreover, market volatility in and of itself is never comforting and by most all measures it was a volatile year, particularly for growth stocks. In fact, according to Dow Jones Market Data the NASDAQ swung 2% or more 84 of 252 trading days on its way to a 33% loss. Combining these growth-stock price moves with the ominous signals from today’s inverted Treasury yield curve, 30-year mortgage rates twice what they've been in recent years, and a raucous political season, it is easy to understand how investor sentiment is registering so negative.

"Our earth is degenerate in these latter days; there are signs that the world is speedily coming to an end; bribery and corruption are common; children no longer obey their parents; every man wants to write a book, and the end of the world is evidently approaching." - Assyrian tablet, dating from 2800 B. C., preserved in Constantinople

As for the good news, investor sentiment is so bad that it appears opportunity awaits the risk-tolerant investor. And, as the 2800 Assyrian quote above illustrates, it is somewhat comforting to know we’re far from the first generation to be convinced it was all “going to hell in a hand basket.”

Capital Is Suddenly No Longer Cheap, But It Is Still Available

In the context of historical interest rate shifts, the past twelve-month period represents the most aggressive Federal Funds hiking cycle in forty years. Fortunately, many disciplined retail and corporate borrowers recognized how attractive the low rates of recent years were and took steps to extend loan maturities at fixed-rates in the form of thirty-year mortgages and ten year or longer bond issuances.

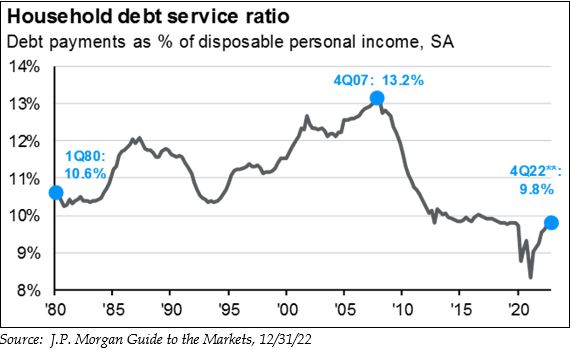

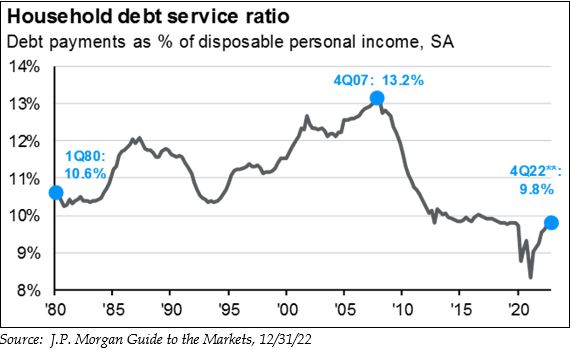

Regardless, today’s higher interest rate environment is presenting challenges. Imagine for a minute the floating home equity loan (i.e., HELOC), which has seen a resurgence as home values have risen the past few years. At 2.5% interest a year ago, this HELOC was possibly an after-thought. Now at 6.5%, it may present significant household cash flow challenges. Similarly, thirty-year mortgage rates topped 7% last fall after a prolonged period of rates closer to 3%. This reset stings whether planning to move or simply accepting the reduced value of your residence in a higher interest rate environment.

Corporations are also feeling the impact of higher rates. Bank facilities and bond issuances have shifted from low-single digit interest rates to mid or high single digit rates, depending upon the quality of the borrower and how desperate they are for the capital.

In thinking about the economic impact of this new landscape, we find some solace in a few important factors. First, consumer balance sheets are relatively strong and, while layoffs are mounting in certain sectors, there are still 1.7 job openings to every job seeker.

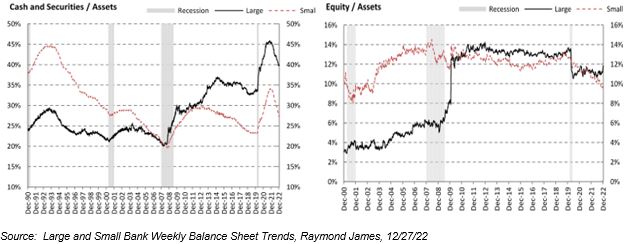

Second, major corporate borrowers enter 2023 in relatively good shape with the leverage in the S&P 500 at 1.6X. This is up from 2012 but below its five-year average and down from a recent peak near 2.0X. (Source: FactSet as of 01/03/23).

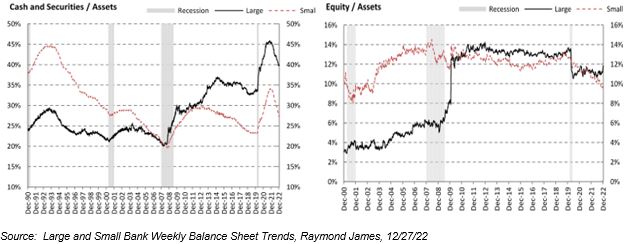

Third, we have not seen the real-estate “no-doc” loan or mortgage-backed security (MBS) equivalent in this cycle. And while banks, many of which focus on real-estate lending, are having to fight to preserve deposits, they entered this downturn with excess deposits and historically strong capital ratios as evidenced by the charts above.

“You told me not to think.” - Rooster to Maverick in Top Gun: Maverick

With the New Year upon us, we’ll make a plug for scheduling an investment review and an update to your long-term financial plan. Volatile markets and recent changes to retirement plan rules provide plenty of topics for discussion independent of any important updates you may have to share. And while not thinking may have worked out for Rooster and Maverick, the first part of the year is a good time to revisit your long-term goals and investment objectives.

Thank you as always for your continued trust and confidence. Best wishes for a safe and rewarding 2023. We look forward to answering your questions and the possibility of visiting soon.

The Woodmont Team

January 3, 2023

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.