"Our real problem then is not our strength today: it is rather the vital necessity of our action today so that we ensure our strength tomorrow.” - President Dwight D. Eisenhower

We all are worried about the well-being of friends and loved ones, especially the elderly who are most at risk. It will take weeks and possibly months for the implications to unfold. One important thing to note is that, if necessary, Woodmont is prepared to work remotely to stay engaged and meet our clients’ needs. The Nashville tornado and the temporary disruption it caused downtown proved a good test of our systems. Please call or email us your questions or when we can be of assistance. Our desire to be responsive doesn’t change if our team has to work remotely.

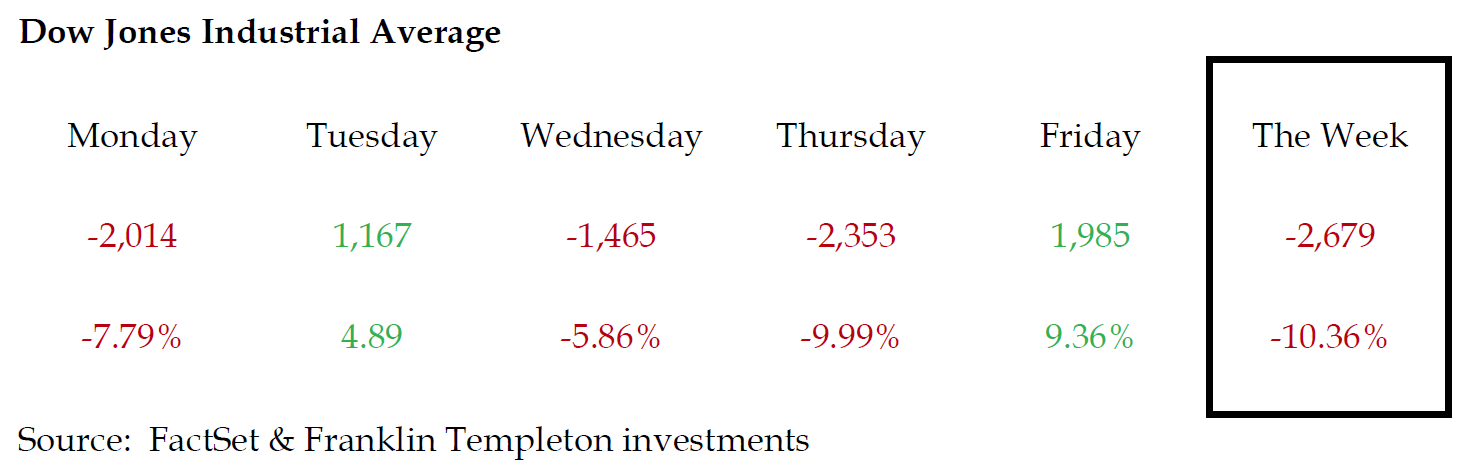

The Market Picture Quickly Went from Bad to Worse, and Then Not as Bad on Friday

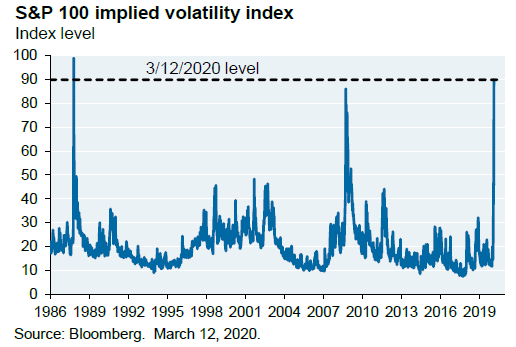

Early this month in an intra-quarter market brief, we wrote that while the markets’ decline from the February high had been average, the correction felt anything but average. We cited some statistics on the pace of declines, volatility, and certainly the increasing fear for COVID-19 spreading throughout the U.S. Fast forward just ten days, and what was a very unnerving “average” correction is officially historic. The records include a volatility index level (i.e., Wall Street’s fear gauge) that surpassed peak fear of the Financial Crisis in 2008 and a 28% decline for the Dow Jones Industrial Average in just twenty trading days.

In that March 4th market brief, we also said things could get much worse before they get better. As a result, we would be measured in adding to stocks as prices declined. Needless to say, things got dramatically worse with the S&P 500 falling 17% from Monday to Thursday. In hindsight, it would have been best not to have bought any stocks until Thursday’s 10% single day decline. This is especially true for stocks in or connected to the financial and energy sectors, which are now down 25% and 47% for the year. While it would be nice only to buy at the bottom of any market down turn, the fact is no one can consistently time it.

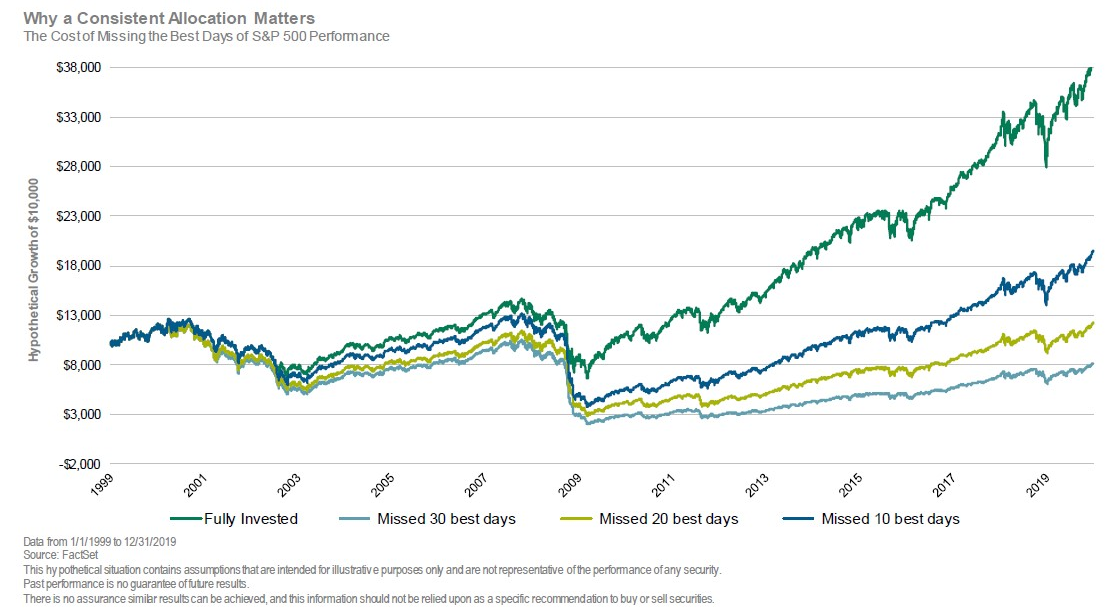

Jumping In and Out of the Market Can Prove Financially and Emotionally Draining

The COVID-19 virus makes buying more difficult than usual, and certainly brings to the table the temptation to sell everything until things calm down. We appreciate holding on during big market swings is not easy. The long-term financial loss of jumping in and out, and possibly missing the big up days, however, is significant. This is apparent from the twenty-year chart below, which highlights the different results when a number of the markets’ best days are excluded. Of course, risk tolerance is personal. It will be different for a retiree than for a young person with a sufficient rainy day fund and a twenty to thirty year investment time horizon. If your comfort with the wild ride that accompanies owning stocks has changed, please call or email us to discuss.

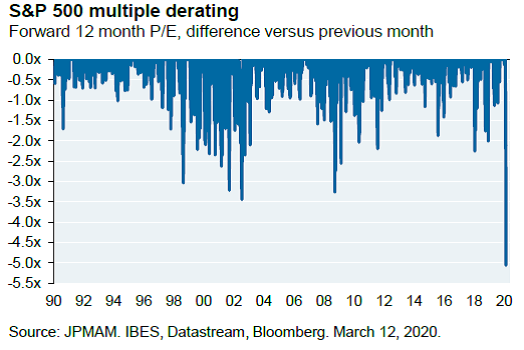

We Still Don’t Know the Earnings Impact, But Prices Have Gotten Better

We discussed the range of economic fallout from the virus in our March 4th brief. One very pessimistic outlook we shared would be for a 25% hit to 2020 gross domestic product (GDP). Regardless of the ultimate earnings hit from the virus, we believe it will be temporary. Certain industries will bounce back more quickly than others, but in time we will recover. Accordingly, the table below highlights the opportunity it is for long-term investors to be buying now. Specifically, the price to earnings ratio had contracted 5X from the end of February to March 12th. This level of correction is not hard to appreciate when surveying the carnage of last week, especially at the end of the day Thursday. Many quality companies are down 30-40% in a few short weeks, even though their long-term earnings outlook has not changed significantly.

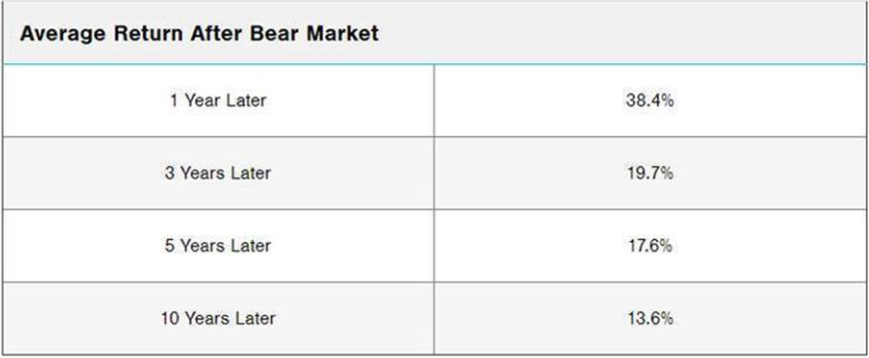

We Reached “Bear Market” Status, Which Historically Has Been a Good Time to Buy

At the close Thursday, the S&P 500 had declined 23.3% from its February high. A retreat over 20% means we’ve entered a “Bear Market.” Thus, as of Thursday’s close the eleven year “Bull Market” had come to an end. The virus, policy developments, and a potential credit crisis brought on in part from a crash in oil prices, are just some of the reasons for why this correction could mark the beginning of a more prolonged and deeper downturn. For this reason, an investor's allocation must be consistent with their ability to accept market risks and their need for cash. If, however, owning stocks is appropriate the table below highlights how the average returns following a “Bear Market” have historically been strong.

Source: Creative Financial Group

“I have just one day, today, and I am going to be happy in it.” -Groucho Marx

Thursday’s record 10% fall for the S&P 500 was followed by Friday’s 9.4% gain. It helped but the damage still stung down 10% for the week.

In the coming weeks, we would expect continued volatility. If you have questions about your allocation or the activity in your portfolio please let us know. Thank you for your continued confidence and trust in this difficult time. We remain hopeful for the future, but are certainly conscious of how tenuous the situation still is.