Our April Market Commentary was titled, The Opposite of Cabin Fever. In short, we expected social and business activity to resume abruptly as vaccines were distributed and the threat of the COVID-19 crisis receded. The caption seemed somewhat bold at the time. Admittedly, we were rather proud of it. In hindsight, we still underestimated the pace at which activity would resume. Pent-up demand for goods and services, the desire to get out of the house (though not necessarily back to the office), and record levels of cash on personal and business balance sheets have combined to fuel the highest level of U.S. economic growth since the early 1980s.

“Let the good times roll, let the good times roll. I don't care if you're young or old. Get together, let the good times roll. Don't sit there mumblin', talkin' trash. If you wanna have a ball. You gotta go out and spend some cash, and. Let the good times roll, let the good times roll.” - B.B King

At the same time, once in a generation demographic, cultural, and secular business shifts are unfolding before our eyes. Higher wages, coupled with improved household balance sheets, have meant workers are quitting or retiring at a record pace. Technology continues to change the way we work, shop, and coming this fall, support our favorite college football players/teams. Moreover, when measured in trillions of dollars, the range of policy proposals on the table in Congress are as wide as we have ever seen."If you're feeling good, don't worry. You'll get over it." - Yogi Berra

The equity markets have responded favorably, even though many argued the year-end 2020 rally was in anticipation of a 2021 recovery. Specifically, in the first half of 2021, the MSCI All-World and the S&P 500 have increased 12.3% and 15.3%, respectively. These same indices are now 26.9% and 21.9% above their pre-pandemic February 2020 highs. The more economically cyclical sectors such as energy, financials, and industrials have led the way in 2021 while the defensive sectors have lagged in this risk-on environment. Bonds have lost ground year-to-date. For instance, the Bloomberg Barclays Intermediate Government Credit index is down 0.9% on increasing inflation concerns. Nevertheless, the appetite for corporate and government debt remains high with spreads incredibly tight, signaling few concerns for credit risks.

At the halfway point of an already eventful year, there are plenty of data points for the glass half-full Bull or half-empty Bear. We will discuss several of these in this commentary, as well as highlight some interesting developments as of late. In summary, we know better than to make any near-term market predictions. Yet our office view of Nashville’s entertainment district would lead us to believe that few plan a return to the cabin anytime soon.

Life After Stimulus

In response to the COVID-19 crisis, Congress appropriated an unprecedented $5 trillion of Federal funds in the form of direct payments, forgivable loans, and payment deferrals to individuals and businesses. Bank deposit balances confirm much of this stimulus continues to sit in savings. For many, however, these funds kept their business doors open and proved the difference for buying anything other than life’s basic necessities. Regardless, the extent of the stimulus in the first half of this year and last begs the question as to what will happen once the checks and other forms of support roll off.

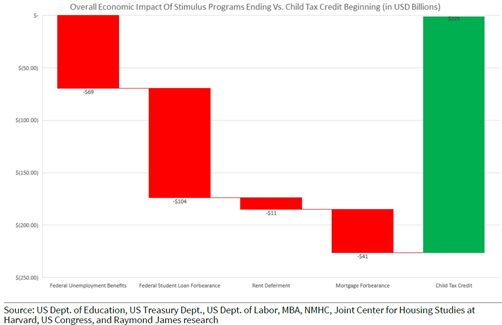

For businesses that benefited during the shutdown, sales comparisons will prove difficult. Meanwhile, it may be 2022 before we understand the impact on the consumer. First, wages continue to climb. This will prove an important offset to the end of the stimulus checks and the much-discussed supplemental unemployment payments. Second, as the chart below highlights, Child Tax Credits, which will be paid directly to 36 million American families beginning in July, will in effect replace much of the declines in first half stimulus. So, while consumer confidence is often a balance of current cash on hand versus expected cash flows, we may not understand life after stimulus until 2022.

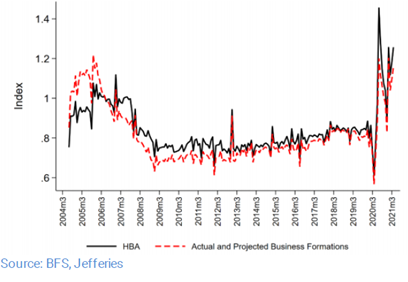

New businesses are forming at the greatest pace since 2004, which is when the National Bureau of Economics Research began tracking the data. This is interesting given its sharp contrast to the period following the Great Recession, but also for its geographic implications considering Texas, Florida, and certain southeastern states disproportionately represent the new business hot spots.

Investors are Focused on Inflation for a Reason

Following a dovish March update, in June the Federal Reserve’s updated “dot plots” indicated there could be two rate hikes in 2023. While far from certain, and “well off into the future” according to Chairman Powell, investors remain on edge with each inflation and jobs report. Of particular focus in the coming weeks will be labor costs and employment now that many states have declined the federal government’s supplemental unemployment benefits. While still at historically low levels, the Ten-Year Treasury Yield has climbed from its 0.6% 2020 low to 1.5%.

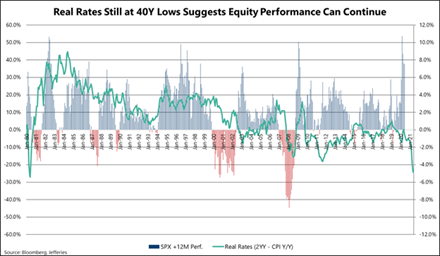

As we have discussed before, the reason for investor focus on interest rates is relatively straightforward. Increased interest rates equal a higher discount rate for stocks, which in turn means lower prices for stocks, all else being equal. Put another way, if investors can take less risk by substituting more bonds for stocks, and still achieve a minimum investment return objective, they likely will. After all, as attractive as owning stocks can be over the long term, they are not for the faint of heart. One must stomach stock’s greater volatility, which can include periods of significant portfolio contraction.

The chart below highlights the correlation between stocks and interest rates going back to the early 1980s (interest rates up, stock headwinds ahead). With real rates (i.e., Two-Year Treasury’s Minus Consumer Price Inflation) still negative, we believe the backdrop for stocks remains relatively attractive. Given the strong correlation, however, we will continue to listen to the Federal Reserve and watch the inflation data intently.

While Stock Prices Have Proven Volatile, their Annual Dividends Have Been Incredibly Resilient

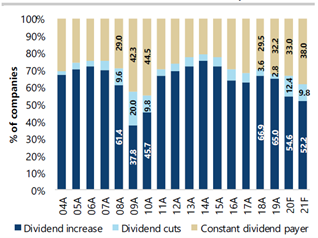

The COVID-19 crisis was an economic test unlike any we have seen in the post-World War II era. Per the chart below, U.S. stocks paying dividends passed this test with high marks. Specifically, in 2020, 55% of dividend paying U.S. companies increased their payouts, 33% kept them the same, and just 12% cut or suspended them. This experience is encouraging considering the unique historical window COVID-19 provided boards for a dividend reset or cut.

Source: Jefferies & Co.

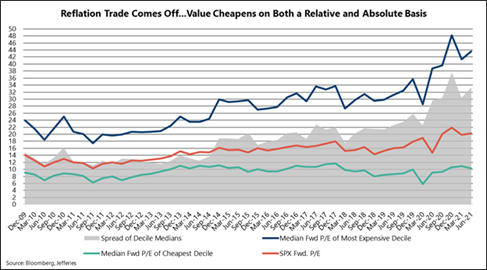

“A Stock Market or a Market of Stocks?”

Investors have long discussed the merits of viewing equity markets in the aggregate or as a collection of individual stocks. The chart below, which highlights the valuation spread between the S&P 500’s most expensive and cheapest stock deciles, has added fuel to that debate as of late. We continue to believe any long-term investor should “own the entire market” for purposes of diversification and tax efficiency. Yet, today’s historic valuation discrepancies have created opportunities for some targeted activity. While the rotation earlier in the year to financials, energy, and industrial stocks closed the gap on the margin, the valuation discrepancy between the most expensive and all other stocks remains historically high. For instance, while oftentimes faster growing and worthy of a premium, the top decile of stocks currently trades near 45X forward earnings. This compares to 20X for the broader S&P 500 and 11X for the least expensive decile. Many in that cheapest decile are cheap for a reason. There are still a significant number of quality companies, however, trading at a 20-30% discount to the broader market and well positioned to grow their earnings at a reasonable clip for years to come.

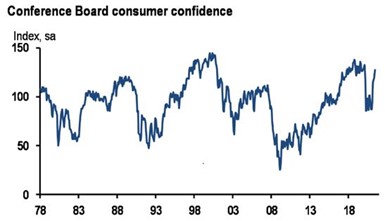

In the face of the challenges of the past eighteen months and those ahead, including a menacing Delta variant of COVID-19, consumer confidence is approaching levels not seen since 2018. Similarly, investors remain upbeat as measured by recent sentiment surveys. Stock market gains, a recovering job market, and getting out of the house and away from our social media outlets have not hurt the measurement of either.

Source: JP Morgan Economics, Conference Board

Only time will tell whether current optimism captured in this data is representative of our resilience or folly. There are strong opinions lined up in support of each, and we know from experience the existence of few market bears is generally not a bullish signal.

In the meantime, and ahead of the July 4th holiday, the quote below is a valuable reminder of how preserving freedom has its demands. Yet despite over two centuries of challenges, we seem to find a way to pick up and move on. Put another way, if anything our 245 year history has taught us to appreciate our collective ability to see the cup of opportunity as half-full and not half-empty.

“Those who expect to reap the blessings of freedom, must, like men, undergo the fatigue of supporting it.” - Thomas Paine

Thank you for your continued trust and confidence. We look forward to answering any questions you may have, and wish you a safe and relaxing 4th of July weekend.

The Woodmont Team

July 01, 2021

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.