Topics Included in This Issue:

- Hope Springs Eternal

- The Great Equity Divide

- The Opposite of March

- The 2020 Election Cycle Is Not Over Yet

- Cash Levels Remain Elevated. Where Will It All Go?

- How Much of This Cash, If Any, Should Go to Fixed-Income?

- A Weaker U.S. Dollar – A Short Term Blip or Long-Term Trend?

- It's an Easier Call When Investors Are Not So Enthusiastic

- Cybersecurity: We Cannot Be Too Careful

- A New Year and Ready to Roll

Hope Springs Eternal

“Look, 2020, I just think I should start seeing other years.” - Author Unknown.

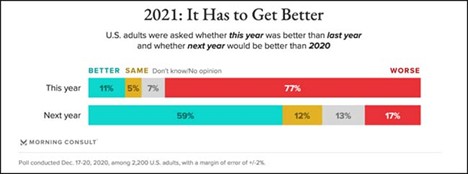

Well said, Unknown! 2020 has been a tumultuous year and arguably the most consequential since 1969. For all of us, on the fly adjustments became the rule not the exception. Organizations of all types and sizes accelerated proposed innovations and strategic plans by years not just weeks or months. Other seemingly cemented plans were abandoned completely in lieu of new and still evolving perspectives on work, play, education, and equity. Simply put, many of the ideas and adaptations unleashed in 2020 will prove influential for decades to come.

“2020 is a unique Leap Year. It has 29 days in February, 300 days in March, and five years in April.” - Author Unknown.

While the year’s uncertainties could have paralyzed us all, Americans pressed forward. This resilience was apparent as essential workers in healthcare, food, construction, and logistics worked extended hours, despite the heightened health risks. Remarkably, consumers were undeterred during the worry and strife. According to the Wall Street Journal, retail sales for the recent holiday season were up an estimated 2.4% from 2019. While the shopping format changed dramatically with online growing 32.4% and in-store traffic down 31.3%, the increased spending hardly points to a country feeling down and out.

Some insist the retail sales growth highlights a false sense of security from the unprecedented and unsustainable Federal stimuli. The current slow pace of the vaccine inoculations could also delay a recovery. Others argue at our core we are collectively a hopeful bunch anxious to move on from present hardships in anticipation of better days ahead. In the 2020 context, this translates to young and old alike wanting their routines back and willing to spend, move, and take financial risks to make that happen. While time will tell, the stock market’s recovery from the March lows, the subsequent November and December rally, and broader survey data certainly point to the latter forward looking and hope theory.

In this commentary, we consider whether this investor optimism has exceeded the prospects for an economic and earnings rebound. We also discuss where we see opportunities somewhat independent of how the economic recovery unfolds at home. We never want to be blind to challenges ahead. Yet, we too remain hopeful for the future and for long-term investment gains for investors who can endure volatility and appreciate how ingenuity and determination are powerful offsets to even the most daunting of obstacles. These investment principles certainly applied in 2020, and as we know, history tends to repeat itself.

The Great Equity Divide

Despite all these challenges, 2020 proved a rewarding year for equity investors with the S&P 500 gaining 18.4% and The All-World equity index up 16.3% thanks largely to one of the strongest November and December periods on record. More so than most years, the amount of those equity gains an investor captured was dependent on the composition of their equity portfolio. Broadly diversified or growth-focused portfolios did well. For instance, the Vanguard Growth exchange traded fund (ETF) gained a remarkable 40.2% and small-cap stocks increased 20.3%. Meanwhile non-U.S. and U.S. value stocks trailed notably up just 11.1% and 2.3%, respectively. The Vanguard High Dividend ETF gained a measly 1.1% for the year.

To highlight the narrowness of market returns, the S&P 500’s 2020 gain would have been up less than 10% excluding just three stocks - Apple, Amazon, and Microsoft. Exclude the top 24 tech sector performers from the 500 stocks in the index, and the 2020 return is flat versus the reported 18.4% gain. (Source: 361 Capital and @hsilverb: IT). Not since the 2000 tech boom has there been such widespread discrepancy in returns by style. This made for a tough year of relative performance for income-focused investors who may own dividend stocks and low-yielding bonds.

Investor enthusiasm for many of the “work from home” momentum stocks, most of which are tech-focused and often valued at as much as 20-30X sales, is expected to subside. Whether the other 476 stocks in the S&P 500 can recover some of the lost ground depends in large part on the pace of the economic recovery in 2021 and 2022. The recent introduction of vaccines and improved prospects for a recovery made for better relative results in the fourth quarter with value stocks gaining 14.4% compared to growth stocks up 10.0%.

The Opposite of March

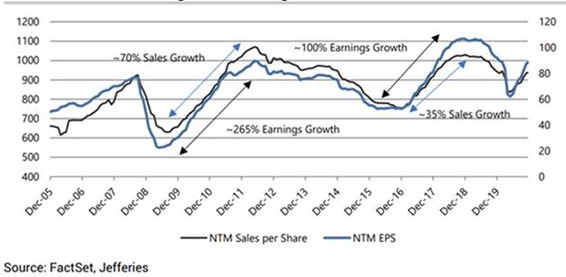

Many factors (technical and strategic) can influence a stock’s value. Its intrinsic value, however, is a product of its future earnings. On March 24th, we issued a market brief highlighting how the S&P’s valuation (13.9X 2019 EPS at the time) implied earnings would not recover to 2019 levels until 2028. The idea that it would take that long to get back to the 2019 earnings level was too dire in our view and added to our conviction for either adding to client equity portfolios or just holding steady where appropriate.

Today, the S&P 500 trades at 23.5X 2019 EPS. Looking forward, the S&P 500 is valued at 22.7X 2021 and 19.4X 2022 EPS. In March, investors were unwilling to look forward to an earnings recovery. Now investors are anticipating a recovery and increasingly borrowing to gain stock market exposure to this recovery as evidenced by the highest margin debt levels since the year 2000.

We believe an eventual earnings recovery is in order, particularly in sectors forced to go nearly dormant the past nine months. And the Federal Reserve’s commitment to keeping short-term rates at zero certainly adds to the relative attractiveness of stocks. Of course, how much of this recovery is already embedded in current prices is difficult to know. Fortunately, as highlighted in the chart below the sales and EPS revisions are trending in the right direction.

The 2020 Election Cycle Is Not Over Yet

The two Georgia U.S. Senate run-off races occur on Tuesday and will determine whether the Democrats or Republicans control the Senate and thus Congress. In our October commentary we discussed the historical results under different political scenarios and offered that the markets would likely favor a divided government because it would slow the pace of policy changes, particularly with regards to corporate taxes. In addition to positive vaccine news, an expectation for this gridlock likely helped fuel market gains in November and December. If Republicans were to lose both Georgia races, we would expect some level of give-back of the recent gains. So, until the outcomes and Senate control are resolved, Georgia is on our and other investors’ minds.

Cash Levels Remain Elevated. Where Will It All Go?

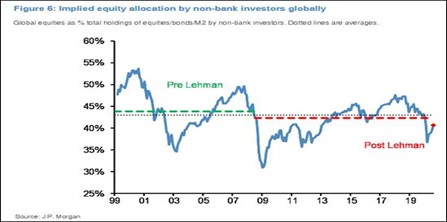

In our October market commentary, we discussed how historically high levels of investor cash was one indicator of potential upside for stocks, especially if a Washington gridlock scenario resulted from the November 4th election. Interestingly, the investor build in cash is still high relative to previous build-ups and recoveries. Per the table below from JP Morgan, only about half of the COVID-19 $1.5 trillion increase in U.S. money market funds has been invested or withdrawn from investor accounts. If previous recessions are any indication of what is to come, investors have considerable cash left to invest as the recovery unfolds.

Increased investor enthusiasm for initial public offerings (over 400 in 2020), Bitcoin, and nearly $70 billion raised by Special Purpose Acquisition Companies (SPACs) likely consumed some of investors’ cash hoard in recent weeks. Yet we believe it will be tough for remaining cash-heavy investors to ignore many of the sectors and asset classes that lagged in 2020. Those most attractive include non-U.S. stocks in general, financials, industrials, certain consumer discretionary segments, and healthcare. Fourth quarter results highlight this trend already with non-U.S., financials, and value stocks all outperforming the S&P 500. If the fourth quarter performance reversal has real momentum behind it, the relatively attractive valuations for many of these asset classes means 2021 could be a significant year of recovery for these multi-year laggards.

How Much of This Cash, If Any, Should Go to Fixed-Income?

As for fixed income, unfortunately yields remain so low it is tough to envision us increasing allocations to the asset class anytime soon. Specifically, the Ten-Year U.S. Treasury yields just 0.9% and the additional yield for owning high-quality and even junk debt remains low relative to the risks of owning bonds if interest rates were to rise or credit conditions deteriorate. While the Federal Reserve remains committed to do everything in its power to keep interest rates low for the next couple of years, these powers have their limitations. As a result, we hesitate to commit incremental funds to longer duration fixed-income securities just when we may be testing those limits.

Obviously there remains an important role for fixed income in all but the most aggressive of portfolios. Yet for now we believe better risk-reward opportunities are available in equities and several low beta and volatility-based strategies available to us in institutional class mutual funds, which we continued adding to most client portfolios in 2020.

A Weaker U.S. Dollar – A Short Term Blip or Long-Term Trend?

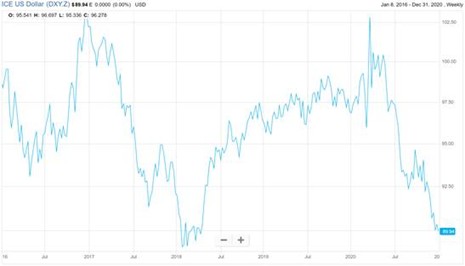

In November, the U.S. dollar spot index reached its lowest levels since April 2018. COVID-19 has been tough on the U.S. dollar. Specifically, per the price chart below, the dollar index is down about 8% since the beginning of the year and down nearly 13% from its January 2017 highs. A recent Jefferies & Co. report cites several factors for this trend. These include a decline in the U.S. savings rate and the COVID-19 fight adding significantly to our outstanding debt. At the same time that U.S. debt continues to mount, our output as a percentage of global output has declined. Even though the dollar recovered some of the lost ground in recent weeks as fears for another COVID-19 virus strain surfaced, highlighting the U.S. dollar’s continued position as the currency of choice in times of turmoil, the threat of its decline certainly presents risks to investors.

Source: Factset & WIC

As a partial hedge to this risk, we continue to diversify portfolios through the purchase of non-U.S. securities, ETFs, and mutual funds that invest in non-U.S. assets. In addition to accessing some interesting trends, particularly as many emerging market economies mature, investors will benefit if the dollar weakens further by having used appreciated U.S. dollars to purchase assets whose fate is connected to other currencies. It remains to be seen whether currency investors’ recent concerns for the rising U.S. debt persists, further weakening the dollar. After all, an honest assessment of the U.S. entitlement picture has shown for years a significant and unsustainable growth in liabilities.

It's An Easier Call When Investors Are Not So Enthusiastic

Recent investor survey data such as the Jefferies index below highlight how risk taking is back in vogue. And, as you know, we would prefer to be buyers of equities when most other investors have headed for the hills.

Source: Jefferies & Co.

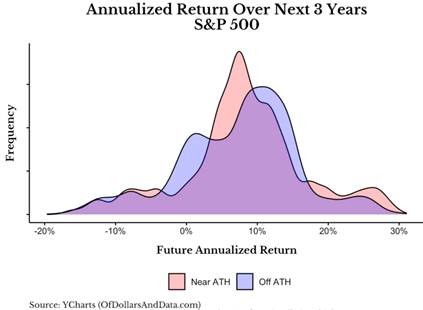

Of course, investors don’t always have the luxury of incremental cash on hand during market corrections. In fact, it is often quite the opposite since the reasons for the excess liquidity is frequently tied to a transaction influenced by the strength of the stock market, low interest rates, or another investor’s willingness to take risks. Deciding what to do with cash when markets are at or near an all-time high can be difficult. Going back to 1950, however, the average three-year annualized return when investing in the S&P 500 at or near market highs is 8.2% versus 7.4% when investing when the S&P 500 is 5% or more below an all-time high. (Source: Dollars and Data) These are averages so the range of returns is much greater. Nevertheless, the data is helpful when determining a plan for getting off the sidelines in a bull market.

Source: YCharts, OfDollarsandData.com. “Near ATH” defined as within 5% of market highs and “Off ATH” 5% or more below market highs.

Cybersecurity: We Cannot Be Too Careful

News of the recent and large-scale cyberattack once again highlights how we must all stay focused on protecting our data. Unfortunately, cyberattacks and hacks are becoming increasingly sophisticated, often using recent events or a crisis to lure you into clicking a dangerous link or providing sensitive information to the wrong party. As a reminder, we will never ask for login credentials or ask you to send sensitive information without alerting you first to the request and providing an encrypted method for submission. Please reach out if you ever have a question or receive a suspicious request. We and our custodian partners have multiple protections in place to safeguard your data and funds, but there is no substitute for a healthy level of skepticism and good cyber practices such as changing passwords regularly and using multi-factor login methods.

Ready to Roll in the New Year

2020 has brought about unexpected events and never anticipated changes for all of us. While we have maintained a physical presence in our downtown office since March, some of the team has worked remotely. As we’ve all learned, existing technology has made this possible and new innovations for how independent firms like Woodmont can communicate and serve our clients are constantly available. Of course, while emails and reports may be helpful, they are no substitute for old fashioned communications like phone calls and now Zoom video conferences. While not all physically in one spot, we remain tightly tethered and look forward to our next opportunity to visit with you regarding your portfolio and financial plan.

Thank you for your trust and continued confidence. We look forward to answering your questions and wish you all the best in this most welcome new year.

The Woodmont Team

January 04, 2021

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.