Hot Dogs, Apple Pie, and A.I.: July 2023 Market Commentary

We hope you enjoyed the July 4th holiday. While food and fireworks likely added to your fun on the fourth, the emergence of artificial intelligence (A.I.) as an investment theme proved a major catalyst for investor excitement and strong first-half equity returns. Of course, all the ways in which A.I. will change our lives are under fierce debate. Some see job creation (not elimination), increased productivity, and new life-saving technologies. While others, quite frankly, fear for our lives. Most everyone, however, is at least a little reticent to export the advanced computer chips fueling this technology. This hesitancy speaks to A.I.’s rapid adoption and the range of its use cases – positive and negative.

On the following pages, we will provide more details on the stock market’s A.I. boost and discuss current stock and bond valuations, investor sentiment, and the economy. We won’t solve the A.I. regulatory and adoption quandary in this commentary but remain cognizant of its emerging investment opportunities and threats. In addition to publicly traded investments, we are evaluating many illiquid private investment opportunities and would be happy to share our perspectives when we visit.

“Time in the market beats timing the market.” – Peter Lynch

Staying bullish on stocks, even for our intrinsically optimistic team, is not as easy as it was just a few months ago. Many investors previously on the sidelines have entered the market, and the handful of winners that propelled the year-to-date gains are trading at never seen before market capitalizations.

We take solace, however, knowing that U.S. and non-U.S. markets are still 7% and 16% off the 2021 highs, the economy remains incredibly resilient, and stock market breadth broadened in June. Most importantly, we understand a long investment time horizon is an investor’s best friend and that for many, selling stocks means giving up 23.8% of the gains in federal taxes. The combined federal and state tax leakage can rise to as much as 30%-40% in states with high capital gains tax rates. While better than the “taxation without representation” from which our founders declared independence 247 years ago, this is a steep price to pay for temporarily exiting a historically strong asset class.

Quite the Rebound!

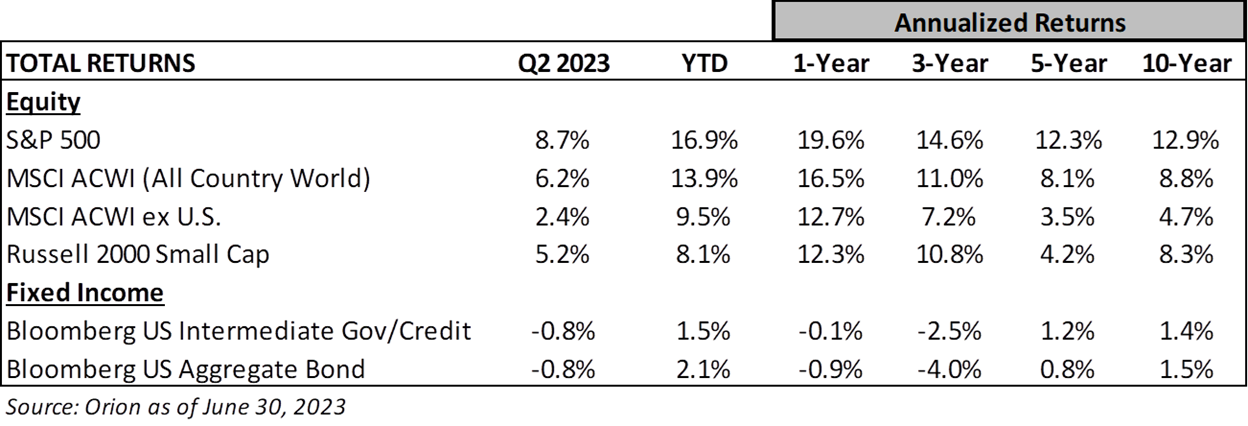

2022 was one of the worst years in market history with the major stock and bond indices registering losses of 18% and 14%, respectively. Thus far in 2023 we’ve seen quite the rebound. The S&P 500 is up 17%, which is a top quintile first half according to Jefferies & Company. The MSCI All-World stock index gained 14%.

Plenty of challenges confronted investors during the first half of 2023. These included a high-profile debt ceiling showdown, banking crisis, the Ukrainians’ continued efforts to repel the Russian invasion, and the anticipated onset of a recession. These challenges weighed on many sectors with energy, financial, healthcare, and consumer staple stocks all flat or down to start the year. On the other hand, technology, communication, and consumer discretionary stocks (or at least a few of them) carried the day.

Suffice it to say, this has been an incredibly narrow market. The seven largest stocks within the S&P 500 accounted for over 75% of the S&P 500’s first half returns. As a result, these seven stocks now represent 26% of the S&P 500’s market capitalization.

Much of the enthusiasm fueling these high-profile stocks was anchored in expectations for A.I. as a long-term investment theme. Most of our clients have exposure to these technological advancements via some individual stocks and a semiconductor fund, which we added to many portfolios earlier in the year. The concentration of gains in just a few stocks, however, reiterates the benefits of exposure to all stocks via tax-efficient and low-cost exchange traded funds (ETFs).

We have utilized ETFs in most portfolios for well over a decade. While ETFs that track an index capture all the downside in tough periods like 2022, they are an effective way to ensure exposure to underappreciated stock winners that can become far bigger than most imagine. In fact, it seems like yesterday (August 2018 to be exact) when market prognosticators doubted the ability of Apple (AAPL) to sustain its newly minted $1 trillion-dollar market capitalization. On Friday last week, Apple’s market capitalization surpassed $3 trillion.

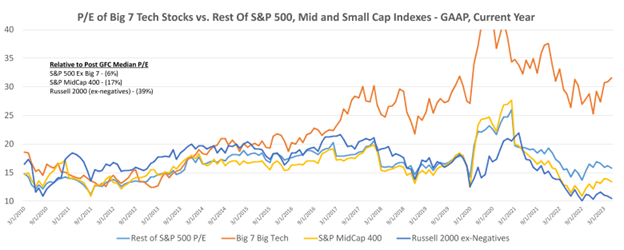

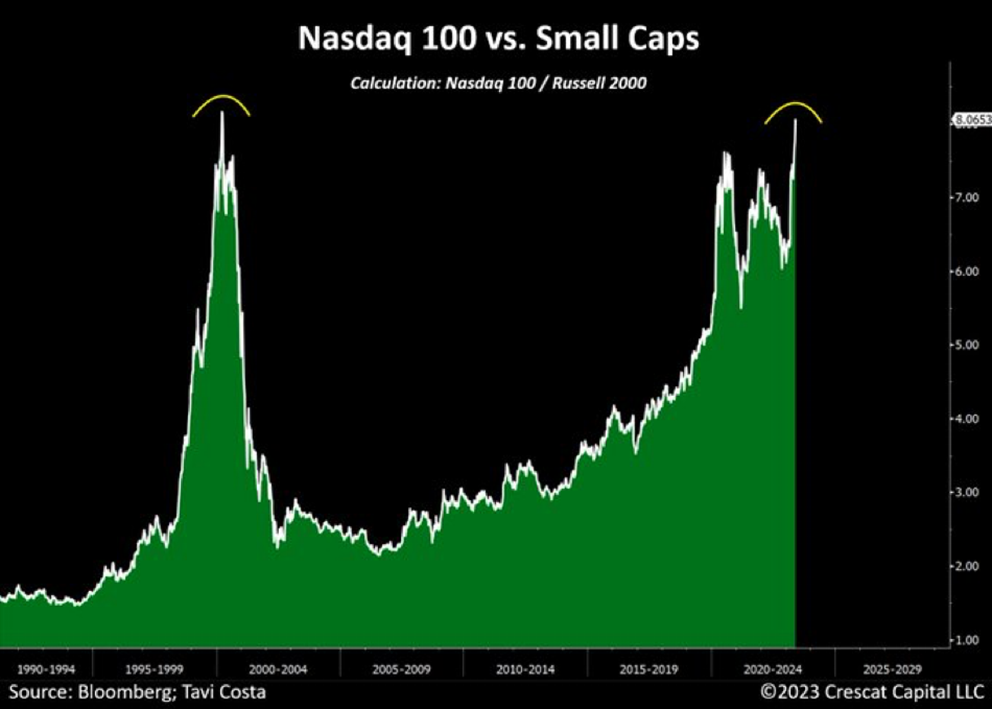

A Return of the Stock Valuation Haves and Have Nots

One product of this large yet narrow stock rally is the return of a much wider-than-normal spread between the valuations of a few high-profile companies and the rest of the market. The chart below from mid-May reflects the extent of the divide. Fast forward to today and the gap between the big seven and the rest of the S&P 500 is 25 P/E turns at 45X compared to 20X. After rallying in June, the small-cap index excluding companies not yet profitable trades at 11X P/E ratio.

Source: Raymond James

Fast forward to today and the gap between the big seven and the rest of the S&P 500 is 25 P/E turns at 45X compared to 20X. After rallying in June, the small-cap index excluding companies not yet profitable trades at 11X P/E ratio.

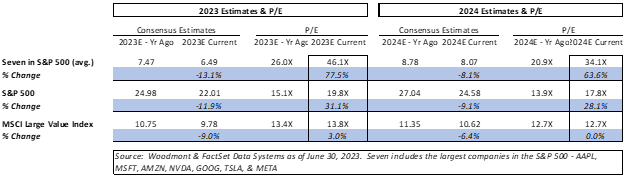

Successful growth stocks often report earnings that exceed analyst estimates. Thus, the P/E ratios on forward estimates could turn out to be much more palatable when looking back a year or two from now. Nonetheless, it is interesting to consider how 2023 and 2024 earnings per share (EPS) estimates and the price investors are willing to pay for those anticipated earnings have changed since this time last year. In summary, 2023 and 2024 estimates for the big seven are down 13% and 8% from a year ago. Yet the P/E multiple for these companies increased 78% and 64%, respectively. Estimates are down about 10% for the entire S&P 500 with the P/E multiple up around 30%. This significant P/E multiple expansion, which has far exceeded the earnings declines, has been the formula for higher prices for the big seven and S&P 500 thus far in 2023.

As for the current stock market “have nots,” estimated earnings for value stocks have declined less than both the S&P 500 and the big seven in the past year. Because P/E multiples have stayed roughly constant, these stocks trade around 13X earnings compared to the market’s 17X twenty-five-year average.

No doubt some of the resulting valuation divide reflects investor expectations for the reliability of the current forecasts. For instance, the earnings for A.I. exposed or certain technology-related companies may weather a recession better than many financial, industrial, energy, and consumer stocks. Regardless, it is comforting to know that opportunities exist for equity investors to purchase high-quality U.S. companies, which have endured many economic cycles, at valuations below historical averages. Investors just have to look among the 493 “have nots” to find them.

Is Everyone on the Same Side of the Boat?

The most recent AAII investor sentiment data released on June 29th was the fourth consecutive week of above average levels of investor optimism. This streak is the longest since fall of 2021. While the data is not this granular, it would be interesting to know how investor optimism fluctuates depending upon exposure to different equity market capitalizations, styles, and sectors. Our sense is optimism is high for the big seven and for any companies directly or indirectly touching the emerging A.I. ecosystem. On the other hand, investors in small capitalization, value, and non-US stocks have much less bounce in their step given the performance divide of the first half.

As most of you know, our historical bias is to invest in U.S. large-cap stocks. We invest in some non-U.S., mid-cap, and small-cap companies for diversification and if the reward for the risk is too attractive to ignore. So far in 2023, this diversification has been a drag on returns relative to the S&P 500. Now is not the time to abandon diversification given the extent of the valuation divide and out of favor status of most everything beyond a few large-capitalization stocks. After all, when everyone looks to be on the same side of the boat, it is probably a good idea to consider a seat on the other side.

It is Not the 1970s & 80s, Yet?

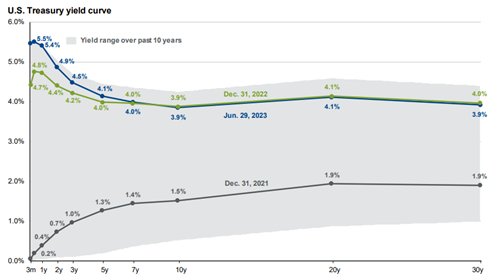

The Intermediate and total bond market indices gained 1.5% and 2.1% in the first half of 2023. In general, shorter-term rates moved higher and longer-term rates didn’t budge much. Within Treasuries, the yield on the Two-Year is up 0.5% to 4.9% since the start of the year. The yield on the Ten-Year is basically unchanged during this period at 3.4%.

"Inflation pressures continue to run high, and the process of getting inflation back down to 2 percent has a long way to go." Federal Reserve Chairman Jerome Powell, June 29, 2023

We have modestly extended duration for most fixed-income portfolios to lock in today’s yields for longer. This move makes sense considering it was just eighteen months ago when the Two-Year and Ten-Year Treasuries paid 0.7% and 1.5%. We remain somewhat cautious, however, in tying up investors’ capital with bonds maturing beyond five years.

Source: JP Morgan

Our hesitation is not because we believe interest rates are returning to levels even remotely close to the 1970s and early 1980 when the Federal Funds rate topped out at 20% compared to 5.1% today. The economy, however, continues to benefit from post-pandemic tailwinds including efforts to bring certain manufacturing activities back to the U.S. Moreover, consumers remain flush with cash, that they can now invest and earn 5% via risk-free Treasuries and FDIC-insured CDs.

This newfound yield only adds to household income at a time when many, particularly retirees, are eager to spend and catch up on life after hibernating during the pandemic. The eagerness is apparent when trying to book a trip or simply looking at airline and cruise stocks this year.

There are also reports of an uptick in healthcare utilization. Young and old alike are on the go at home and abroad. The resulting return to activity often means aggravating that shoulder, hip, or knee, or going ahead and completing the procedure long deferred due to the pandemic.

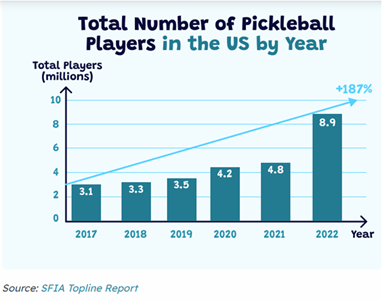

In addition to a healthy and active consumer, many of whom are giving Pickleball a try, we know unprecedented amounts of aid and government funding have been injected into the economy. Implications of all the stimulus and resulting liquidity remain unclear.

Given all the inflation variables, we are content to forgo the potential for additional fixed-income price appreciation if long duration bonds were to rally because inflation eases faster than expected. This seems like a small price to pay to reduce the risk of principal loss in our fixed-income portfolios if it turns out today’s inflation battle is more akin to the 1970s and early 1980s than anticipated.

"Humanity has won its battle. Liberty now has a country." — Marquis de Lafayette

The July 4th holiday season is a wonderful time to take a deep breath and reflect. In addition, we would encourage everyone to remember the holiday’s intent and celebrate our democracy and what is now 247 years of independence. As the people of Ukraine have reminded us, liberty cannot be taken for granted and a democratic system where we determine our own fate is worth defending.

"Independence Day: freedom has its life in the hearts, the actions, the spirit of men and so it must be daily earned and refreshed — else like a flower cut from its life-giving roots, it will wither and die." – President Dwight D. Eisenhower

The Independence Day quote from President Eisenhower is inspiring. As the Supreme Commander of the Allied Force in Europe, President Eisenhower witnessed first-hand a historic fight for freedom that has and should leave subsequent generations forever indebted to the men and women who sacrificed so much to preserve liberty for so many.

It also reminded us of the need for individuals and organizations to invest in themselves and constantly look for ways to improve. We continue to make investments at Woodmont so that we can position our firm to take great care of clients for decades to come. Along these lines, we are preparing to move our Nashville office later this year to a larger and newly renovated space and have added another team member, Hans Reitz, in early June. Hans joined our client service team with valuable experience at UBS and has hit the ground running, though some on the team struggle to reconcile his University of Tennessee degree with his devotion to the University of Kentucky Wildcats.

We’ll communicate additional details regarding the Nashville office relocation and other client service improvements early this fall. In the meantime, if you have questions or suggestions for anything we might do better, please let us know.

Thank you for your continued trust and confidence. Have a wonderful summer and we look forward to visiting soon.

The Woodmont Team

July 5, 2023