Thank you to all of our out of town clients and friends who have expressed concern and sympathy for the deadly tornado that ripped through Middle Tennessee March 3rd. While our team was grateful not to suffer directly, many in the area are hurting. Our thoughts and prayers are with those who lost loved ones or have been otherwise impacted by the storm. Similar to after the historic flood of 2010, Nashville and the surrounding communities are already coming together to support those in need. Case in point, a local non-profit’s website crashed three times on March 3rd due to the thousands of people trying to volunteer to help. With 2010 as an example, we are confident our community will emerge from this tragedy as a more cohesive and optimistic metropolis.

The Coronavirus - A Challenge for All of Us

While Middle Tennessee confronts the loss from this week’s tornado, the rest of the world is working hard to limit the spread and impact of the coronavirus. We won’t repeat what has been written about the virus and its potential. No doubt everyone is following the official and unofficial developments closely. We will, however, share a few thoughts regarding the markets’ reaction and our positioning given the health threat and the economic impact from the increasing and prudent corporate and community prevention efforts.

This Almost “Average” Correction Doesn’t Feel Average

From the February 19th high to its recent low, the S&P 500 declined 12.7% and was down 6.7% for the year as of Tuesday. The All-World Index also fell 11.6% from its February high and is down 7.3% year-to-date. Bonds have rallied as investors continue to pay up for safety, and the Federal Reserve is doing all it can to keep the cheap money spigot flowing. As a result, the U.S. Ten-Year Treasury’s yield fell below 1% for the first time ever this week. The Thirty-Year Treasury yields 1.6%. If you haven’t already, now is the time for anyone who has a mortgage to explore their options.

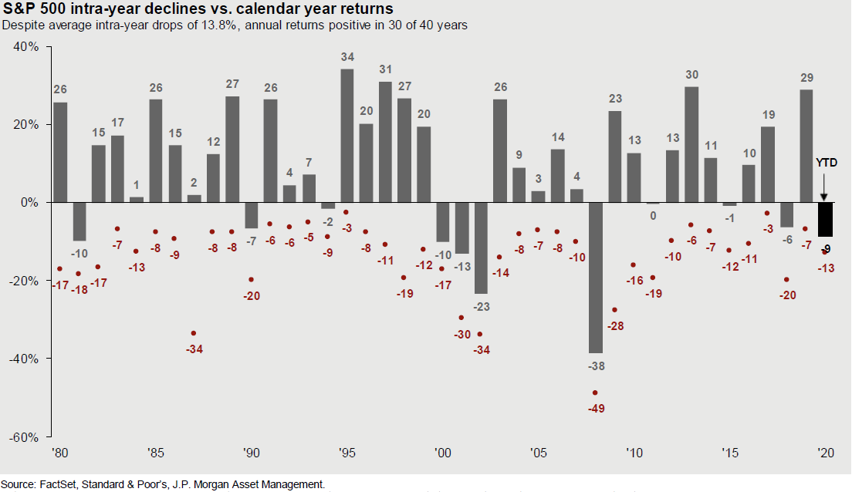

This draw down for the S&P 500 is in line with historical pullbacks per the chart above. Yet it certainly doesn’t feel average. Its rapidity (last week represented the worst one-week return since 2008), the complacency that may have set in on the heels of a strong 2019, and the range of uncertainty surrounding a fast-spreading virus has dominated headlines and our everyday chatter. Put another way, there is nothing average about the volatility index reaching its highest level since the financial crisis.

The Earnings Hit Is Coming. How Much Is Anyone’s Guess at This Point.

Entering the year, many economists were forecasting economic growth in the 2.5% to 3.0% range. Today the 2.5% looks like a long shot, even if the virus effect tapers off by early summer. The loss of economic optimism is showing up in the corporate earnings outlook as evidenced by high-profile companies like Apple, Visa, Microsoft, and Coca-Cola already indicating the virus will negatively impact first quarter earnings.

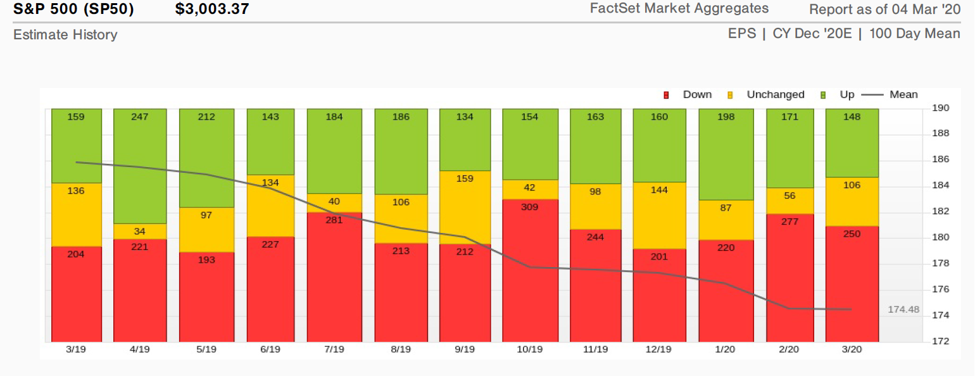

According to FactSet, the consensus estimate for 2020 earnings growth stands at 7.6% compared to 9.7% at the beginning of the year. This decrease may understate the headwinds posed by the significant consumer behavior changes and business supply change disruptions taking hold. Citigroup’s Tobias Levkovich has one of the more pessimistic outlooks. He believes earnings will do well to be flat and could fall 25% year-over-year if the virus pushes us into recession. While no one knows exactly how things will play out, the increased uncertainty for the economic outlook has been factored in to some extent.

Do You Pay A Discount or a Premium?

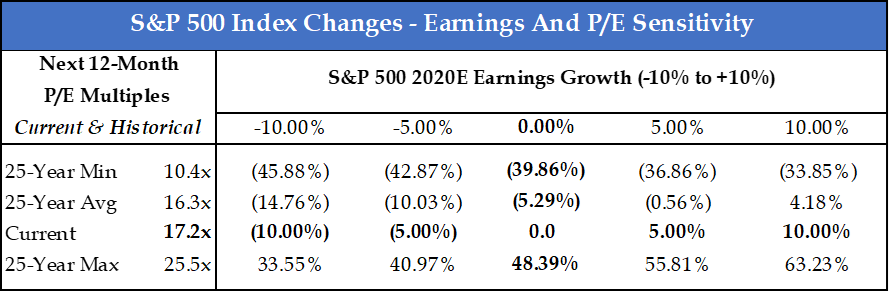

How much the reduced earnings outlook causes the market to go up or down from current prices will depend on several factors. These include 1) whether the virus earnings impact is viewed as a longer-term structural shift in global earnings or something temporary, 2) the extent to which the virus scare is the catalyst that ends this extended economic recovery, and 3) how much the lack of income alternatives in today’s low-rate world increases investors’ appetite for risks and stock dividends. In other words, near-term corporate earnings are important but just one part of the valuation equation. What investors are willing to pay for an expected long-term stream of earnings is the other, and generally more impactful factor, as the table below illustrates.

Source: FactSet & WIC

Have Presidential Politics Contributed to Investors’ Angst?

One other factor that will affect earnings and the price investors are willing to pay is the expected economic policy stances of a new Congress and the re-elected or newly elected President. For instance, will the lower corporate tax-rate survive, will there be an infrastructure spending push, and will we see more or fewer trade disputes? We discussed the markets’ likely fixation on these issues in our July 2019 Market Commentary. We are not interested in discussing politics. Yet as stewards of our clients’ capital, we have to try to understand and assess the risks of all of the factors potentially affecting the market. Along these lines, it did not seem coincidental to us that some of last week’s volatility followed big developments in Presidential primaries. The reality is markets fear big policy changes, particularly those that could severely reduce corporate earnings. Thus, last week’s momentum from Sen. Sanders, who is proposing significant changes to our nation’s economic policy, caught many investors by surprise.

You Can’t Time It, But Long-Term Investors Can Wait It Out

It is going to be November before we know for certain the likelihood of any big policy shifts from a change in Congress and/or the White House. And maybe before then, or soon thereafter, we’ll know better whether this economic cycle (record in length but not magnitude) has run its course, or the momentum has resumed. Regardless, we continue to believe long-term investors will be rewarded for owning stocks and have been comfortable upon this recent pullback increasing equity exposure within a clients’ appropriate risk parameters. Investor fear has been palpable, and we know from experience the opportunities are greater amidst wide-spread fear than euphoria. Also, while a near-term moving target, stock valuations are approaching the historical averages and the still well-covered dividends of many quality companies yield two to four times today’s risk-free rate of return.

Rest assured, however, we recognize the current intra-year draw down is just average. Things could certainly get much worse before they get better. Thus, while we were adding to stocks last week and early this week for many clients, our pace will be measured. Thank you for your continued confidence. As always, we look forward to answering any questions you may have.