Perhaps not surprising considering the uniqueness of the American “experiment,” a Civil War and two World Wars, predictions for America’s failure have been frequent and from all perspectives. Yet to borrow from Mark Twain’s quip, reports of our nation’s demise (even with all its imperfections) have been greatly exaggerated.

"We hear people pronounce the end of American democracy at every turn…the fact that it hasn't ended…suggests that maybe [it will] last a good deal longer." Professor Dennis C. Rasmussen, Syracuse University, and author of Fears of a Setting Sun.

Our record of resilience does not mean we won’t regularly be tested. Just this past quarter, we grappled with the mounting deficits our founders warned us against, tested the meaning of due process, and beheld the politically motivated murder of the Speaker of the Minnesota House. It also doesn’t help that information travels faster than ever and is increasingly proffered by Artificial Intelligence bots designed to fuel maximum engagement versus a reputation for accuracy and objectivity.

“Try not to crack under the stress, we’re breaking down like fractions.” Alexander Hamilton in the Broadway Musical, Hamilton (Coming to TPAC 2026)

Entering the second half of the year, the heightened tariff uncertainties from April have seemingly dissipated. In their place is a lively debate of our current fiscal and legislative priorities within the constraints of the budget reconciliation process, which requires the legislation to focus on budget rather than policy issues. Regardless, the prospective Reconciliation Bill, which could pass as early as July 4th, will have significant near-term implications for taxes, discretionary spending, and business and consumer confidence.

In this commentary, we’ll discuss stock and bond valuations following the first half’s wild ride. We will also consider the latest Social Security Trustees report and factors impacting the U.S. dollar index’s 11% decline the past six months. It is not our view that the Greenback is doomed. The first half’s decline relative to other currencies, however, warrants a discussion and is yet another reminder of the benefits of diversification.

As for the Republic, in our firm’s 25 years, we have a long history of not betting against the collective resilience and ingenuity of the American people or the Constitution’s powerful guardrails. While the list of challenges is long and the political drama intense, we are not wavering from this conviction and our confidence in the associated rewards for investors who can tolerate the fireworks.

A Big Drawdown and Rebound for Stocks!

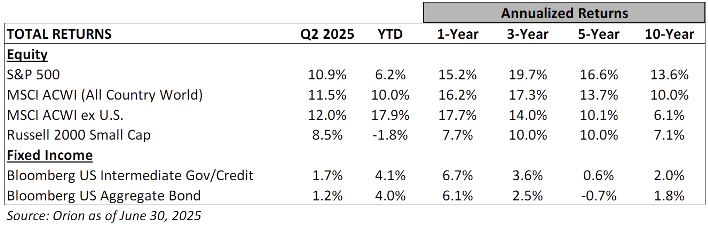

Following the early April “Liberation Day” tariff announcements, the S&P 500 fell 10% in two days. This represented the fifth-worst two-day decline since World War II, leaving the index down 19% from its February high. Mid-and small-capitalization stocks fared even worse, down 22% and 24% from their recent peaks. Not immune to the spike in trade policy uncertainty, non-U.S. stocks fell 10% over three days.

By April 9th, however, most of the losses had been recovered. Specifically, the President’s 90-day pause to the historically high tariff rates prompted aggressive buying and short covering. U.S. and non-U.S. stocks gained 9.5% and 7.2% on April 9th alone. By quarter end, stocks had staged a big rally, including the best month of May for the S&P 500 since 1990.

Regardless of whether the “Liberation Day” tariff reveal was part of a broader negotiating strategy, the April 9th pause recognized the heightened angst and uncertainty for investors, business owners, and consumers alike. We won’t revisit our April Market Commentary on the challenges of tariffs, even amongst laudable trade fairness objectives. We will note, however, that market volatility, like we experienced in early April, often provides powerful and real-time guardrails for policy actions.

Stocks Now Face a Higher Hurdle for the Second Half

The significant second-quarter stock rebound leaves the S&P 500 and non-U.S. indices trading at 22X and 14X next-twelve-month estimated earnings. The near-historic premium of U.S. stock valuations compared to non-U.S. stocks has narrowed following the first half’s non-U.S. stock outperformance. Of course, at current levels, both indices are trading at premiums to their respective 20-year P/E averages of 16X and 13X.

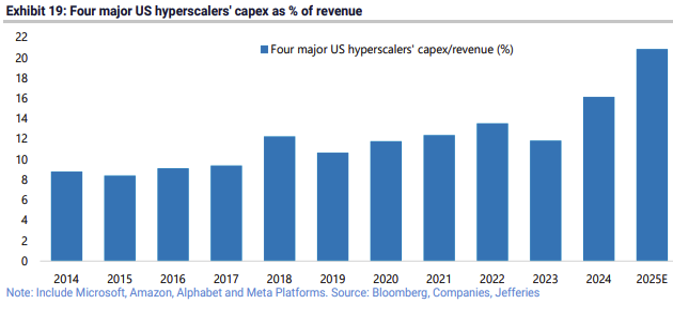

Whether this premium means investors have overindulged or Wall Street underappreciates the next twelve months’ earnings potential will begin to unfold in the second half. The sectors leading the way this year – industrials, communication services, and utilities, all up 9% or more – are benefitting from considerable tailwinds, including record levels of capital investment and increased power demand from major players in the AI arms race.

Even so, it would be difficult to conclude that consumer confidence hasn’t been negatively impacted by the tariff and government spending policy uncertainties earlier this year, not to mention the increasing threat of AI to replace workers. In fact, while new jobs and opportunities will emerge, headlines pronouncing AI’s eventual gutting of entry-level white-collar jobs are sobering.

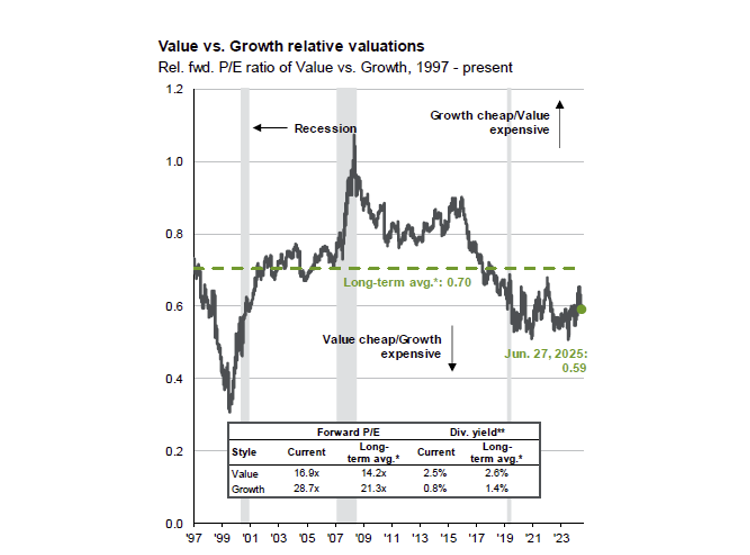

Speaking of AI, the infrastructure buildout and enthusiasm for companies bringing solutions to the foreground have fueled much of the market’s recent recovery. Specifically, since April, growth stocks are up 18% compared to 3% for less-directly AI-exposed value stocks. As a result, growth stocks are again trading at a significant premium to the market and appear to be pricing in better-than-expected earnings.

Source: JP Morgan

We seek to invest in the most innovative and fastest-growing segments of the economy either via individual stocks, sector exchange-traded funds, or broad-market diversification. For the risk-averse equity investor worried about today’s premium market valuations, high-quality dividend-focused companies trading at half or two-thirds the price-to-earnings ratio of the broader market are a nice complement. These companies' earnings prospects should also benefit from AI innovations that increase efficiency and improve profit margins.

Bonds: Yields Have Come Down from Recent Highs, But Still Offer a Reasonable Return Relative to the Risk

Fear, geopolitical strife, and the talk of budget deficits made for a volatile first quarter for U.S. Treasury investors and, by extension, most fixed-income investors. This volatility was acutely apparent at the intermediate and longer ends of the yield curve. For instance, the 5-Year and 30-year Treasury yields swung by 89 and 78 basis points amid the uncertainties.

“We haven’t been through a situation like this, and I think we have to be humble about our ability to forecast it.” Chair of the Federal Reserve, Jerome Powell, June 18, 2025

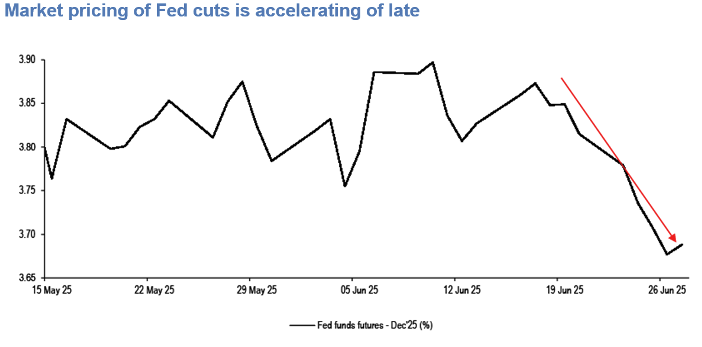

Chairman Powell is content to wait for data on the inflationary impact of tariffs and the threat of tariffs to guide the Federal Reserve’s actions. Notwithstanding this patience, Treasuries rallied after peaking on May 20th in part due to relatively dovish consumer price index data and weakening employment trends.

Following the rally to end the quarter, investors have priced in at least two quarter-point cuts beginning in September. While time will tell if these anticipated cuts are too much or too little too late, those with floating-rate debt or impending loan maturities are not complaining.

Source: JP Morgan

For clients’ fixed-income investments, our goal is to lock in three to four years of income visibility within fixed-income portfolios. This reduces the risks of owning long bonds in a potentially deteriorating credit and/or inflationary environment. Yet it recognizes that today’s reasonable 4-5% yields for investment-grade bonds could disappear in a risk-off environment or when Chairman Powell’s term ends and the President appoints a new Chair.

As for a new chair, given the chance, what politician would not want lower rates to reduce borrowing costs, minimize the U.S. debt interest burden, and stimulate the economy? Of course, powerful guardrails mean the President must wait until Chairman Powell’s term ends in May 2026 to try to affect this low-rate preference.

Forecasting the U.S. Dollar’s Relative Value Has Never Been Harder

While U.S.-centric investors, we have regularly discussed the importance of global asset diversification in this commentary. One reason for the diversification is it provides exposure to potentially faster-growing markets. Population growth is, after all, a natural tailwind for economic growth. However, since U.S. companies can sell their goods and services worldwide (and have successfully done so historically), a more notable reason for this diversification is to mitigate the risks of a falling U.S. dollar. Put simply, if you invest in overseas assets, the value of that investment increases when the U.S. dollar’s value declines.

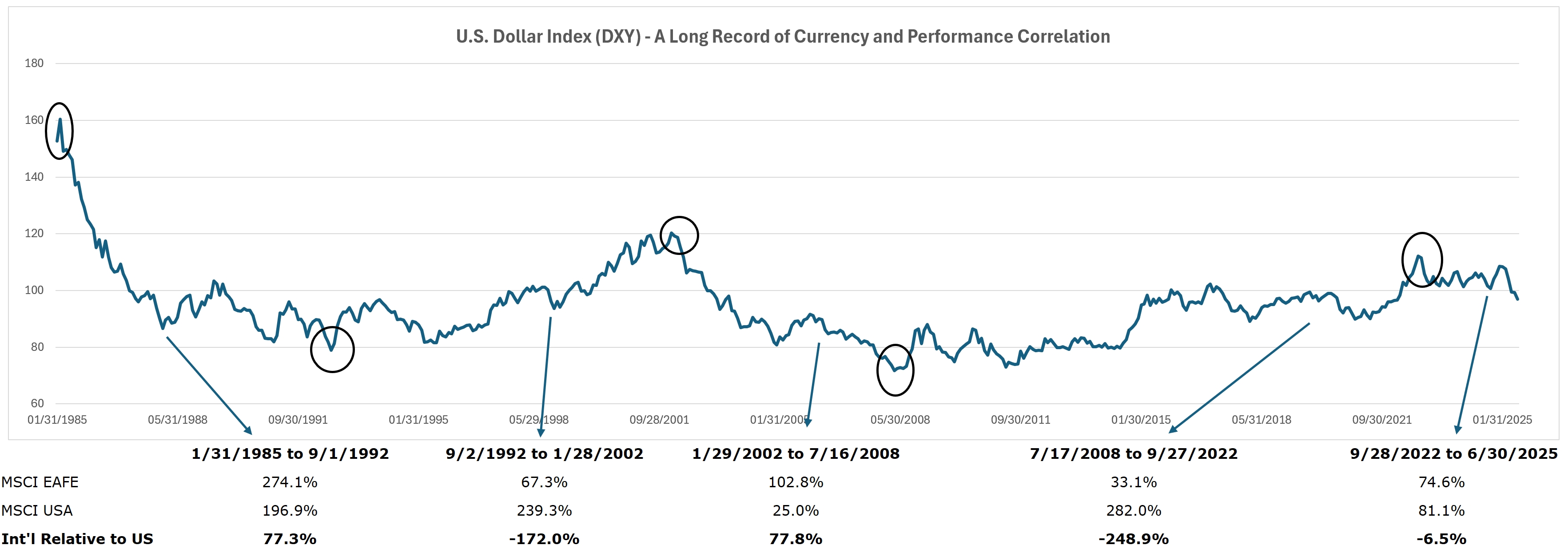

This currency and performance correlation was apparent in the first half’s equity results. The U.S. dollar declined 11% relative to a basket of foreign currencies, which contributed to the ex-U.S. stock index gaining 18% versus gains of 6% for large capitalization U.S. stocks. As might be expected, the reverse is also true and is one of the reasons (the innovation divide being the other) that non-U.S. stocks have underperformed so much in the past fifteen years.

Source: FactSet Data Systems and Woodmont

As for the U.S. dollar’s prospects, we are tracking several variables impacting the demand for U.S. dollars, including those below:

Interest Rates: If U.S. Treasury yields increase relative to other sovereign debt offerings, overseas investors will increase the demand for U.S. dollars to buy more U.S. Treasuries.

Demand for U.S. Goods & Services: The demand for U.S. goods, services, and assets such as stocks will influence the U.S. dollar. After all, to consume or purchase these goods and assets, foreign buyers must exchange their currency for U.S. dollars.

Reserve Status: Another factor is the U.S. dollar’s status as the global reserve currency. Currently, central banks around the world hold U.S. dollars for transactions but also because of its perceived safety relative to other currencies, which are historically more volatile.

While the concepts behind these variables are reasonably straightforward, the impact of “Stablecoins,” tariffs, and cryptocurrencies certainly complicates the outlook. Treasury Secretary Bessent believes Stablecoins will solidify the U.S. dollar’s dominance since most transactions are collateralized with U.S. Treasury bills. If, however, significant transaction volume shifts to cryptocurrencies, the demand for the U.S. dollar or any fiat currency (i.e., government-issued money) could weaken.

Suffice it to say, the currency and digital payments landscape is rapidly changing. A diversified portfolio can help mitigate the risks and ensure participation in the solutions developed to serve this new landscape. And while we remain optimistic for the U.S. dollar’s long-term strength and status, we are increasingly mindful of how technology and global politics could alter this outlook.

Social Security: Should I Worry?

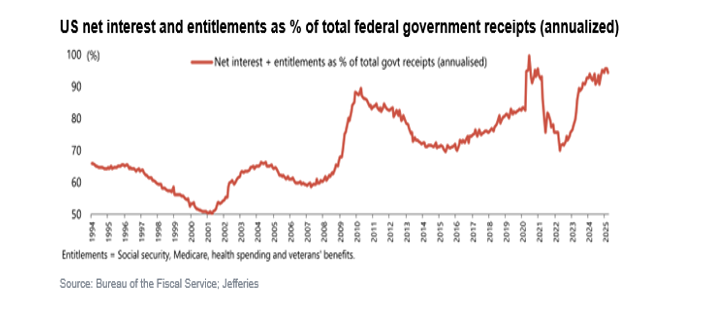

The challenges of the U.S. Government’s fiscal picture are well documented. We have noted regularly how reforming entitlements is necessary to improve the outlook.

In fact, currently over 90% of all government receipts are spent on entitlements (Social Security, Medicare, Medicaid) and interest expense. And while the growing burden of servicing $36 trillion in debt is gaining attention in today’s higher interest rate environment, seemingly no politician from either party wants to tackle the entitlement spending challenge.

“I am a firm believer in the people. If given the truth, they can be depended upon to meet any national crisis. The great point is to bring them the real facts.”

President Abraham Lincoln

In June, the Social Security Trustees issued their annual report. The updated forecast is that the current program will be insolvent by 2033. Without changes, benefits would be reduced 23% across the board.

Whether the recent update draws meaningful attention to this and other entitlement challenges remains to be seen. Fortunately, even modest changes for Social Security beneficiaries with decades to prepare can significantly improve the program’s fiscal outlook. Other nations with generous benefits and demographic challenges are responding. For instance, in May, Denmark raised its retirement age for its version of Social Security from 67 to 70 for anyone born in 1971 or later. Considering that at the outset of Social Security in our country, the average U.S. life-expectancy, excluding infant mortalities, was 65 compared to today’s 79, most appreciate that reforming the program is inevitable. Regardless, when helping clients plan for retirement, we take a measured approach to the sustainability of these benefits, particularly for anyone below age 50.

Woodmont Celebrates 25 Years!

Woodmont was founded 25 years ago this fall. Suffice it to say, we have seen and discussed in this Market Commentary plenty of economic, geopolitical, and financial industry fireworks during this time. The services we offer have evolved, including adding comprehensive wealth management and financial planning to our long legacy of managing investment portfolios. Yet, our commitment to put clients’ interests ahead of our own and identify ways to better serve clients remains paramount.

Thank you to everyone who has been with us all 25 years and to those who have more recently entrusted their finances to our stewardship. We are grateful for your trust and confidence and look forward to celebrating this milestone and those to come with you this fall.

We wish you a wonderful 4th of July Holiday. Please let us know if you have questions or if we can be of assistance.

The Woodmont Team

July 1, 2025

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.