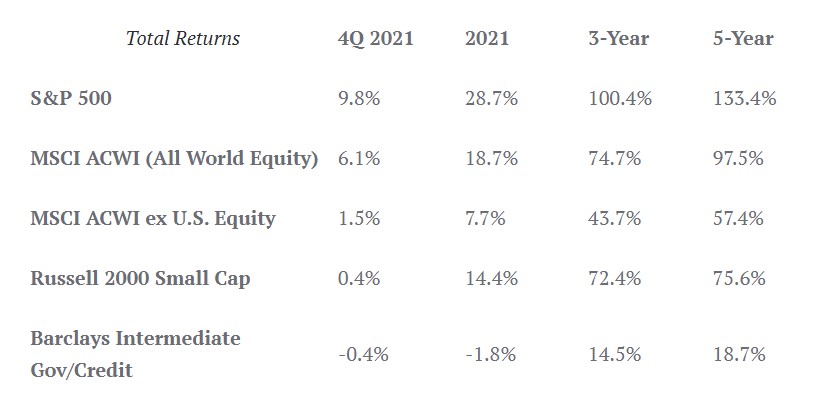

After an incredibly resilient 2020, most stock market prognosticators expected only modest gains in 2021. The conventional wisdom was that markets had raced ahead in anticipation of the 2021 COVID-19 earnings recovery thus already “pricing in” the good news. The extent of the 2021 earnings recovery, however, has far exceeded even the most optimistic forecasts. For instance, this time last year the consensus Wall Street forecast for 2021 S&P 500 earnings was $164. While the Omicron surge could negatively affect fourth quarter reports, the current 2021 S&P 500 earnings estimate is for $207, a whopping 26% better than expected and 20% ahead of pre-pandemic 2019 earnings. (Source: FactSet) We’ve often remarked over the years how the consensus view is regularly the wrong one. Yet the magnitude of this miss has surprised even the long-term skeptics of Wall Street forecasting.

Source: FactSet as of December 31, 2021 using the relevant exchange traded funds as a proxy where necessary.

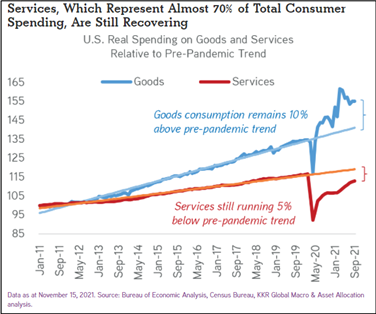

Key to the earnings recovery in 2021 has been a strong desire on the part of consumers, businesses, families, ball teams, and old friends to catch up on lost time. While still below pre-pandemic activity levels, the increased activity has been so strong it has created a whole new set of challenges. We’ll discuss a few of these, including today’s labor shortages and the prospect of higher interest rates, in this market commentary.

Whether these challenges will derail what has been one of the greatest bull market runs for U.S. stocks on record (and growth stocks in particular) remains to be seen. With five mega-cap stocks contributing over one-third of the S&P 500’s 28.7% gain in 2021, one could certainly conclude the list of big market winners will likely need to broaden. Fortunately, given some of the current economic and equity market dynamics, we think value, non-U.S., and small-cap stocks, which underperformed in 2021, are well positioned to contribute more meaningfully to market returns and close some of the relative performance gap of recent years. As for bonds, we are intent on keeping portfolio duration relatively short and high quality. After all, if current inflation trends persist, the Federal Reserve will have lots of catching up to do.

“Don’t put off until tomorrow what you can do today.” Benjamin Franklin

With the better than forecasted earnings recovery as backdrop, the strong gain for the S&P 500 index is easier to comprehend. The market’s ascent, including a strong fourth quarter, has only added to the pain of those investors waiting for a good entry. Other than the historic COVID-19 related drawdown in early 2020, volatility has been relatively mild and the windows to invest on significant pullbacks limited. Since 2008, the lone negative year for the S&P 500 was 2018 when it declined 4%. Suffice it to say, this strength in the face of significant uncertainty reminds us of that old market adage that the best time to invest is when you can.

A Fairly Selective Bull Market

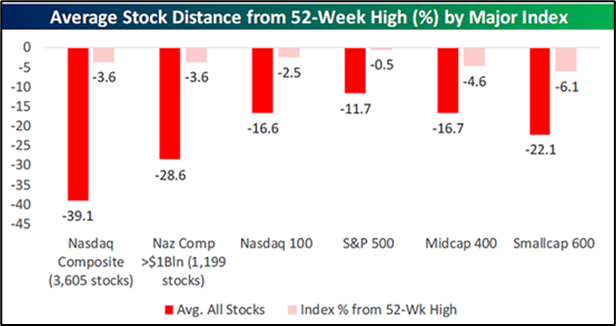

If the historical data supporting investing today versus tomorrow is unconvincing, it may help the sidelined or cash heavy investor to consider not all stocks are at or near their all-time highs. According to MarketWatch data, nearly one in five S&P 500 stocks are down 20% or greater from their 2021 highs. The average stock is down 11% from its high. This under the radar correction is why the P/E for the equal weighted S&P 500 is 17X versus its market-weighted P/E of 21X. More broadly, even many of the popular growth stocks that fared so well during the pandemic have experienced a healthy market correction. In fact, the average NASDAQ stock is down nearly 40% from its 52-week high, albeit a very lofty high in many instances. Prices can always fall further, but for the long-term investor looking to invest in good companies, the greater risk is trying to time the bottom.

A Trillion Isn’t What It Used to Be

United States Senator Joe Manchin is currently standing in the way of his fellow Democrats’ efforts to pass a multi-trillion-dollar spending bill. Judging from the Senator’s conviction regarding what should and should not be included in an “infrastructure” bill, not to mention his current 61% approval rating among West Virginia voters, this high-profile legislative matter may be on the shelf until after the Fall 2022 mid-term elections.

Regardless, with nearly $6 trillion of stimulus passed since early 2020, and 2022 government deficit spending projected to exceed $1.1 trillion, both political parties seem to have entered a new fiscal policy paradigm. While the U.S is still the best house in the global neighborhood in our view, investors likely won’t ignore this fiscal shift forever. Accordingly, we continue to look for ways to diversify portfolios and benefit (even if modestly) in the event the shift weakens the U.S. dollar, limits our ability to respond to a future crisis, or results in systemic inflation. And, as you might suspect, we won’t be purchasing any long bonds given today’s low yields relative to the bond price risks if interest rates increase. While our current fixed-income perspective is probably a consensus view, we are content to pass up the opportunity to effectively make long-term loans and assume all credit risks for a low single-digit return.

The Trillion Dollar Club is Growing

Not too long ago, many investors believed a company would struggle to eclipse a market capitalization of $1 trillion. The theory was the bigger a company gets the harder it is to sustain earnings growth and develop new products and service offerings with end markets large enough to move the financial needle.

Apple (AAPL) first debunked this theory reaching $1 trillion in August of 2018. The company’s market capitalization ended 2021 just under $3 trillion. Thanks to the combination of accommodative Federal Reserve policies, investors willing to bet on future versus current earnings, and a secular shift in how we consume and communicate, this exclusive trillion-dollar club currently includes Apple, Microsoft, Amazon, Alphabet, and Tesla. Collectively, these stocks represent 21% of the market-cap weighted S&P 500 and accounted for over one-third of the index’s 28.7% return in 2021. The strength of these and a few other mega-caps carried the S&P 500 to new highs in December, all the while over 300 S&P 500 companies reached 52-week stock price lows. While this performance divergence can be viewed as an ominous sign, the lost purchasing power that comes with holding cash in an inflationary period may be all the reticent investor needs to come off the sidelines.

"The number one issue facing the man on the street, as well as investors, is inflation." Paul Tudor Jones

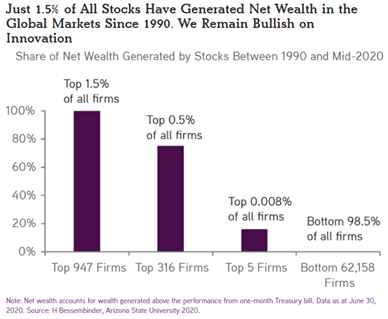

Finding the Next Big Winners

There are many impressive companies doing their best to join the trillion-dollar club. Berkshire Hathaway, Nvidia, and UnitedHealth Group have market capitalizations of one-half to three-quarters of a trillion. Many life-science, fintech, and cyber security firms have promising outlooks and in many cases a chance to succeed independent of the economic cycle. Because of the needle in a haystack aspect of identifying these generational winners, let alone hold them for the long-term, we seek to include some broad market exposure for most of our clients. It’s tax efficient and helps eliminate the performance risks of missing one of the coming decade’s next big winners.

In the near term, the major U.S. indices’ sustained success is fairly dependent on the ten largest stocks in the index. The fact that only Microsoft remains among the top ten companies in market capitalization twenty years ago and today highlights just how hard sustaining that success is.

It's been a hard day's night, and I've been working like a dog

It's been a hard day's night, I should be sleeping like a log

But when I get home to you I find the things that you do

Will make me feel alright – The Beatles “A Hard Day’s Night” 1964

Wage inflation and the “great resignation” of an estimated 3% of the workforce have been much discussed in recent months. While many have been experiencing these pressures first-hand, the 6.8% November consumer price index increase documented the issue both for investors who fear inflation and companies challenged with responding to demand and maintaining margins. Some of the inflationary pressure points should ease as the seasonal slowdown allows for supply chains to catch up. What happens on the labor front, however, is less clear. Just last week, the Labor Department released the latest initial jobless claims data. According to Briefing.com, the initial claims four-week average of 199,250 is the lowest it has been since October 25, 1969. COVID-19 related policies, worker fears, and priority shifts have contributed to the current labor imbalance. Recent wage gains, however, are also a continuation of a trend that goes back a few years. Today’s jobs require more skills and attracting skilled workers requires more wages.

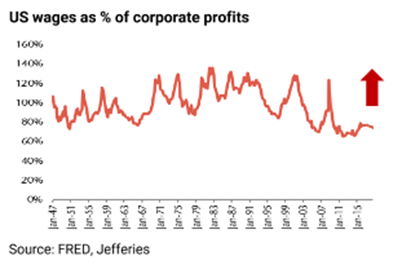

Finally, these wage gains may reflect a rebalancing of the share of profits the C-suite can expect to retain. We wrote about the widening gap between the average worker and CEO compensation in our April 2018 market commentary, which can be found here. Our purpose for highlighting this was certainly not political, but in recognition of an important factor to consider in evaluating profit margin sustainability and consumer demand. After all, the relatively low-wage worker spends more of their wage gains than the high-income earner.

Fortunately, technology and automation continue to allow organizations to do more with less and thus offset some of these pressures. Even still, employees’ leverage to negotiate wage gains and benefits hasn’t been this strong in decades. Perhaps this positioning was highlighted when one local Nashville healthcare company CEO gifted some of his personal shares to employees, presumably without being asked and certainly to help his company retain its workforce.

Will Non-U.S. Stocks Ever Catch Up?

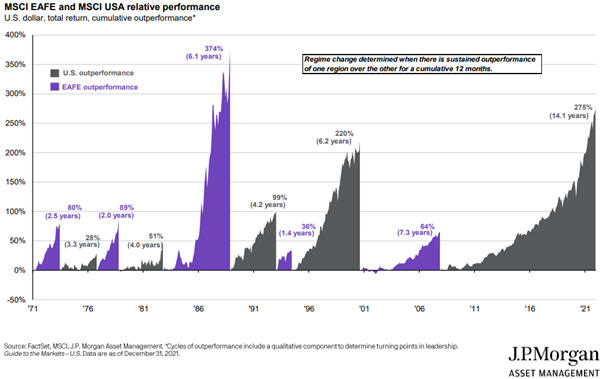

While unapologetically U.S. biased in our investment approach, we believe it is important to maintain a diversified portfolio in terms of style, market capitalization, and geography. In 2021, and for several years now, this diversification has made it difficult to keep up with the major U.S. indices. The chart below highlights the U.S. versus non-U.S. relative market performance discrepancy of recent years.

The potential for a reversion to historical trends alone is not a sufficient reason to invest in non-U.S. stocks. Yet relatively attractive valuations, coupled with the magnitude of the catch-up potential if the recent trend reverts, are good justification for maintaining some non-U.S. exposure, particularly for our growth-oriented investors.

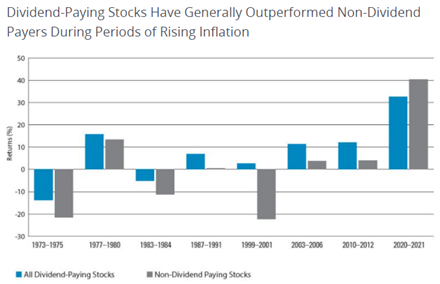

Attractive Dividend Yields and a Good Relative Record During Periods of Rising Inflation

Few if any companies will have it easy in today’s inflationary environment, especially considering labor can represent as much as two-thirds or more of the costs of goods and services. It is worth noting, however, that dividend paying stocks have historically fared relatively well during inflationary periods. In fact, with the exception of this most recent period, which has arguably just begun, dividend payers have outperformed non-dividend payers in the previous seven inflationary stints going back to the early 1970’s.

Source: HartfordFunds and Ned Davis Research, as of 09/30/2021.

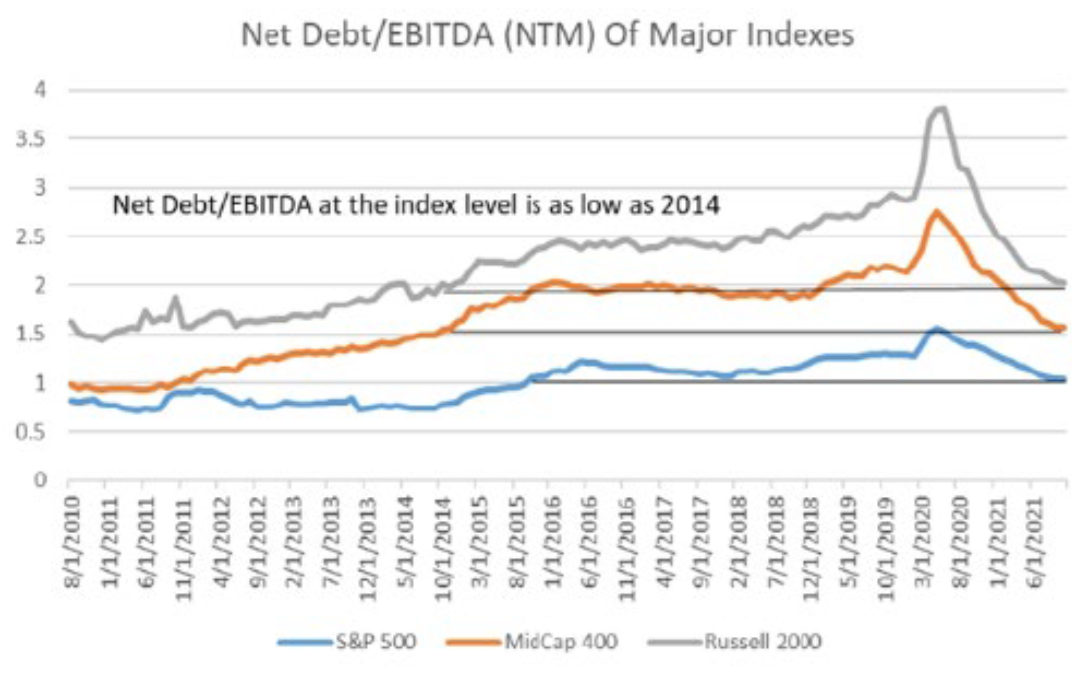

Some of the Best Balance Sheets We Have Seen in Years

The 2021 earnings recovery has not only fueled strong market gains, but has resulted in dramatically improved credit metrics for public companies. Per the chart below, the Net Debt/EBITDA levels for small-, mid-, and large-capitalization stocks have returned to 2014 levels. While still higher than the conservative positioning coming out of the Great Recession, these low debt levels provide companies with significant flexibility to fund growth, repurchase shares, or weather an economic downturn. Put another way, if a new COVID variant, policy surprise, or geopolitical development leads to an economic slowdown, it’s good to know that most public companies’ financial leverage is lower than it has been in years.

Source: Raymond James

Will Omicron or Future COVID-19 Variants Put an End to this Bull Market?

Our clients and market commentary readers understand our approach well enough to know that we don’t make near-term market predictions. If someone has one for you, hold on to your wallet. It could be about as reliable as the 2021 Wall Street consensus earnings estimate at the beginning of the year. What we know, however, is we have learned a great deal the past two years, COVID vaccines are helping reduce hospitalizations and everyone is ready to move on while taking reasonable and necessary precautions.

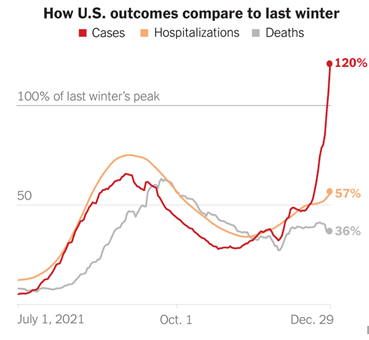

Source: New York Times database

Perhaps this potential shift from pandemic to endemic was highlighted in the recent change in the Centers for Disease Control guidelines, which are focused on tracking hospitalizations and not infections and reduced the recommended quarantine period. And while some companies and schools are starting the year remotely, TSA travel data shows that more people flew during the holiday season in 2021 than in 2019. Judging from TV coverage, major college bowl game attendance has also rebounded strongly.

2022 Here We Come

There is an old Wall Street saying, “Skeptics sound smart. Optimists make money.” We never want to ignore macroeconomic or company-specific risks or make light of today’s challenges. There are plenty of them and markets will suffer setbacks when something underappreciated captures investors’ attention. Yet, we remain no less hopeful for 2022 and beyond. A thirst for innovation and the tailwinds of economic growth will continue to reward those investors willing and able to endure the ups and downs.

As for Woodmont, we eclipsed a milestone in 2021 with client assets exceeding $1 billion. We also added three new team members with valuable skills and experiences. Most importantly, however, these colleagues share our unwavering commitment to always place clients’ interests first as we seek to help them achieve their financial goals.

Thank you for your continued trust and confidence. We wish you all the best in the New Year and look forward to answering your questions and assisting you in any way we can.

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.