While the continuation of many of the TCJA provisions is significant for planning purposes, we will focus our OBBBA analysis on the changes for individuals, families, and businesses. Most complex tax bills feature varying start and end dates for different provisions. To clarify these changes, we have provided specific dates where applicable.

Individuals

Ordinary Income Tax Rates

The OBBBA permanently adopts the income brackets from the 2017 Tax Cuts and Jobs Act. This increases visibility for tax liabilities and makes income realization options, such as Roth conversions, a vital part of many clients' planning strategies. Importantly, many of these provisions include a phaseout threshold based on income, which can lead taxpayers to face higher effective tax rates than their nominal tax brackets. By engaging in proactive tax planning, taxpayers can find opportunities to avoid or reduce the impact of these phaseout thresholds.

Itemized Deductions: SALT & Other Changes

(2025-2029)

One of the heavily debated elements in the tax conversation has been the SALT (state and local tax) cap. Limited to $10,000 under the 2017 TCJA, the cap has increased to $40,000, with a built-in 1% cost-of-living adjustment through 2029. This could swing the pendulum back toward itemizing for many high-tax state residents. The SALT deduction is phased out starting at an income of $500,000.

(2026 - Permanent)

The OBBBA impacts itemized deductions in some new ways, including:

- Allowable itemized deductions are reduced by 2/37ths for the amount that exceeds the 37% tax bracket. This means taxpayers in the top tax bracket will see their deduction benefits decrease from 37 cents to 35 cents.

- A new threshold is being set, requiring you to clear 0.5% of your adjusted gross income before receiving a deduction for itemized charitable donations.

- Educators can now deduct unreimbursed qualified education expenses they incur, provided they itemize their tax returns.

Senior Deduction (2025-2028)

For those ages 65 and older, a new senior deduction of $6,000 per person has been added. This comes on top of your standard or itemized deduction and begins to phase out once your modified adjusted gross income (MAGI) exceeds $75,000 (single) or $150,000 (married).

Estate and Gift Tax Exemption Extended (2026, Permanent)

The federal estate tax exemption has been permanently increased to $15 million per individual and $30 million for married couples. These amounts will continue to be adjusted annually for inflation.

Charitable Deduction Revival (2026, Permanent)

Borrowing from COVID-era tax relief, the OBBBA includes a simplified charitable deduction of $1,000 for individuals or $2,000 for joint filers, even if you do not itemize. Donor-advised fund contributions don’t qualify and are only available if you itemize deductions.

Beginning in 2027, a new non-refundable tax credit of $1,700 is introduced for eligible taxpayers who make donations toward scholarships for elementary and high school students.

Auto (2025-2028)

New- If you’re driving a U.S.-manufactured vehicle (sorry to our European car enthusiasts), the OBBBA allows you to deduct interest on personal car loans, up to $10,000, subject to income limits of $100,000 (single) and $200,000 (joint).

Ending- The $7,500 EV tax credit for electric vehicles ends September 30th.

Families

Child Tax Credit (2025, Permanent)

The child tax credit has been increased to $2,200 per child, up from $2,000, including a refundable portion of $1,400. Furthermore, the credit will now be adjusted for inflation. Children must be under the age of seventeen to be claimed.

Expanded 529 Plans (2026, Permanent)

These education savings plans can now be used for qualified postsecondary credentialing expenses, broadening their utility for families pursuing nontraditional or vocational paths. The OBBBA also increased the limit for qualified K-12 expenses from $10,000 to $20,000 annually beginning in 2026, with a wider range of expenses now covered.

Dependent Care FSA (2026 - Permanent)

The maximum amount excludable from income for dependent care benefits increases from $5,000 to $7,500. Dependent care covers the cost of caring for children under 13, such as expenses for daycare and preschool.

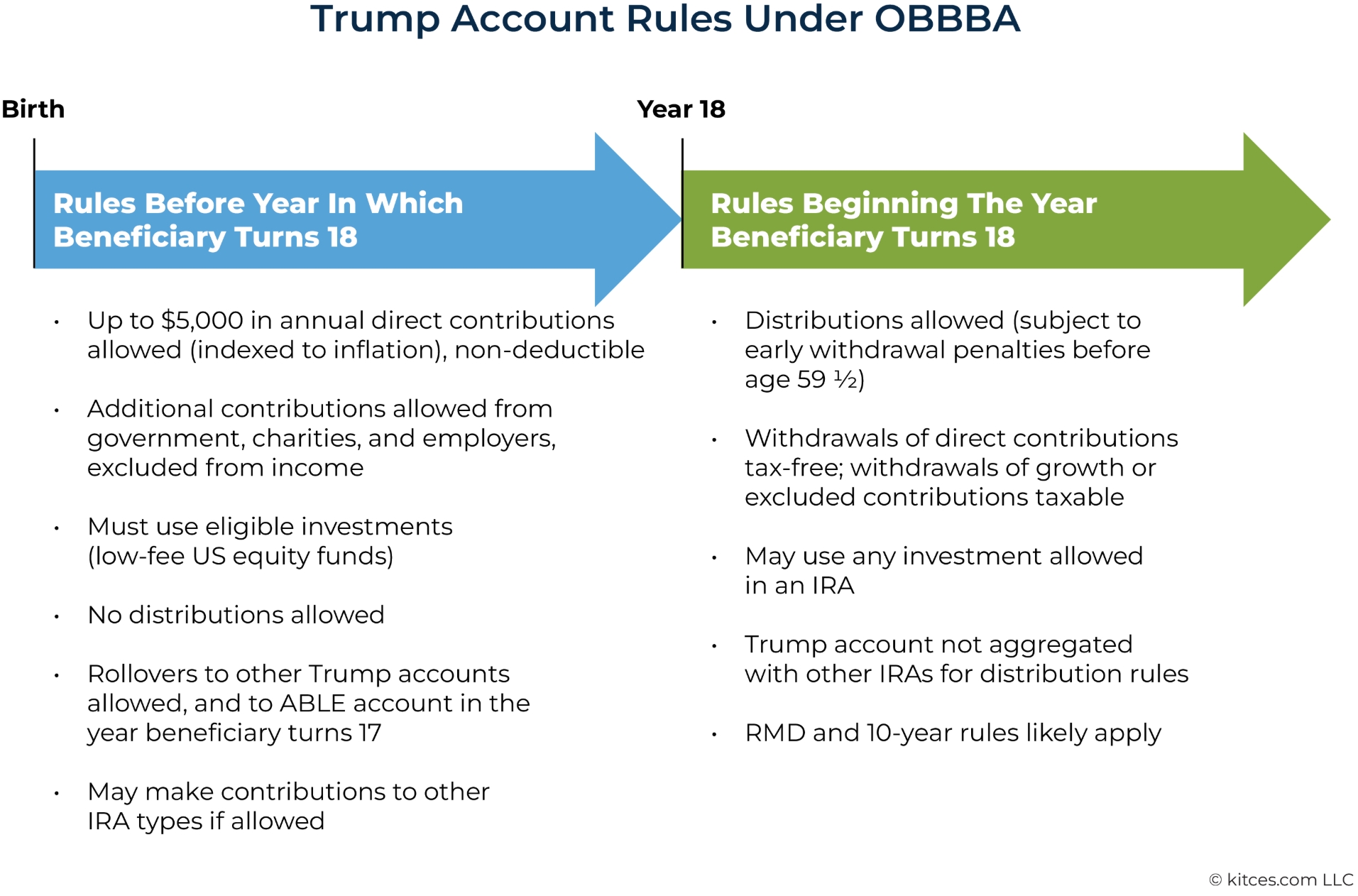

Baby IRAs - aka “Trump Accounts” (2026-Permanent)

Families will be able to open a new type of retirement-style account for children under 18. As an added incentive, the government is offering a $1,000 grant to anyone who opens one of these accounts for a child born between 2025 and 2027. The owner can contribute up to $5,000 annually, with a separate employer contribution limit of up to $2,500, both subject to inflation adjustments each year. Unlike a traditional or Roth IRA, the child does not need to have earned income.

While the framework for these accounts has been established, many implementation details remain unclear. We expect further guidance and clarification as regulatory agencies begin to interpret and apply the law.

Businesses

Qualified Business Income (QBI) Deduction (2026, Permanent)

The OBBBA made the QBI deduction permanent at the 20% level for eligible pass-through income. A floor was also introduced for QBI, meaning that if you have at least $1,000 of qualified business income, you will automatically receive a $400 deduction.

Special Depreciation (Property Acquired After January 19th, 2025 - Permanent)

Businesses planning large investments in capital expenditures can take advantage of 100% depreciation in the first year when assets are placed into service.

Section 179 Expansion (2025, Permanent)

The cap on immediate expensing of equipment and machinery doubles to $2.5 million, with up to $4 million in total section 179 property allowable before phaseout. This is beneficial for businesses reinvesting in growth.

Opportunity Zones (2025, Permanent)

While extended, Opportunity Zones will now face enhanced scrutiny and compliance measures, including stricter eligibility requirements. Key changes include adjustments to the median family income threshold and the implementation of an anti-gentrification cap linked to the poverty rate.

Starting in 2027, investors in a qualified opportunity fund will benefit from a 10% basis step-up on their deferred gains, provided they hold the fund for at least 5 years. Furthermore, the OBBBA will create a new “rural qualified opportunity zone” offering a 30% basis step-up if the fund is held for at least 5 years.

Qualified Small Business Stock “QSBS” – (2025 - Permanent)

Investors in QSBS are eligible for a reduction or elimination of the capital gains tax. Although the IRS excludes a broad category of businesses from qualifying based on the "reputation or skill of one or more of its employees," recent changes in the new bill have modified the holding period and asset limits to be more favorable. The key updates are as follows:

- The company’s gross assets must not exceed $75 million at the time of investment, an increase from the former $50 million limit.

- For capital gains, the percentage of exclusion from taxes increases with the holding period: 50% for 3 years, 75% for 4 years, and 100% for 5 years.

- Increase in capital gains subject to exemption from $10 million to $15 million, indexed for inflation.

Closing Remarks

Woodmont is actively integrating the OBBBA changes into clients' planning strategies. Whether you are an individual, family, or business owner, the new provisions can impact your tax strategy. We are available as a resource and look forward to working with your CPA or tax advisor to take advantage of any tax-savings opportunities.

Regards,

The Woodmont Team

Useful Links

One Big Beautiful Bill Act

Tax provisions in the One Big Beautiful Bill Act

Breaking Down the One Big Beautiful Bill Act: Key Provisions and Implications

Don’t Itemize? Doesn’t Matter. You’re Getting a New Tax Break.

Qualified small business stock exclusion: Who’s eligible?

How the One Big Beautiful Bill Act Will Reshape 529 Plans

Breaking Down The “One Big Beautiful Bill Act”: Impact Of New Laws On Tax Planning

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.