Over our firm’s twenty-three year history, we’ve produced market commentaries during challenging times and on the heels of some horrible tragedies. Yet we cannot recall a commentary when the tragedy was both so recent and so close to home as The Covenant School shooting one week ago today. Something this awful and senseless certainly puts in perspective our quarterly discussion of the economy and financial matters.

Like all of Nashville and so many across the country from whom we have heard, we continue to mourn and pray for the families of the precious children and dedicated educators who were killed. We are also incredibly grateful for the police officers, school leaders, and school staff, who risked their lives and responded with valor. This sacrifice and care for others provides hope even in the darkest of times.

No Shortage of Topics

Geopolitics, volatile inflation readings, the shifting sands of credit and confidence, and the discussion of artificial intelligence as both opportunity and threat made for an eventful first quarter, even before the cresting of the bank crisis in mid-March. We issued a commentary to clients specific to the bank crisis on March 13th. and will summarize its conclusions in this commentary. We also share our assessment of the economy, stock and bond valuations, and the unfolding implications of this latest banking crisis. The technical nature of some of these topics requires us to get into the financial weeds. Thus, here are some key takeaways:

- Stocks and Bonds Both Posted Gains to Start the Year

- Stocks Remain Reasonably Priced and Have Discounted Some Level of Economic Slowdown

- Bond Yields Are Still Near the Highs of the Past Decade

- Banks Seem to Have Averted a Wide-Spread Contagion Crisis, But Now Face an Earnings Challenge

- Main Street Has Taken Much of the Recent Bad News in Stride. How This Latest Banking Crisis Impacts Consumer Confidence and Activity Levels Later This Year Is Unclear.

- Data and Time Are a Good Prescription for Investors During Periods of Uncertainty

In addition to these investment topics, we want to remind you to remain vigilant when it comes to protecting your information and guarding against cyber security threats and email phishing schemes. The constant improvements in artificial intelligence technologies, our increasingly interconnected world, and geopolitical tensions have increased the risks that someone will attempt to access your information or convince you to move money out of an account. As we’ve mentioned before, neither Woodmont nor Schwab will ever ask you to provide sensitive information via email. We also will not ask you to upload personal information into a website portal unless it is part of a specific initiative you’ve discussed with us. We have protections in place to prevent bad actors from accessing your accounts and information. Because these bad actors are getting better at their craft, we encourage you to remain vigilant and skeptical. If ever a question, please give us a call. As they say, it is better to be safe than sorry!

Stocks and Bonds Both Posted Gains to Start the Year

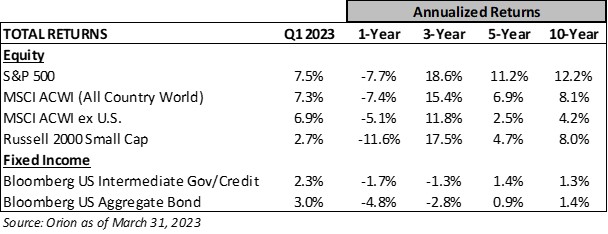

While below the early February highs, the S&P 500 and MSCI All Country World indices increased 7.5% and 7.3% in the first quarter. In general, stocks that performed most poorly in 2022 tended to outperform to start 2023, with mega-cap growth stocks leading the charge. For instance, the growth-heavy NASDAQ was up 17.4% in the first quarter following a 32.5% decline in 2022. Consistent with the first quarter market trend of performance reversals, the Dow Jones Industrial Average gained just 0.9% in the first quarter. However, the dividend-stock heavy index outperformed in 2022, down 6.9% versus the S&P 500’s 18.1% decline.

Bonds experienced one of the most volatile quarters on record. After rallying to start the year, bonds sold off on hawkish Federal Reserve comments in February. Beginning in mid-March bond prices shot higher as investors sought safety and began to anticipate tighter bank lending standards, which would help the Federal Reserve succeed in its fight against inflation. The result of all these developments were some of the most dramatic short-term changes in bond yields investors had ever seen. For instance, a Two-Year Treasury on March 8, yielded 5.1%. Nine days later the yield had declined to 3.8% only to creep back up to 4.1% at the end of the quarter. When the dust settled, the Bloomberg Intermediate U.S. Government/Credit Bond Index had appreciated 2.3% during the quarter.

Stocks Remain Reasonably Priced and Have Discounted Some Level of Economic Slowdown

Nearly two-thirds of U.S. economists believe the economy will enter a recession in 2023. Many others are anticipating a “slowcession” where the economy will grow very little, if any, but not contract. (Source: Wall Street Journal)

The yield curve is another closely watched recession indicator, especially for those who subscribe to the old Wall Street adage that “economists have predicted eight out of the last six recessions.” It remains inverted with short-term yields exceeding longer-term yields. For instance, a Ten-Year U.S. Treasury yields 3.5% when a two-year U.S. Treasury yields 4.1%. This inversion reflects an expectation the Federal Reserve will cut rates amidst an impending economic slowdown and thus the higher shorter-term yields won’t last.

The extent of the current inversion is not insignificant. In periods of economic expansion, investors usually demand 1-2% more yield for Ten-Year Treasuries compared to Two-Year Treasuries. The chart below tracks this spread over the past decade.

Source: Federal Reserve Economic Data, March 2023

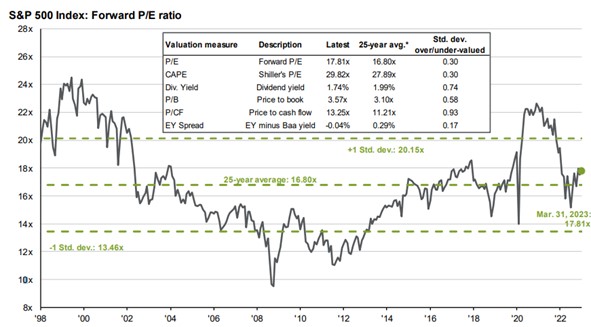

It is not just bond investors who have anticipated an economic slowdown. Wall Street analysts’ estimates for 2023 S&P 500 earnings are 13% below this time last year. For context, the average peak to trough earnings decline in the past twelve recessions was 14%. (Source: J.P. Morgan)

In addition to analysts lowering earnings estimates, the price investors are willing to pay for those expected earnings (i.e., the P/E ratio) declined from 22X in late 2021 to about 18X today. The graph below highlights this price to earnings contraction, which leaves U.S. stocks valued modestly above the 17X average for the past twenty-five years.

Source: J.P. Morgan, Guide to the Markets, 3/31/23

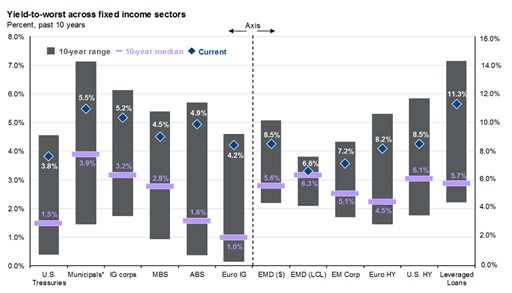

Bond Yields Are Still Close to Ten-Year Highs

As we’ve discussed in recent commentaries, the dramatic increase in interest rates during the past year means investors have lower risk investments offering a reasonable return. Today’s 4-6% yields for short and intermediate term fixed-income securities compare to 1-3% yields of a year ago. Just last week, we purchased one and two-year FDIC insured bank CDs with yields of 5% or more. This is a far cry from Silicon Valley Bank’s now infamous 2021 purchase of $80 billion of ten-year mortgages yielding a paltry 1.8%. If inflation persists longer than expected, bond prices will fall and yields will increase. Anyone investing in the 1970s and 1980s knows what is possible. Considering how far interest rates have come, it is tough to conclude investors buying intermediate fixed-income at today’s prices are reaching for yield.

Source: J.P. Morgan, Guide to the Markets, 3/31/23

The Banking Sector Seems to Have Averted a Wide-Spread Contagion Crisis

The two largest bank failures since the Great Financial Crisis and the urgent need to provide assurances to all bank depositors prompted the Federal Reserve, Federal Deposit Insurance Corporation, and Treasury Department to take dramatic actions on Sunday, March 12th. On March 13th we issued a commentary, You’ve Seen One Bank, You’ve Seen One Bank, explaining why these bank failures were the result of a unique set of risks in their business models. We also discussed why the challenges facing banks did not impact cash or investments held at Charles Schwab, which serves as the custodian for most of our clients’ investments. This commentary is available on our website. Fortunately, the bank deposit crisis seems to have crested, and banks’ liquidity needs are currently being met.

“SVB failed because the bank’s management did not effectively manage its interest-rate and liquidity risk, and the bank then suffered a devastating and unexpected run by its depositors.” Michael Barr, Federal Reserve Vice-Chairman for Supervision.

But Banks Now Face an Earnings Challenge

The emergency actions and a better understanding of the crisis among depositors stopped a modern-day run on any bank with a high mix of uninsured deposits. Nevertheless, the crisis could negatively impact the banking sector for years to come and have lasting implications for the economy.

One near-term challenge for banks is pressure on profitability. Specifically, banks must pay more to attract deposits or fund deposit withdrawals. Another challenge for bank earnings and the economy will be if banks tighten credit standards and make fewer loans to preserve liquidity. Banks are an important source of capital, particularly for small and medium-sized businesses. If banks pull back on the heels of this crisis, there will be an economic ripple.

Any banker will tell you a new profitability challenge is preferred to a rapidly deteriorating credit environment. And unlike the Great Financial Crisis where banks experienced impairments in both loans and investments, credit quality has been holding up, other than weakness in the major urban office market. Most banks’ real estate loans are focused on owner-occupied real estate with limited exposure to investor-owned office buildings. If, however, real estate values decline materially due to higher interest rates and declining capital availability, the crisis could shift from one of funding deposits (i.e., a bank’s liabilities) to protecting the value of its loans (i.e., a bank’s assets).

Consumers’ Financial Health Remains Relatively Strong

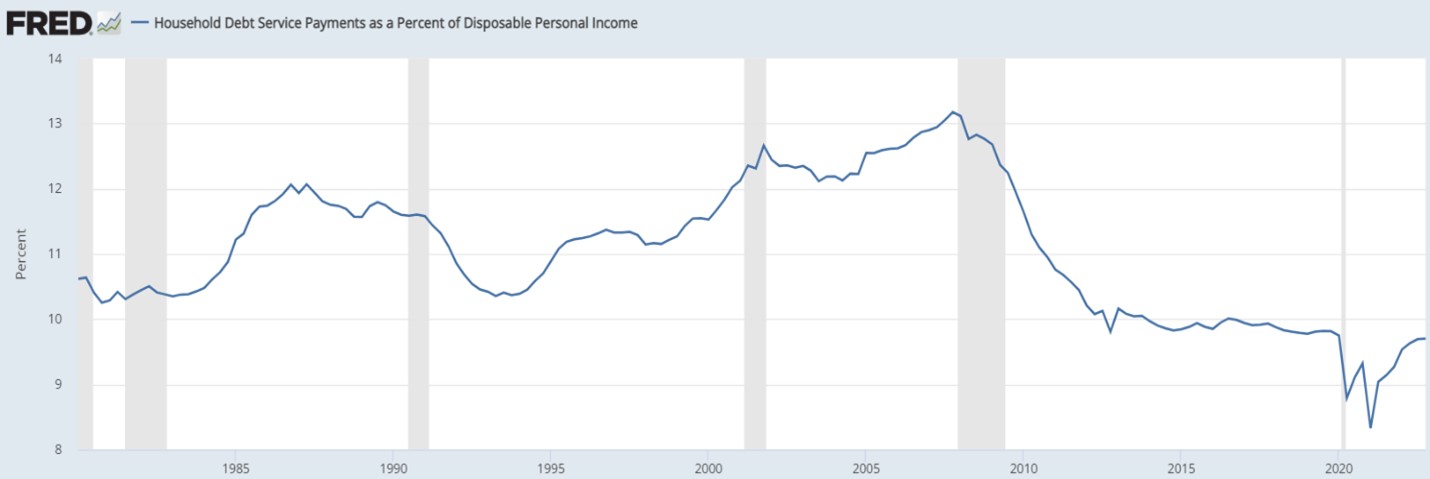

Sifting through today’s business headlines, investors could easily be discouraged and conclude we’re in an economic downturn. Take a walk on Main Street, jump on a plane, or dine out and activity levels appear relatively robust. To this point, Major League Baseball just this week set a record for opening day attendance. Which of these opposing pictures are leading versus lagging indicators is a topic for debate. Yet, these activity levels are consistent with consumers’ still healthy balance sheets and income statements. For instance, while a few hundred billion in bank deposits shifted to brokerage accounts in recent weeks, 2023 began the year with household checking accounts $4 trillion above 2019 levels. (Source: Federal Reserve) Credit card delinquencies stand at 2.25%. This is up from 2.1% last fall but below 2.6% in 2019 and the 6.8% peak during the 2008/09 financial crisis. (Source: J.P. Morgan) And thanks to timely mortgage refinancings, debt paydown during the COVID-19 crisis, and a freeze in student loan payments, household debt service as a percentage of disposable income has been increasing but remain below 2019 levels.

Source: Federal Reserve Economic Data, March 2023

“A bend in the road is not the end of the road, unless you fail to make the turn." -- Helen Keller

Regardless of the relative financial health of most consumers, the mid-March deposit crisis was scary. One can’t help but worry about a hit to consumer or corporate confidence or the unintended consequences of such drastic policy actions. After all, the recent banking crisis was at least in part an unintended consequence of the Federal Reserve keeping interest rates so low for so long.

Data and Time Are a Good Prescription for Investors During Periods of Uncertainty

When investing in periods of uncertainty, data and time are helpful. Data helps reduce the emotional torment of investing and time has proven an investor’s best friend. As for the data, it is certainly mixed. The national debt is almost $32 trillion, and deficits appear to be the norm for years to come. On the other hand, corporate leverage remains historically low, stocks and bonds are trading at reasonable prices, and corporate credit spreads have not widened much, which historically would indicate trouble is ahead.

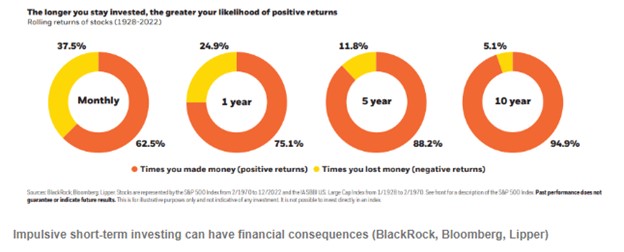

As for time, the longer one is invested the more likely the prospect for gains. For instance, if you invested in any rolling ten-year period going back to 1928, you made money 95% of the time. Investors made money 88% of the time for any five-year rolling period. This is a historical analysis, and we all know past performance is not necessarily a predictor of future returns. It’s helpful, however, to know that amidst the challenges of the past century, markets rewarded those with the fortitude and patience to stay invested.

“Think of your family today and every day thereafter, don’t let the busy world of today keep you from showing how much you love and appreciate your family.” Josiah, King of Judah, 640 to 609 B.C.

Spring is a busy time of year. Work, taxes, travel, school, and community activities make for long days and short years as the saying goes. The last week, however, has reminded us of many things. One of those is to cherish life and those around us.

Thank you for your continued trust and confidence. We are grateful to work with so many wonderful clients and teammates and will never take this gift for granted. As always, please let us know if you have questions or we can be of assistance.

The Woodmont Team

April 3, 2023