The third quarter proved an eventful one for investors. Interest rates ticked higher, the Delta variant reminded us that COVID-19 is still very much with us, and the supply chain disruptions of 2020 started coming home to roost. The confluence of events, and some profit taking given the strong first-half gains, contributed to September’s 4.8% and 4.1% declines for the S&P 500 and All-World equity indices. September’s losses wiped out the gains for the quarter, but considering the major equity indices are still up 14.8% and 11.6% thus far in 2021, it is tough to complain.

While these developments and the September market volatility have been top of mind for investors, last month’s twentieth anniversary of 9/11 certainly captivated much of our nation. The video footage, pictures, and eye witness accounts of 9/11 and the days that followed were both heart wrenching and inspiring.

“You can be sure that the American spirit will prevail over this tragedy.” — Colin Powell

Those who in recent weeks have reflected upon the attacks and heroic responses, likely can recall convicted conversations at the time about how the attacks changed life in our country forever. In many ways, that proved true. Yet few would argue in the two decades since 9/11 that the American spirit failed to “prevail over this tragedy.” We continue to enjoy freedoms and opportunities unavilable to citizens of any other country. Whether these freedoms and our unique spirit will persist, is the subject of contentious debate – a debate which the cable news and social media outlets are happy to facilitate.

“September 11 is one of our worst days but it brought out the best in us. It unified us as a country and showed our charitable instincts and reminded us of what we stood for and stand for.” — Lamar Alexander

No one can say for certain what happens in the weeks ahead, let alone, in the next two decades. We can, however, remember our fears at the time of 9/11 and appreciate how those fears did not change who we are and how we live.

Evergrande Is Only so “Grande.” China’s Privatizaton Crackdown Is Another Matter.

The Chinese real estate developer, Evergrande, has been a signficiant source of investor angst in recent weeks. With $300 billion of debt, and unfunded obligations to complete millions of apartments, the company’s spiraling financial health was viewed by some as a potential 2008-09 Lehman Brothers-type moment. No doubt China’s dependency on real estate for economic growth in recent years is alarming. Citing a Citibank analysis, the Wall Street Journal estimated that real estate activity (directly and indirectly) represents about 30% of China’s economic activity. As for Evergrande, the company’s total liabilities are rougly equal to 1% of all bank loans in China and approximately 0.6% of aggregate credit outstanding (source: MatthewsAsia). The Chinese government may have limited regard for debt holders (especially foreign). However, it is unlikely to allow millions, who have flocked to its cities for work in recent years, to lose down payments for housing.

As it pertains to China, the government’s efforts to limit activities in the private sector are more concerning for long-term global economic growth. We’ve seen this with Internet-related crackdowns, global brand scrutiny, and more recently limitations on kids and video games. O.K., so maybe just two of these three are bad ideas?

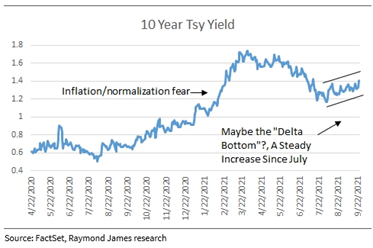

Still Historically Low, Interest Rates Leaped Higher in Recent Weeks

With the recent sell-off in bonds, the yield on the U.S. Ten-Year Treasury is now 1.5% compared to 0.7% one year ago. Corporate bond prices are down as well pushing the yield on the Barclays Aggregate Intermediate Bond index to 1.4%. While credit risks still look muted, the combination of a renewed focus on the Federal Reserve’s eventual tapering of bond purchases, indications that today’s inflation may not be so transitory, and the potential for even more “stimulus” in the form of trillions in infrastructure spending, have been enough to cause bond investors to insist upon better yields.

What Happened to the Supply Chain?

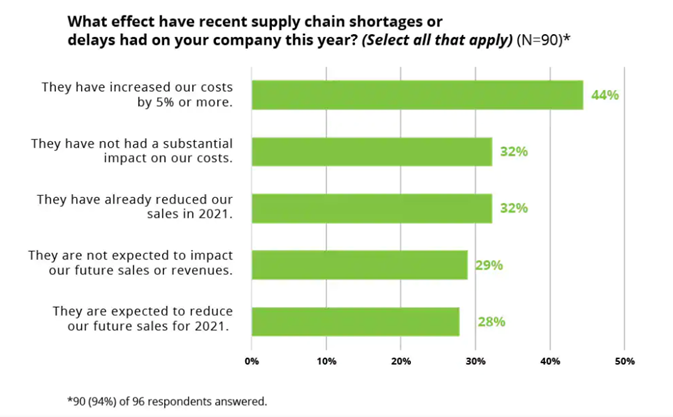

Investors have been closely tracking infrastructure legislation and its potenital price tag. Yet, a constrained supply chain with limited capacity and lingering bottlenecks is arguably the most immediate source of inflationary pressure. Many consumers have money to spend but shelves are sparse and service providers too busy. And even if goods are there, higher energy prices, the challenge of moving goods around the globe, and increased labor costs have forced suppliers and service providers to raise prices in an attempt to preserve margins.

Source: CFO Signals: 3Q 2021, CFO Program, Deloitte LLP

On the energy front, significant capital is rushing into clean energy technologies, some of which may not be ready for commercial application for years. Whereas oil, gas, and coal demand have increased yet producers are reticent to add de novo capacity or increase production given the current policy outlook. Consequently, higher energy prices may persist for some time.

We do expect to see other supply chain responses that could relieve existing supply chain bottlenecks. Demand for goods and services remains strong as the economy continues to recovery from COVID-19. This strong demand, coupled with what are often high margins on incremental capacity, will prove enticing. It always has in a capitalistic system. In the meantime, the fourth quarter holiday shopping season is sure to test even the most resourceful of shoppers.

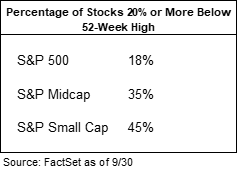

Stock Prices: Another Look Under the Hood

In our July market commentary, we discussed the historic valuation gap between the most expensive decile of stocks and the other 90%. While few stocks have been immune to the headwinds of September’s 5% correction, the valuation gap has only widened since then. In fact, those watching closely have observed a steady fall in prices for many "value" stocks going back to late spring. The result is nearly one-fifth of the stocks in the S&P 500 and almost half of the small-cap Russell 2000 stocks have declined more than 20% from their highs earlier in the year.

Investors looking to invest new funds and those currently invested, should take some solace. The magnitude of price corrections, paired with reasonable valuations, creates an opportunity. In other words, there are numerous stocks to buy at prices well below recent highs, and in many cases, half to two-thirds of the valuation multiples of the major market indices.

Even Still, History Teaches Us Not to be Afraid of All-Time Highs

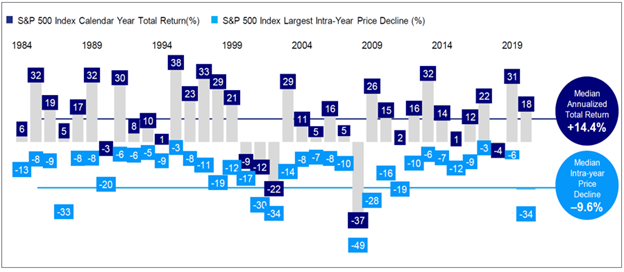

All investors prefer to buy low. We were certainly busy adding equity exposure for most clients during the 2020 COVID-19 crisis. Yet the chart below is a great reminder that for the long-term investor, buying at any point in the past ten years has been rewarding. Specifically, since recouping the market losses from the Great Financial Crisis, there have been 329 new all-time highs.

Of course, markets are not linear. There have been plenty of 5% losses along the way, with the typical intra-year drawdown approximating 10% going back to the early 1980s. Given this context, September’s declines were relatively mild.

Source: Invesco

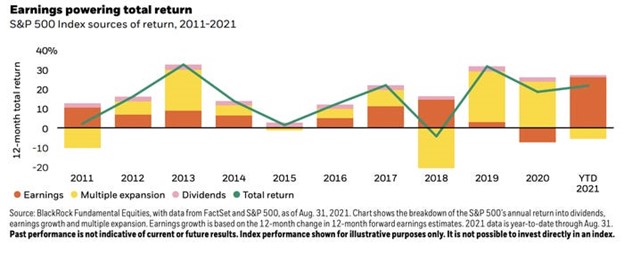

2021’s Earnings Growth Has Fueled the Market’s Strong Year-to-Date Gains

Plenty of market strategists are calling for reduced equity returns in the years ahead, particularly for U.S. stocks. We can be encouraged, however, that the market's gains in 2021 have been fueled by an improved earnings outlook. For instance, at the beginning of 2021 the consensus Wall Street estimate for the S&P 500’s 2021 earnings was $165. Today, the consenus is for $199, representing an increase of 21%. Considering the S&P 500 is up 15% year-to-date or less than the earnings improvement, the market at 22X 2021 estimated earnings is now cheaper than the start of the year.

The Lobbyists Are Working Over Time. And So Are the Estate Lawyers.

It is tough to remember a period in which the range for potential tax and estate law changes was so significant. Fortunately for investors, recently released U.S. House leadership proposals seem to have taken the high end of President Biden’s proposed corporate and capital gains tax increases off the table and provide a framework for what could emerge. Nevertheless, a several percentage point swing in either direction could result in a material negative adjustment to corporate earnings and capital investment. Depending upon the details, particularly with regard to the fate of State and Local Tax deductions (SALT), we might also continue to see additional population moves from high-tax to low-tax states. Consequently, until the policy picture is clearer, we would not be surprised if markets remained volatile.

On the estate front, the various proposals being discussed have received a great deal of attention from many wealthy families. While it is impossible to know what might end up as law, the range of outcomes is no less significant than on the corporate and indivdual tax fronts. Current proposals include:

- Gift exemptions to be effectively halved from the current amounts

- The elimination of the stepped-up basis rule (notably absent in the recent House leadership proposal)

- Changes to grantor trust status rules, which would limit estate planning opportunities for families

- Additional Required Minimum Distributions on large retirement accounts for high earners

The current politics (those between the parties and within them) may prevent sweeping reform this year. It is worth noting, however, that many of the provisions enacted in 2017 as a result of the Tax Cuts Jobs Act are set to sunset at the end of 2025, most notably the higher estate exemption amounts. For many, a wait and see approach is the best strategy. For others, who may have delayed making estate plans or seen a dramatic increase in their net worth in recent years, a strategy session with your estate lawyer could be long over due. While we regularly discuss these issues with clients as part of a comprehensive financial plan, please let us know if you have questions or we can assist in identifying estate or tax counsel.

In Person or Virtual – Either Works for Us

As you know, the Woodmont team has grown considerably in recent years. Just this year, we’ve addded three new team members (two in February and another in July). Given this growth, we are grateful to be working safely in our office in downtown Nashville. Zoom is a powerful tool, but the conversations around the water cooler are tough to replicate in a virtual setting.

The fourth quarter is a busy time of year. It is also a time when many are rushing to complete those financial to do’s established at the beginning of the year. If we are not yet part of your efforts to get your financial house in order, please let us know how we can assist. We are ready and willing to help in person or via Zoom.

Thank you for your continued trust and confidence, and best wishes for a wonderful fall season.

The Woodmont Team,

October 01, 2021

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.