The passing of the resilient and remarkably dutiful Queen Elizabeth II represented the end of a long era. Few Britons have lived under another monarch. The affection for the Queen was apparent from the British response, including a nearly five-mile “queue” of citizens waiting to pay their respects. Similarly, tens of millions in the United States were drawn to the funeral coverage. We’ve been through a lot with our friends across the pond. We also respect people who are rigidly resolute in keeping the commitments they make.

"When life seems hard, the courageous do not lie down and accept defeat; instead, they are all the more determined to struggle for a better future." Queen Elizabeth II

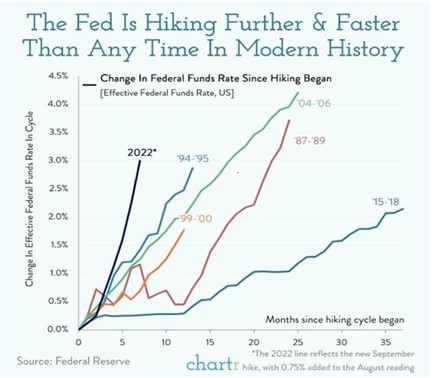

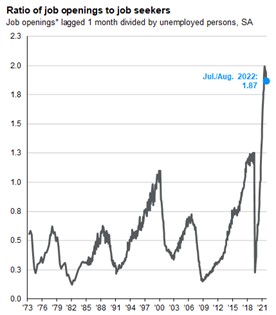

For investors, the third quarter marked an emphatic end to a near fifteen-year era. Specifically, the T.I.N.A. (There Is No Alternative) investment thesis supporting risk assets - whether publicly traded or privately held - is over. The Federal Reserve’s five consecutive interest rate hikes pushing the current Federal Funds rate to 3%, and expectations for an additional 1.5% of increases, has dramatically changed the investment landscape.

Importantly, interest rate hikes are not unprecedented. Inflation has struck before, and the Federal Reserve appears dead set on tamping it down. It remains to be seen whether the recent rate hikes, ceasing of Federal Reserve bond purchases, and hawkish inflation talk will get the job done while avoiding a severe recession.

In this commentary, we will address some of the implications and our tactical steps for this new era. These include 1) how our appetite for risk assets such as stocks remains intact for those investors with the time horizon and temperament to endure the volatility, 2) recognition of the opportunity to extend bond maturities to up to four and five years to lock in today’s higher yields, and 3) an appreciation for the magnitude of the shift in borrowing costs and how this will weigh on businesses and asset classes carrying significant debt.

Moreover, we remain convinced as ever that jumping in and out of markets in anticipation of the Federal Reserve’s next move and the market’s reaction, is a likely path to either long-term wealth destruction, or, at best, significantly diminished returns. An era’s worth of investor performance data that far exceeds Queen Elizabeth II’s seventy-year reign is proof enough.

A Historically Severe Correction Including the Worst Year for Bonds Since 1926.

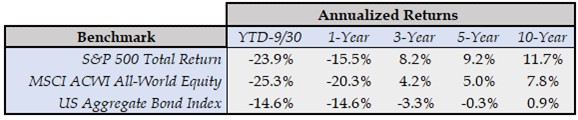

In our July commentary, we discussed the “one-two punch” of stocks and bonds falling in tandem. Additional declines in the third quarter have resulted in $16 trillion of financial market losses, which exceed those of the 2020 COVID-19 sell off and the Great Financial crisis of 2008-09.

The bond market is about twice as large as the stock market. Thus, the Bloomberg U.S. Aggregate bond index’s 15% decline in 2022 (the worst since 1926) is responsible for a significant portion of investors’ pain. Unfortunately, many bond investors, such as those utilizing popular 401K target date funds, had their fixed-income portfolios set to track the index with no regard or understanding for the risks to bond prices in a rising interest rate environment. The fact these significant bond losses are part of the “conservative” portion of investor portfolios is salt in the wound.

Source: Woodmont & Factset Data Systems

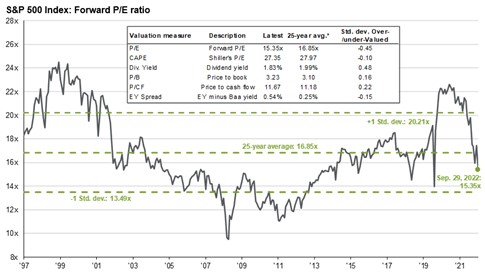

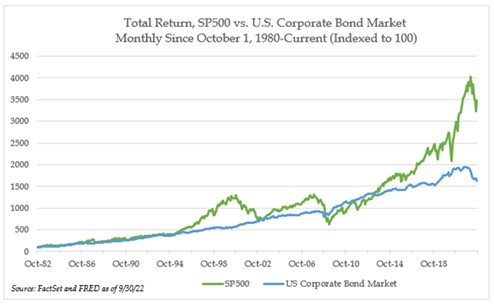

At the end of the quarter, the S&P 500 trades at 16X 2022 and 15X 2023 estimated EPS compared to a twenty-five-year historical range of 10X to 25X and average of 17X. Consistent with historical trends, the ex-U.S. global stock index is cheaper at 10X this and next year’s EPS. In a matter of months, the price investors have been willing to pay for S&P 500 earnings (i.e., the “P/E”) has contracted by roughly 25%. While the outlook for earnings growth has diminished, the real culprit is that for the first time since the mid-2000s investors can earn a low-risk return on their capital. For years, risk-averse investors have had to accept yields from 0.5% to 3% for short and intermediate term U.S. Treasury and investment grade bonds. Today, those securities are yielding from 4% to 6%.

Source: JP Morgan Guise to the Markets

The year-to-date P/E contraction is the gravitational pull Warren Buffett references when discussing the relationship between interest rates and the valuation of risk assets such as stocks. We discussed this correlation in our July commentary and for several quarters have noted how the threat of rising interest rates presents a greater risk to the valuations of higher multiple or cash burning growth stocks compared to value and dividend stocks.

The historical correlation has held true thus far in 2022. For instance, the CRSP Large-Cap Growth stock index has declined 33% compared to the CRSP Value and High Dividend yield indices’ 14% declines. While far from unscathed, the relative outperformance of slower growing dividend stocks in this year’s volatile market environment is a reminder of their appeal for certain risk-averse investors.

Is It Over or Will the Force of Gravity Continue to Take Its Toll?

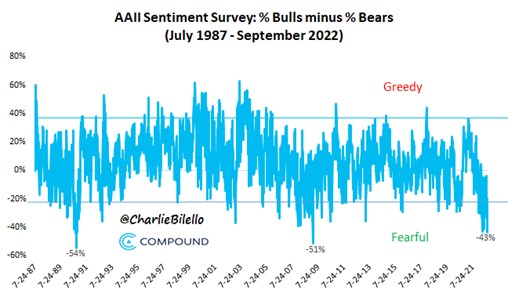

Regular readers of our commentary know we never attempt to predict how low or how high stock prices can go in the short-run. Market declines approaching the average 24% drawdown during a recession, and the resulting P/E multiple contraction, reflect a considerable amount of bad news. Investor sentiment as measured by the American Association of Independent Investors is approaching levels of fear rarely seen before. This historically would indicate we are approaching a market bottom. Certainly, any lingering signs of investor euphoria have evaporated and there seems to be little consideration for an upside surprise such as a cease fire in Ukraine, subdued inflation data, or a better than expected upcoming earnings season.

On the other hand, recent earnings disappointments from high profile companies such as FedEx (FDX), CarMax (KMX), and Nike (NKE) demonstrate the potential for earnings deterioration in coming quarters. The cloudy earnings outlook only adds to the allure of low-risk mid-single digit returns for Treasuries and investment grade bonds.

Regardless of how the earnings picture unfolds, increased yields represent new competition for stocks and risk assets in general. This shift to higher rates is why for the first time in years we have been extending bond maturities within our fixed income portfolios. Granted, we are still uninterested in buying bonds with maturities beyond four or five years given the magnitude of price risk if the Federal Reserve fails in its efforts to control inflation and interest rates move even higher than currently expected.

The Fed’s Commitment to the Inflation Fight: Much Greater and Far Reaching Than Many Expected.

As the chart below illustrates, we’ve seen interest rate hikes before but not at this pace nor at the same time the Federal Reserve has reversed accommodative measures such as its bond purchasing program of recent years.

“We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t.” Federal Reserve Chairman Powell

The end of the cheap money era that followed the Great Financial Crisis creates considerable uncertainty beyond the universe of public companies. Private companies and real estate assets will undoubtedly be subject to the same gravitational pull of higher rates. In fact, while many public companies have used strong cash flows to pay down debt in recent years, private equity and real estate investors have taken advantage of accommodative credit markets to try to enhance returns and justify deals that just won’t work under today's higher interest rates and tightening credit environment. Consider, for example, the company with a maturing fixed-rate credit facility that must now be refinanced at a cost of debt 4-5% higher at the same time earnings are under pressure. While public company equity valuations and bond prices adjust quickly to a changing economic environment, it can take some time to see the impact of higher interest rates on privately held investments and less liquid real estate.

Amidst It All, the U.S. Dollar Has Strengthened Dramatically Relative to Most Currencies.

Shifts in interest rates also impact currency markets. Overseas investors have flocked to the dollar for its relative safety and because of increased demand for U.S. Treasuries. The downside of a strong dollar is that goods and services we export are much more expensive. Assuming static prices, an iPhone, for example, now costs a consumer in the United Kingdom nearly 20% more than this time last year given the British Pounds’ depreciation relative to the dollar. Consumers spending Euros have lost about 16% of their purchasing power.

Of course, it’s not just iPhones that are more expensive. Approximately 40% of sales for S&P 500 companies are to foreign buyers, which highlights the extent of the potential earnings headwinds. The built-in overseas link for U.S. companies is also why we have historically underweighted our global stock exposure relative to the approximately 40% weighting of non-U.S. stocks within the All-World equity index.

Are the Inflation Pressures Subsiding?

The Federal Reserve’s inflation target is 2%. This is a far cry from August’s 4.9% increase in the core personal consumption price index or the consumer price index’s 8.3% increase. When dining out or visiting the grocery, the percentage increases are likely even greater.

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” Sam Ewing

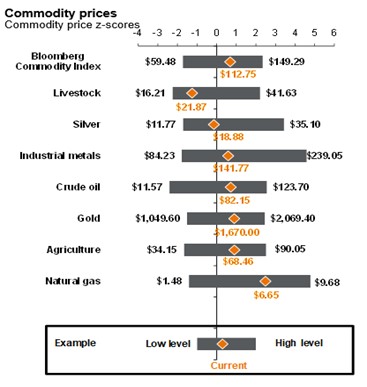

Source: World Bank, for the one-year period ending September 28, 2022

The pace of increases for the most-watched inflation metrics are declining thanks in part to large drops in most commodity assets. Yet, the inflation data is not falling fast enough for the Federal Reserve.

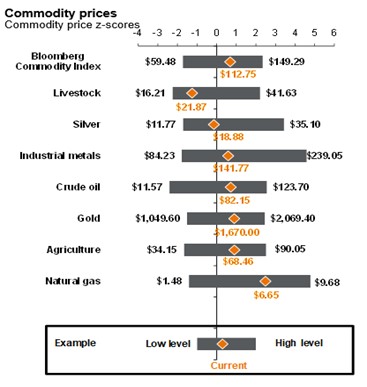

One obstacle to the Fed’s efforts in the inflation fight is the strength of the jobs picture. There are two job postings for every person looking. Despite announced layoffs and reductions among many tech and high-growth enterprises, weekly jobless claims data have stayed stronger than expected. Moreover, consumer bank balances remain historically high, and the boom in mortgage refinancings of recent years has insulated many homeowners from higher mortgage rates now near 7% for a thirty-year fixed-rate.

Source: The Economic Times .

“

Inflation is the most universal tax of all.” Thomas Sowell

Suffice it to say, there is plenty of data to fuel the inflation debate. Historically speaking, however, at some point investor losses and likely flat or declining home values will weigh on consumer confidence enough to affect demand. The reduced demand, coupled with an increasingly de-bottlenecked supply chain, should eventually slow the rate of price increases.

A More Volatile Ride, But One Historically Worth It

Some market strategists think an upcoming election, the threat of a hard economic landing, and signs of inflation retreating in some areas will cause the Fed to pull back on its current rate hiking path. Today’s inverted yield curve, where 5-year let alone 10-year Treasury yields are below 2-year yields, indicates that investors believe the inflation bout has a limited shelf life.

For equity investors, there has always been a long list of variables to consider when deciding whether and how much to invest: interest rates, expected earnings growth or earnings contraction in a recessionary period, big policy shifts, and current market prices.

We’ve always maintained, however, that deciding whether to invest in equities is mostly a function of risk tolerance, the desire for capital appreciation versus income, and perhaps most importantly, an investor’s time horizon. Put simply, if your investment era is long, or your financial picture enables you to go years without needing to rely on some or a portion of your equity assets, the considerable gap between long-term historical equity and bond returns is well worth the additional volatility.

It Helps to Focus on What We Can Control

Periods of market volatility and economic uncertainty only heighten the importance of focusing on the financial pieces of our lives that we control. This includes an investment allocation consistent with one’s long-term objectives and risk tolerance. Our discussions with clients and efforts to understand their near-term needs enables us to identify an appropriate investment allocation. Importantly, the allocation is focused on the long-term, which helps eliminate the temptation to try and time the market in periods of uncertainty.

Outside of these investment-related steps, there is plenty within one’s control that can increase the likelihood of achieving financial goals. For instance, how much should someone save or spend? What should one do with existing savings, a particularly relevant topic now that interest rates have increased so much? And are there steps to take to reduce tax liabilities today and eventually for your heirs?

In our experience, a thorough review of one’s financial picture often reveals opportunities. If we have not discussed these financial planning topics with you recently, or your circumstances have changed, we would welcome a meeting to review.

A Historic Storm for These Historic Times

It is not lost on us that for many the ups and downs of the stock market are of little concern these days. Certainly, we’ve discussed in previous commentaries the Ukrainian’s fight to resist aggression and maintain independence. Their resilience and success against a much larger foe continue to serve as inspiration for anyone who values freedom and democracy.

In addition, we want to acknowledge the destruction of Hurricane Ian and how the ensuing disruption will be felt for years in parts of Florida. We have clients in Florida and all know individuals affected by the storm. We are hopeful the recovery and relief efforts will go smoothly and are encouraged by the long list of communities that have rallied together to recover from horrible natural disasters including in Florida. In fact, the response to these disasters makes it clear to us we are far from the end of the era in which neighbor helps neighbor and communities move forward with the “struggle for a better future.”

Thank you for your continued trust and confidence. Best wishes for a safe and rewarding fall season, and we look forward to answering your questions and the next opportunity we have to visit.

The Woodmont Team

October 3, 2022

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.