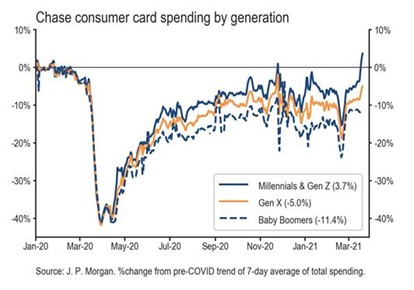

Judging from increased pedestrian traffic and the return of pedal taverns and party barges, signs of life in downtown Nashville are emerging. While certainly tepid relative to recent years, and despite the enormous challenges still facing the major arts and entertainment venues, the activity is encouraging. More broadly speaking, business and social activities around the country are returning at a rapid pace. As the chart below reflects, spending by Millennials and Gen Z is already ahead of pre-pandemic levels.

“Spring is nature’s way of saying, “Let’s party!” – Robin Williams

Unprecedented financial liquidity and government stimuli, a desire to catch up on life, and some sunny spring weather are proving a potent combination. With increasing supplies and availability of vaccines, we remain hopeful emerging coronavirus variants won’t send everyone back to the cabin.

- A Change in Market Leadership

- What's Priced In?

- Infrastructure and Taxes: The What and the How

- Improved Household Financials, Including “Excess” Savings

- The Fed Is Not Worried About Inflation. Should Investors Be Worried?

- Positioned to Do More With Less

- Mounting Tensions – From Tariffs to Boycotts

- Life Outside the Cabin and at Woodmont

A Change in Market Leadership, and the 2021 Version of the Message Board

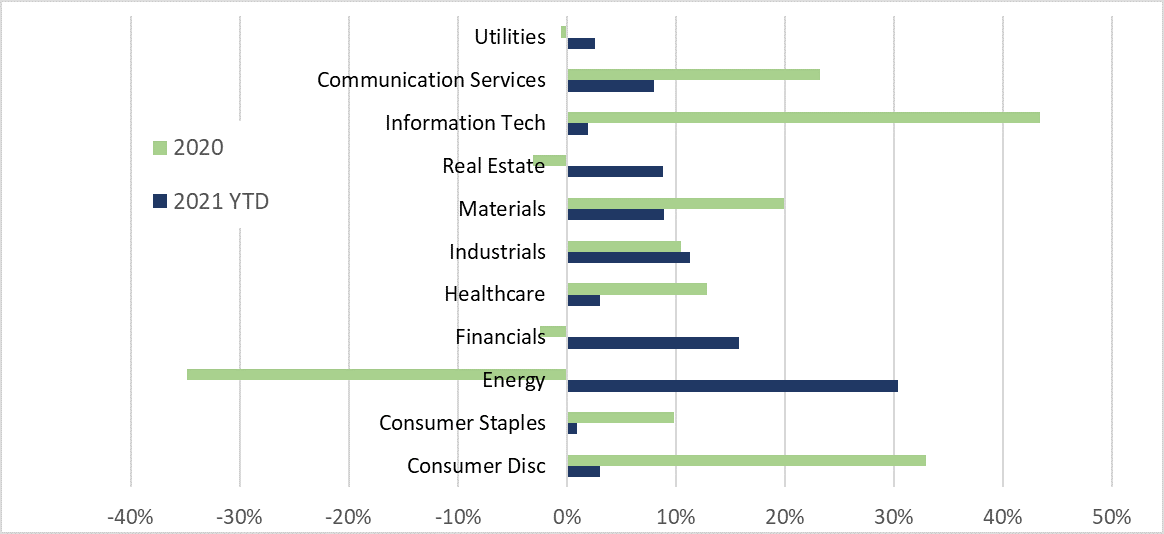

As evidenced by recent gains in domestic and international stocks, the signs of economic recovery, though still far too narrow, have not gone unnoticed. Year-to-date, the S&P 500 and All World Equity Indices are up 6.2% and 4.6%. Cyclicals are outperforming defensive stocks and the “work from home” technology stocks that performed so well in 2020 are now the laggards, down 5% in 2021.

Source: FactSet

With the recovery in motion and record amounts of financial liquidity, capital is flowing into all types of risky assets. Two hundred SPACs or Special Purpose Acquisition Companies have raised $70 billion since January and are now looking for fast-growing businesses to acquire. Speculative trading in recovery opportunities and the promotion of a handful of stocks via online “investing” forums, is reminiscent of the message board activity of 2000. Even penny stocks are in vogue with recent trading volumes ten times greater than just two years ago.

It’s not just stocks that have seen increased activity and higher valuations. Thanks in part to a COVID-19 pause in supply, broader demographic shifts, and increased construction costs, housing prices are setting records in many parts of the country. According to Zillow, prices are up 20-25% year-over-year in many warmer weather and generally lower cost-of-living states such as Texas, Florida, and Tennessee. The housing price strength may come as little surprise as interest rates have remained historically low, and the 2020 lockdown reshaped priorities for many. Similarly, commodity prices are at or approaching multi-year highs. These gains have pushed prices of timberland, crop land, and energy stocks higher. In fact, energy is the best-performing market sector in 2021 after being left for dead in 2020. Suffice it to say, the combination of historic liquidity, increased demand, and COVID-19-impaired supplies have been a big boost for owners of real assets.

What’s Priced In?

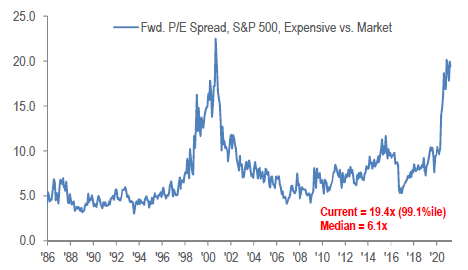

For investors, the analysis has quickly turned from how to participate in an economic recovery to whether a complete recovery is already reflected in today’s prices. The S&P 500 now trades at 23X 2021 and 20X 2022 estimated earnings, although the gap between the most and least expensive stocks comprising the S&P 500 remains near record levels. For context, these earnings multiples compare to a historical average of 16X and 14X this time last year during the depths of the COVID-19 crisis. The All-World ex-U.S. index trades at 17X 2021 and 14X 2022 earnings. Besides a relatively attractive valuation, we continue to believe some exposure to non-U.S. stocks is an important diversifier and potential offset if the U.S. dollar were to weaken.

Source: JP Morgan

In this commentary, we discuss some encouraging signs that may be under appreciated and some threats possibly being overlooked. While tough to fathom at the time, a year ago just about anything one invested in would have increased in value. Today, we believe opportunities remain and the long-term investor will be rewarded. Yet, in some instances, a rifle as opposed to a shotgun approach could be in order.

Infrastructure and Taxes: The What and the How

With the ink barely dry on the $1.9 trillion American Rescue Plan Act of 2021, the Biden administration is beginning to provide details of its two-part $4 trillion infrastructure plan, including the proposed tax increases to pay for it. Like many things in this COVID-19 era, back-to-back legislative initiatives of this size are unprecedented. For investors, how this legislation is debated and passed (i.e., by reconciliation or by eliminating the filibuster in the Senate) could be as hot of a topic as what it contains given the implications for other 2020 campaign policy initiatives such as the “Green New Deal” and healthcare reform. As a result, Wall Street government policy strategists are working overtime, particularly those with perceived insights into the plans of a few swing Senators. And while successful investors have long learned to look beyond the sausage making process, another sea shift in tax policy and the business operating landscape could prove disruptive as business leaders – large, small, and newly minted – evaluate risks and opportunities.

Improved Household Financials, Including “Excess” Savings

The COVID-19 crisis has taken its toll on federal and various state government balance sheets. Moreover, since January of last year, 25% of the U.S. dollars in circulation have been printed and the M1 money supply is up over 50% (Source: TheStreet.com and Federal Reserve). If not for banks reporting record levels of deposit growth in recent quarters, one might question these startling statistics. Regardless, our federal government deficits and mounting debt have investors worried about the implications for the long-term strength of the U.S. dollar. While the dollar has rebounded in recent weeks, we are mindful of this risk and therefore remain committed to a diversified portfolio with exposure to assets that would benefit if the dollar were to weaken or inflation accelerate. Along these lines, we added for most clients very modest exposure to a participant in the digital assets’ ecosystem. We also plan to host a virtual event on May 13th at 3 PM CST for interested clients and friends of the firm to learn more about this complex but growing landscape. We will distribute details soon, but don’t hesitate to let us know if you have questions or are interested in participating in the event.

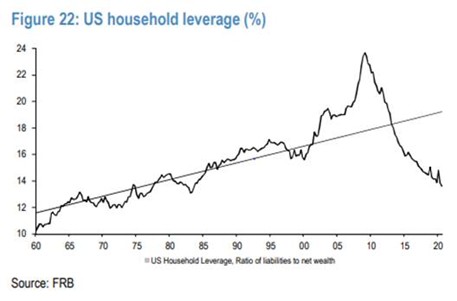

While government balance sheets have deteriorated, households' balance sheets look better than they have in decades. Per data recently highlighted by JP Morgan, excess household savings have grown to $1.8 trillion since the onset of the COVID-19 crisis. Household leverage (liabilities to net worth) is back to levels last seen in the mid-1980s. Part of this improvement is related to stimulus payments and some from reduced spending. Regardless, improved household finances likely represent a tailwind for the 68% of the economy still tied to consumer spending activity (Source: Bureau of Economic Analysis).

Conventional wisdom says the combination of trillions in fiscal stimulus, households holding record levels of excess cash, and limited supply relative to demand, eventually leads to inflation. The sell-off in the Ten-Year U.S. Treasury, which now yields 1.7% compared to 0.9% at the beginning of the year, reflects those mounting concerns.

As a result of the rapid increase in yields, stock investors have begun to worry about the implications of higher rates, particularly with regard to higher priced growth stocks, whose values should be most negatively impacted when the risk-free discount rate increases. Perhaps not surprising given the year-to-date rate move, the high-profile and growth-focused ARK Innovation ETF is down 8% year-to-date and nearly 30% from its highs. Granted, the fund more than doubled in 2020.

"We’ve been living in a world of strong disinflationary pressures for the past quarter century. We don't think a one-time surge in spending leading to temporary price increases would disrupt that." Federal Reserve Chairman Jerome Powell - March 23, 2021

While Chairman Powell remains unconcerned, owning long bonds looks like a risky proposition given today’s still historically low rates and the increased threat of inflation. As a reminder, a one percent change in rates means an approximate 10% and 30% loss of principal for bonds with ten and thirty-year durations. If spreads were to widen and/or short-term rates tick up, we would look to add short to intermediate term fixed income for some investors. With cash earning nothing, the bar is not that high when clients can hold bonds to maturity. In the meantime, we remain convinced that stocks of quality companies with growing earnings streams and dividends are attractive compared to bonds. History is also on our side with stock returns near historic averages during periods when interest rates increased one percent or more (source: Fortune).

Positioned to Do More With Less

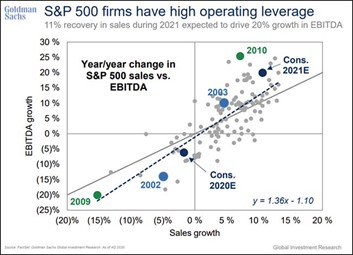

Today’s headlines provide many reasons for investors to worry. Yet recent AAII investor sentiment surveys reached its most bullish levels of the year on March 24th. While there is plenty of macroeconomic and geopolitical content for both the Bulls and Bears, certain dynamics of the post COVID-19 landscape reminds us of the period that followed the great financial crisis in 2008/09. That is, in the years following the crisis, companies kept identifying opportunities to improve margins and grow earnings. We see similar prospects today, particularly for those companies with scale and a willingness to invest in transformational technology tools. While the margin rebound of 2021 may not quite match the 2010 rebound depicted in the Goldman Sachs chart below, we are optimistic for operating margin expansion from the combination of a strong sales rebound and the operating improvements necessitated by this crisis.

Mounting Tensions – From Tariffs to Boycotts

While the partisan gap appears as wide as ever on the domestic policy front, both Democrats and Republicans continue to employ strong rhetoric when describing our economic and political relationship with China. Just this week, U.S. Trade Representative Katherine Tai confirmed that the United States will maintain the Trump administration’s tariffs on Chinese imports. Perhaps in response, Chinese leadership recently called for boycotts of specific U.S. and European brands seen as criticizing Chinese policy.

China represents 7% of sales for S&P 500 companies and nearly 16% of all U.S. exports. The U.S. imports approximately $500 billion of Chinese goods or nearly 17% of its exports. Clearly, the geopolitical and economic stakes are high, and the range of near and long-term outcomes has implications for more than just the economy and investors. Consequently, we would expect the issue of China and U.S. relations to remain in the headlines and are focused on trying to position portfolios accordingly.

Life Outside the Cabin and at Woodmont

There is no shortage of research attempting to determine what life looks like on the heels of the COVID-19 crisis. According to Verizon’s recent Look Forward study, video conferencing remains almost 30X above pre-pandemic levels, twice as many people work remotely at least part time, and shopping in the future will be equal parts online and in person. Outside of work and retail, it remains to be seen whether the sustained response is a “Roaring 20s” type decade or continued nesting with family and neighbors.

Consensus, however, is emerging around a few topics with consequences for how Woodmont helps our clients. One is the need for businesses to continuously invest to better serve clients or customers. The other is taxes, which for our high-net-worth and business owner clients are likely headed higher. Given these impending realities, we have recently added internal resources for clients including hiring Nicole Hughes, CPA/CFP. Nicole won’t be preparing tax returns, but is here to help navigate changing tax laws and coordinate with our clients’ existing tax advisors. Cade Schacher has also joined our wealth planning team, and we are currently recruiting for a financial analyst position to support our investment process.

While at an all-time high in terms of team members, it has not been all additions. Our long-time partner, James Conner, retired from the investment industry earlier this year. As you may know, James moved to Charlottesville, VA last summer to be closer to family and take advantage of the COVID-friendly attributes of a less urban environment near the Blue Ridge Mountains. The allure proved too compelling. We will miss James’ market insights, including the ever important “history major” perspective he brought. Most of all, we will miss his passion for taking care of clients and his teammates. James is the kind of person you want in your bunker when adversity strikes. For that and many other reasons, we are most grateful for his partnership and wish him well.

As always, thank you for your continued confidence and trust. We look forward to answering any questions you may have and the opportunity to visit again soon.

The Woodmont Team,

April 01, 2021

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.