The Social Security System is funded by the Social Security Payroll tax (FICA). FICA is accessed to both the employee and the employer, each paying 6.2% Social Security tax and 1.45% Medicare tax on your wages1 . There's a key difference between how Social Security and Medicare taxes are applied to wages. Social Security taxes are assessed on wages up to a specific limit each year, known as the taxable wage base. In 2025, that limit is $176,100. Once wages reach this threshold, you stop paying Social Security tax on any additional income earned that year. On the other hand, Medicare tax applies to all wages throughout the year, regardless of how much you earn. You may also be subject to an additional Medicare tax of 0.9% on income that exceeds $250,000 for joint filers or $200,000 for single filers in 2025.2

If you are self-employed, you are responsible for the employer and employee portions of Social Security and Medicare taxes. This is reflected in the 15.3% Social Security Self-Employment Tax (SECA). Self-employed individuals can deduct half of this tax on their income tax return. The SECA tax consists of two parts: 12.4% for Social Security, capped at the taxable wage base of $176,100, and 2.9% for Medicare, which is assessed on all of your wages.3

Social Security Benefits.

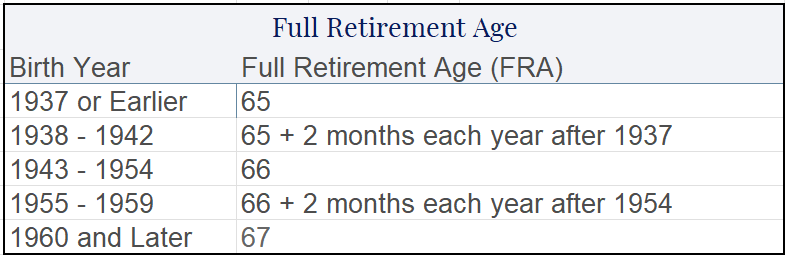

Workers who have earned 40 credits, which is equivalent to 10 years of substantial employment, are eligible for their full Social Security benefit upon reaching Full Retirement Age (FRA). In 2025, you need $1,810 to earn one credit.

Your FRA will be between 65 and 67, depending on your birth year. At FRA, you are guaranteed 100% of your benefit. You can collect Social Security as early as 62 for a reduced amount, but you also have the option to delay taking benefits until age 70 and receive an increased benefit.

Claiming Social Security Benefits Early and Delaying Benefits.

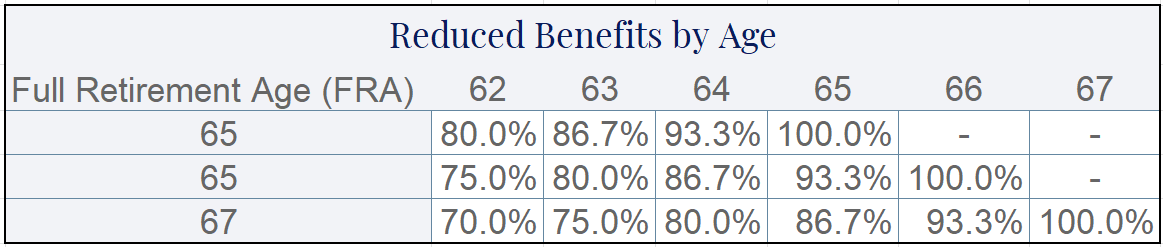

62 is the earliest age to begin claiming Social Security benefits. If you start claiming benefits early, your monthly benefit is reduced by 5/9 of one percent each month before your FRA for up to 36 months. If you claim benefits even earlier, the reduction is 5/12 of one percent for each additional month beyond 364. To simplify things, we have provided the chart below to reflect what percentage of benefits you will receive based on your FRA and the age you decide to claim.

Using the chart above, if your FRA is 67 and you claim benefits at 62, you will only receive 70% of your Social Security benefit, resulting in a permanent 30% reduction.

You also have the option to delay taking Social Security benefits. Once you reach FRA, you can postpone benefits until age 70. By delaying benefits, the Social Security Administration will add Delayed Retirement Credits (DRC) to your benefit amount. People born in 1943 or later will receive an 8% annual increase in their annual benefits for each year they delay taking benefits past their FRA up to age 70. While you can delay taking benefits past age 70, there is no added value.

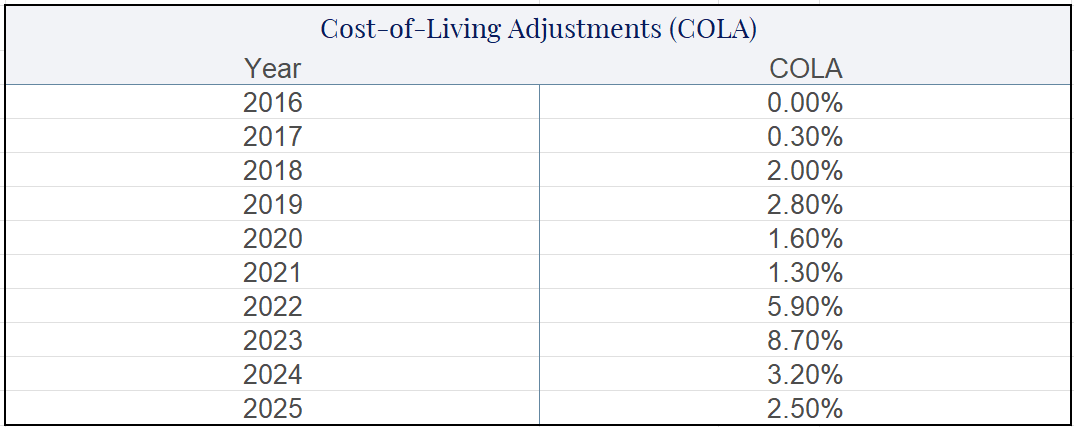

Cost-of-Living Adjustments (COLA).

Inflation can worry many Americans during retirement. In most years, the Social Security Administration provides an annual increase to Social Security benefits called a Cost-of-Living Adjustment (COLA). At the end of each year, the Social Security Administration evaluates current inflation data to decide if and by what percentage Social Security benefits will be increased. In some years, when inflation is low, it is possible not to receive an increase in benefits. Looking back at the last 10 years, the annual COLA increase has averaged 2.83%.5

How are Social Security Benefits Taxed?

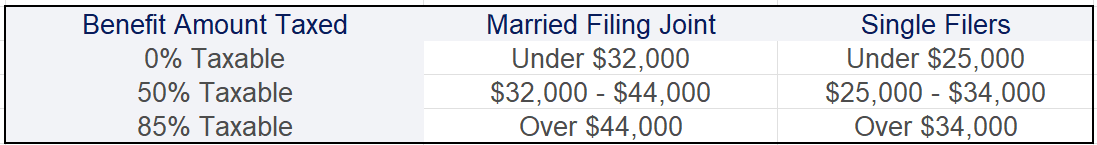

A common question for Americans taking or deciding to start taking Social Security benefits is, “How much of my Social Security benefit is taxed?” According to the Social Security Administration, approximately 40% of Americans who receive Social Security pay federal taxes on their benefits.6

The amount of your provisional income determines the amount of your Social Security benefit that is subject to tax. Provisional income is calculated based on your tax filing status, 50% of your Social Security benefit amount, and any other retirement income you receive. Depending on your provisional income, up to 85% of your Social Security benefit may be subject to taxation. It's important to understand that this does not mean that you will pay an 85% tax rate on your benefits, but rather, 85% of your benefit is subject to tax at the ordinary income rate, depending on your tax bracket.

If you are curious how much of your benefit is taxable, we recommend consulting with your tax preparer. The IRS also provides an online tool to help you understand this calculation.

Conclusion.

Understanding the intricacies of Social Security is crucial for maximizing benefits. Having a financial plan and utilizing tools like the Retirement Estimator can help optimize the best strategy. In the near future, we will provide further details on spousal and survivor benefits.

If you have any questions about your Social Security benefits, please do not hesitate to contact us. We look forward to hearing from you.

The Woodmont Team

March 11, 2025

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.

[1] Contribution And Benefit Base, 2025

[2] Topic no. 560, Additional Medicare Tax, 2025

[3] Self-Employment Tax (Social Security and Medicare Taxes), 2025

[4] Early or Late Retirement, 2025

[5] Cost-of-Living Adjustments, 2025

[6] What You Need to Know When You Get Retirement or Survivors Benefits, 2025