“The will to win cannot be beat, you gotta wanna win!” -Popular youth sports cheer

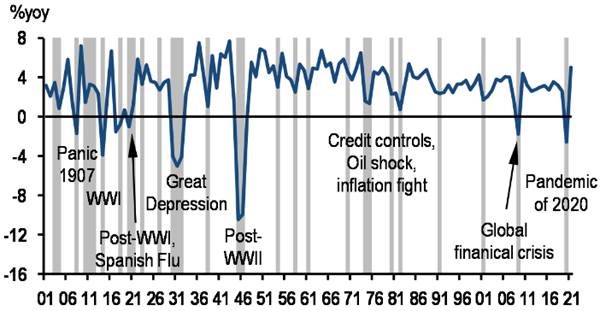

The ink was barely dry on the year-end market reviews discussing the tremendous gains of 2019 when investors started to worry about the risks associated with COVID-19. As cases grew exponentially in Europe, and Seattle was first hit here at home, investors raced to reduce risk and, in some cases, panicked. The health and economic unknowns of the virus’ spread led to the steepest stock market drawdown in history and the second worst first quarter ever. In just 27 trading days the Dow Jones Industrial Average fell 37% from its 29,551 high to 18,591 on March 23rd. Certainly previous market corrections have been more severe, but the pace of the decline and associated volatility in stocks, fixed-income, and commodities were historic.

As a sign of the times, we issued three intra-quarter market briefs. Those briefs are available via the links below and on our website:

- A Tragic Night for Middle Tennessee – March 4, 2020

- COVID-19: You Have Everyone’s Attention – March 14, 2020

- COVID-19: What’s Priced In? – March 23, 2020

Since issuing these briefs, the amplified and increasingly coordinated fight to stop COVID-19 is worth noting. On the front lines are doctors, nurses, and an entire healthcare delivery system. Individuals have stepped up to do their jobs and more, despite the significant personal risks and strain on resources.

Also, companies with deep engineering and supply chain expertise such as General Motors, Ford, and Tesla have quickly shifted manufacturing capacity and partnered with existing suppliers to increase the production of ventilators and important protective devices. Hundreds of companies have donated masks held in storage to our hospitals where they are needed most. And while many companies have had to reduce their workforce in response to sales literally disappearing, others with significant resources have committed to retain all employees during the crisis or to increase hiring in areas where demand has shifted.

Finally, our ability to innovate within the life science realm is as important as ever. Abbott Labs, United Healthcare, and many private labs around the country have brought tests to market and are working closely with the government to track cases using technology not available even a year ago. Johnson and Johnson and Gilead expect to start vaccine trials in September. Moderna began its vaccine trial in March, taking just forty-two days to develop its candidate. And with a 2,000 person study underway in New York City and the state of Washington, we should know soon whether hydroxychloroquine is a legitimate treatment.

Needless to say, the fight is on. While it will take longer than many had hoped and there will be disappointments along the way, the will to win is palatable.

A “V” or a “U” Shaped Recovery?

Not surprising, while the consensus is for a severe retraction in the second quarter, economists’ forecasts for the magnitude of that contraction and eventual recovery are wide ranging. The more optimistic outlook is for a “V” shaped bounce back that includes a robust second half given pent up demand from the March and expected second quarter freeze. The net effect would be a hit to gross domestic product (GDP) in 2020 of around 2% with a strong rebound for 2021. This is depicted in the table below.

Source: JP Morgan

Others believe the extent of the jobless claims, coupled with an oil price collapse of 70%, will weigh on consumer and business confidence prolonging an eventual recovery. This more U-shaped recovery could take time. Some say several quarters while the most draconian forecasts assume United States GDP may not recoup losses for years.

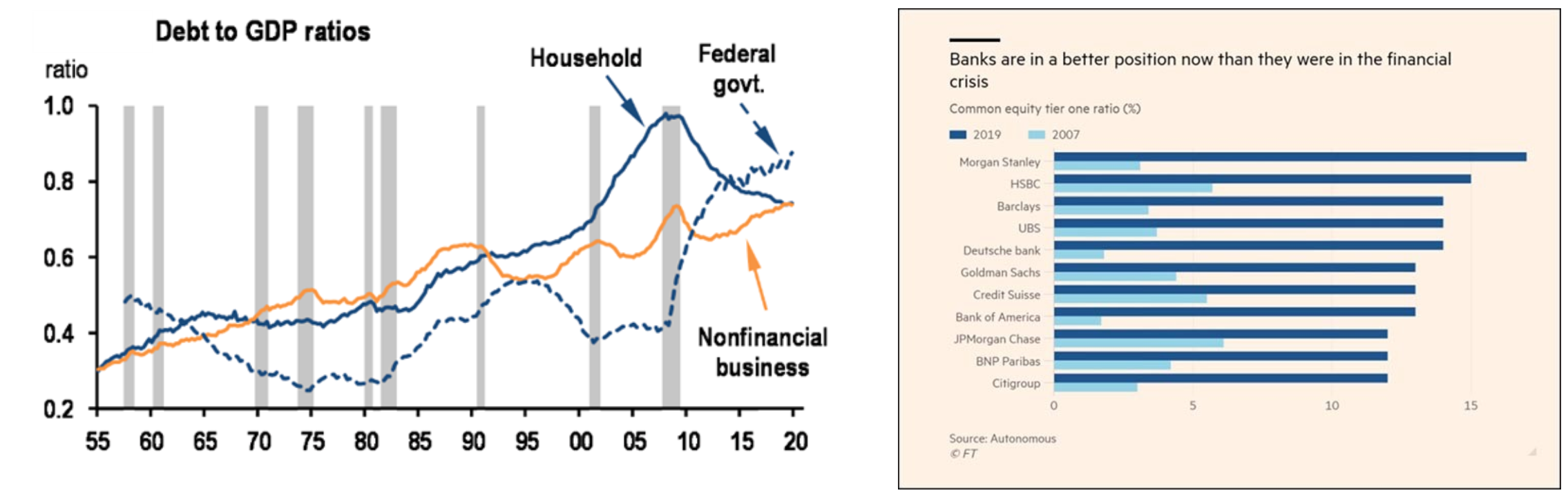

While no one can completely discount the threat of a pro-longed downturn a la the Great Recession, there are a few facts worth noting. First, businesses entered the crisis with large amounts of leverage. We’ve discussed the expansion of leveraged private equity and record BBB bond issuance in previous commentaries. Yet, household debt to GDP is 25% less than 2008/09 levels, and the financial institutions are much better capitalized with most large banks having low to mid-teens common equity cushions versus low to mid-single digits heading into the Great Recession.

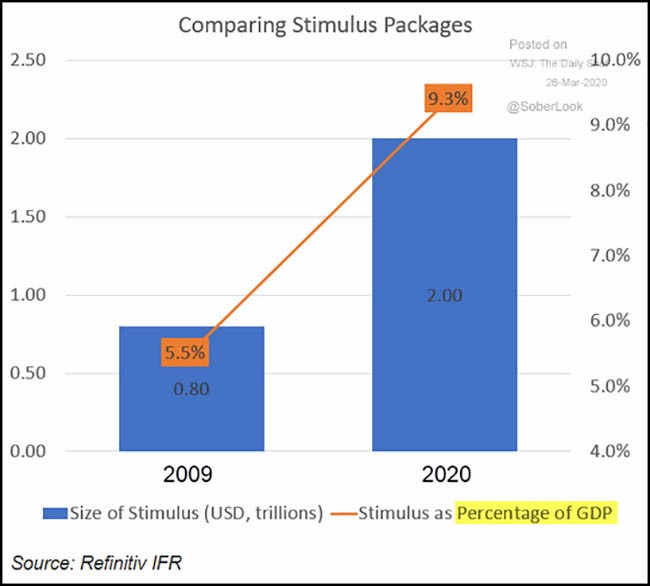

Another stark difference is the pace at which the government and Federal Reserve have moved in response to the crisis. The recently passed CARES Act seeks to inject $2.0 trillion of financial support for businesses and individuals, or almost 10% of GDP, into the economy. This compares to $0.8 trillion and 5.5% of GDP in 2009. The distribution of these grants and loans will be complicated. Mistakes will be made, but there is broad recognition of the uniqueness of this crisis and the required urgency of the response.

On the monetary front, the Federal Reserve is using its full arsenal of fire power to enable credit markets to continue functioning. This included an estimated $1 trillion worth of bond and mortgage purchases over a two-week period. In 2008-09, the Federal Reserve injected a similar amount but it was over an eight-month period. There will be long-term consequences of increased deficits and this unprecedented bond buying activity by the Federal Reserve. The implications for government deficits and debt has been cause for concern for many years now. As for this immediate crisis, we won’t know for months whether the Federal Reserve’s steps were successful in fending off a deep and long recession. One thing, however, is clear. The government and the Federal Reserve have taken several extraordinary steps in this fight.

A Bear Market Rally?

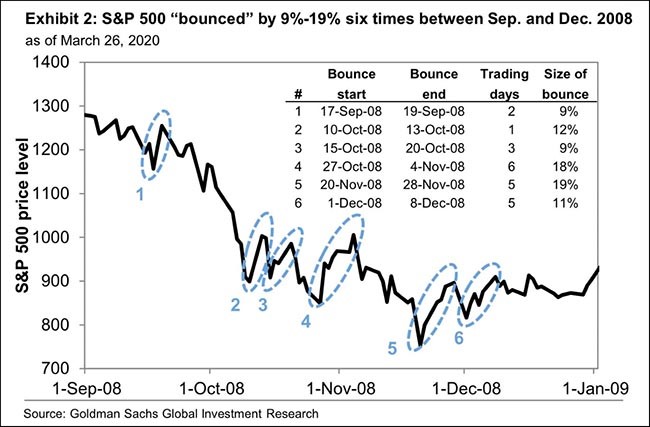

As of March 23rd, the S&P 500 and All-World stock indices had declined 35% from their February highs. Since then both have recovered 16% and 15% and are now down 20% and 24% for 2020. No one can predict whether those gains are simply a bear-market bounce akin to what we experienced between September and December 2008 outlined in the chart to the right.

Or, if a market bottom was established upon reaching the average recession declines of 35%, albeit in record speed.At the recent March 23rd lows, the market had priced in a severe economic and earnings contraction. According to an analysis from Bridgewater & Associates’ the S&P 500’s correction anticipated an S&P 500 earnings decline 50% over the next two years and not return to the initially expected 2020 earnings level until 2030. We thought this scenario was unlikely when we discussed it in our March 23rd brief. Of course, investors are understandably concerned about the lasting damage of a nationwide shutdown that extends into the summer beyond the help of the current stimulus efforts. This is why for now we all are watching the COVID-19 case and recovery counts as much as anything.

It is Tough to Know the Timing of COVID-19’s Defeat, But Even Tougher to Try to Time The Market Reaction

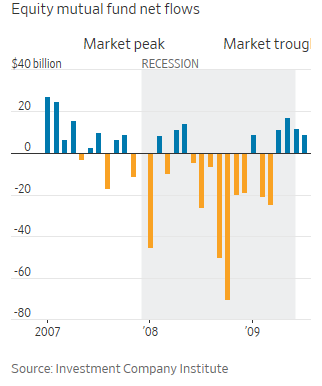

In eleven of the last twelve recessions the market has bottomed well before the recession officially ended. Put another way, if investors wait to get back in when the dark clouds have lifted and the headlines have improved they’ve already missed a crucial part of the recovery. Whether on the way up or down, investors are notorious for buying at higher prices and selling when prices are low. For example, according to an Investment Company Institute analysis discussed in a recent Wall Street Journal piece, investors added a net $84 billion to equity mutual funds in the ten months before the market peaked in October 2007. Yet after significant declines and stocks were cheaper, investors pulled a net $233 billion from June 2008 to March 2009. The table below captures this buy high sell low tendency, which must be avoided for long-term investment success.

The Importance of Credit Doesn’t Get the Credit It Deserves

The week of March 16th represented the worst week for the S&P 500 since 2008. As difficult as the week was for stock investors, it was arguably worse for corporate and municipal bond investors, particularly those who had reached for yield by extending duration and sacrificing credit discipline. The benchmark investment grade corporate bond ETF lost 13% of its value in a few trading days ending the week down 16% for the year. During the same period, the most traded high-yield municipal bond fund lost 11% and was down 33% year-to-date before recovering. It is one thing to see stocks decline in value, but another to experience losses in what is supposed to be the conservative part of a portfolio.

With the decline in bond prices arose real concerns for businesses’ access to capital. Hence, the Federal Reserve’s $1 trillion buying spree to support prices and provide much needed liquidity. While some estimate the Federal Reserve could leverage its commitment and spend up to $4.5 trillion on purchases, investors will have to return to the table as companies look to refinance debt and raise capital to support operations. Fortunately, the spreads between the risk-free rate and corporate and certain municipal bonds have widened to the point where bond investors can earn a more reasonable return for the level of risk. This recognition was apparent when last week 49 companies raised a record $107 billion via issuance of investment grade bonds. Similarly, with spreads on high-yield bonds reaching on average 900 basis points in mid-March, we pursued opportunities within the asset class for the first time in years.

The CARES Act Is Quickly Being Deciphered – Note the Pause in the RMD Requirement

Details are slowly emerging for what the $2 trillion stimulus bill passed on March 25th means for small businesses, certain corporations, and individuals. The facilitators must work fast as it is crucial the funds find their way into the hands for which they were intended. We have some understanding of the options, but many banks will play a role in facilitating the grants and loans included in the package. One important change that is relevant for many of our clients is the ability for individuals to avoid their required minimum distribution in 2020. While many clients use these retirement account withdrawals to pay living expenses, those who do not need these funds can forgo the withdrawal reducing their 2020 tax bill and allow the funds to remain invested for another year.

“It's very, very difficult when you have to prepare for something that might not ever happen.” - Dr. Anthony Fauci

Unlike Dr. Fauci’s plea to prepare for something that might not ever happen, experienced stock investors should appreciate the inevitable cycles of the market. With the declines in stock prices the past few weeks, our view of the long-term risks of owning them has decreased not increased. While it would be ideal only to buy at the bottom of any market down turn, trying to time it has historically proven financially dangerous. Thus, with consideration for a client’s individual liquidity needs and risk tolerance, we have been re-balancing portfolios consistent with their investment plan. It will likely be a volatile few months, but we believe this disciplined approach will prove rewarding in the years ahead.

“When one door closes, another opens. But we often look so long upon the closed door that we do not see the one that has opened for us.” - Alexander Graham Bell

Big changes are expected in the months and years that will follow the 2020 COVID-19 crisis. Some speculate how we gather, greet one another, work, and travel will never be the same. All seem to agree how we source goods, particularly our medical supplies, will change. Watching others fight back the virus, including the lowest case count in Italy in two weeks, are reasons to be optimistic that we too can slow the spread. Exactly how our routines change once we win this fight remains to be seen. Yet, if anything, this struggle leaves us better prepared to address the future health risks of a global world and proves that our will to win remains intact.

Thank you for your continued confidence and trust. Please stay safe, and we look forward to answering your questions and the opportunity to visit via telephone or video conference.